eBook - ePub

Facilitating Financial Health: Tools for Financial Planners, Coaches, and Therapists, 2nd Edition

- 272 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Facilitating Financial Health: Tools for Financial Planners, Coaches, and Therapists, 2nd Edition

About this book

With the newly revised 2nd Edition, Facilitating Financial Health remains a one-of-a-kind publication that bridges the gap between financial planners and mental health practitioners. The authors, two mental health professionals and a CFP®-designated financial planner, pioneered the use of tools that help clients build healthy relationships with money. This concise yet comprehensive Guide enables financial planning and mental health practitioners to effectively integrate tools from the fields of psychotherapy, life coaching, and financial planning as they help their clients change destructive financial behaviors. Facilitating Financial Health, 2nd Edition will enable you to: •Address your clients' money-driven problems, from both financial planning and mental health perspectives •Learn the best techniques and recognize when to call in help from outside your field when dealing with clients' financial issues •Focus on both interior (emotional and intangible aspects of money) as well as exterior (the tangible "nuts and bolts" of financial planning) financial health topics •Explore "Money Scripts" – beliefs about money commonly held by clients, financial planners, and therapists that can lead to destructive financial habits •More effectively work with individuals and couples on difficult financial health topics In addition to everything that made the 1st Edition so popular, this new 2nd Edition delivers these enhancements: •Modern counseling tools are presented with references to updated research and publications for both financial planning and mental health professionals •A more comprehensive description of "Money Scripts" – beliefs that hamper clients' abilities to make sound financial planning decisions •Updated ethical information, including references to new CFP® ethical guidelines •A newly enhanced chapter on creating an integrated financial practice •New tools for working with couples, including tips on working with nontraditional and unmarried couples •Content that has been enhanced by readers about the kinds of money-driven relationship issues that are the most commonly seen by planners and clients alike

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Facilitating Financial Health: Tools for Financial Planners, Coaches, and Therapists, 2nd Edition by Brad Klontz,Rick Kahler in PDF and/or ePUB format, as well as other popular books in Personal Development & Finance. We have over one million books available in our catalogue for you to explore.

Information

Chapter | 1 |

Integrated Financial Planning

The goal of Integrated Financial Planning is to help clients build and maintain a balanced and comfortable relationship with money. The process of helping clients achieve this financial health can originate from either of two perspectives, the exterior or the interior. The exterior is the nuts and bolts of managing money, while the interior is what clients believe about money and the way they emotionally relate to it. Regardless of the starting point, however, both the exterior and the interior are equally important. Neither one alone is sufficient to create and maintain a healthy relationship with money. The Integrated Financial Planning approach combines the exterior and interior aspects of finance to help clients build and maintain financial health.

Financial planners, investment advisors, and other financial professionals typically focus on the exterior aspects of money. Few have any training in the coaching or therapy skills needed to address an individual’s interior money beliefs. Very few psychotherapists and coaches are trained to work with the exterior aspects of money. For that matter, while they may be experts in working with many of the interior aspects of individuals, few have experience working with the interior aspects of money. Financial experts on one hand, and therapists and coaches on the other, can learn a great deal from one another. By working collaboratively, or conjointly, they can enhance the services they provide to clients.

Financial Professionals and Interior Finance

In recent years the financial planning profession has evolved significantly, expanding traditional financial planning services to include helping clients address the emotional and non-tangible aspects of money. Futurist and financial planner Richard Wagner, J.D., CFP®, is credited with naming this trend “interior finance.” Current terms for this emerging subset of financial planning include “life planning,” “financial life planning,” “financial coaching,” and “financial therapy.”

While financial coaching and financial therapy are different from financial planning, we maintain that all financial planning is life planning or financial life planning, because it is simply not possible to deal with finances as a separate and distinct aspect of a client’s life. Money is inescapably interwoven into the fabric of a client’s relationships, dreams, fears, loves, hates, successes, failures, and struggles. It is one of the few elements of life that has an effect on every aspect of existence, from meeting basic needs for food and shelter to satisfying the higher order needs related to the meaning of life and a spiritual connection. Money affects, either directly or indirectly, all aspects of one’s life.

Financial planners intuitively know this is true. A growing number of them also understand that providing exterior information about how money works (saving, investing, spending, and managing) is not enough to help clients succeed financially. In fact, “financial success” is a term that by itself has been traditionally limited to the exterior. A more integrated concept that forward-thinking financial planners are adopting is the notion of an individual having a relationship with money. These planners view the integrated financial planning process as one that helps their clients build healthy relationships with money and, having achieved that, healthy relationships with other important aspects of their lives. They realize that all the financial knowledge in the world will not benefit clients if they are unable or unwilling psychologically to act on that knowledge. Exactly how to help clients overcome these psychological barriers has been much less clear. Planners may suspect that a client is repeatedly sabotaging a financial plan, but lack the training to help the client change that behavior.

In 2004, researchers at Lethbridge University conducted a study of thirty financial planners in Western Canada.1 The financial planners interviewed for the study agreed that clients’ financial health and psychological health were related. They agreed that clients came to them with personal issues as well as financial concerns. The majority of them, however, chose to attempt to address those personal issues themselves, rather than referring clients to therapists or coaches.

This research illustrates two contradictory beliefs that govern the way financial planners work with clients. Planners realize that clients need more than just exterior services, yet those same planners are reluctant to collaborate with coaches or therapists to provide effective interior services. Financial planners would understandably criticize anyone who attempted to provide exterior financial planning services without the necessary training. No doubt they would also criticize a financial planner who offered to provide therapy without the necessary credentials. Yet many of the same planners who wouldn’t think of providing insurance advice without appropriate training do not stop to consider that they may actually be attempting to provide therapeutic services despite not being qualified to do so. This approach is analogous to someone with a heart condition going to an anesthesiologist for help, and the anesthesiologist attempting to provide treatment instead of referring the patient to a cardiologist.

A significant concern for financial advisors is, “How do I know when I have crossed the line from financial planning to therapy?” This question is critical. For example, traditional financial planners or financial coaches would be ill-equipped and in dangerous territory if they attempted to provide direct assistance or advice to clients struggling with clinical anxiety, depression, marital distress, or family conflict. Yet there is no clear “line” to let advisors know when they have wandered into territory outside of their training or capability. Instead, the boundary between financial planning, coaching, and therapy can be a porous one.

Facilitating Financial Health assists financial professionals in appropriately addressing the important interior side of finances without going beyond ethical bounds. It clarifies the differences between financial planning, coaching, and therapy, clearly defining what therapy is and what it is not. It includes step-by-step exercises to help financial professionals work more effectively with their clients. It introduces a Decision Tree with guidelines for deciding when it is appropriate for planners to work with a client’s interior issues and when it is appropriate to partner with or refer the client to a coach or therapist. This book offers specific suggestions for making these referrals without rejecting clients or labeling them as inappropriate for financial planning. It includes ways to design interventions to match clients’ various levels of readiness to change and provides effective tools for working with client resistance. It also offers ideas for incorporating interior services into a traditional financial planning practice.

Mental Health Professionals and Money

For most of us, money is strongly tied to stress and difficulty. Of those responding to a survey conducted by the American Psychological Association, 73 percent named money as the number one cause of stress in their lives.2 Americans currently have the highest rates of debt and some of the lowest saving rates in history. Money is the leading source of conflict within marriages. Some 40 percent of Americans admit to lying to their spouses about money.3 All this financial stress comes at a cost. Research has shown that financial strain leads to depression, anxiety, loss of personal control, poor health, poor role-functioning, poor work performance, and low self-esteem.4

Logically, then, money issues should be considered an important aspect of mental health when people seek psychological help. Unfortunately, this is not the case.

In recent years, our society has become increasingly comfortable with and aware of the value of therapy for emotional difficulties. Therapists are trained to help clients recover from conditions such as depression and anxiety and address issues such as trauma and addiction. Despite the fact that money issues often contribute significantly to emotional difficulties, money remains a relatively unexplored theme in therapy.5

An exploration of the field of psychology suggests several reasons why money is rarely addressed by therapists. It has been suggested that many mental health professionals have taken unconscious vows of poverty. Therapist and author Olivia Mellan refers to them as “money monks.” They have generally chosen their professions because they want to help people, and in our society, helping people and making money tend to be seen as contradictory purposes.6 Money is something therapists are neither trained nor encouraged to deal with, whether it relates to managing their own practices in a business-like way or helping clients address disordered money behaviors. It is rare to find money as a topic of individual therapy sessions, college psychology classes, or professional training conferences. Therapists tend to believe that money does not belong in the realm of personal growth. Since they typically have little or no training or experience in addressing their own money issues, it follows that they will remain unaware of, be unwilling, or be unable to help clients address theirs. Therapists rarely explore clients’ behaviors and beliefs around money.

Despite the prevalence of disordered money behaviors, research on financial beliefs and behaviors has received little attention in the psychological literature,7 and little has been done to attempt to treat these behaviors through psychological interventions. From 2004 to 2006, the authors conducted a study of clients who had participated in the Healing Money Issues program at Onsite Workshops. At that time, outside the realm of pathological gambling, the research literature did not include even one study attempting to research the effectiveness of specific psychological interventions designed to change problematic money beliefs, financial behaviors, and related psychological distress.

It is not surprising, then, that few interventions exist and little research has been done, considering that the mental health field itself may be in denial about the problem. In his groundbreaking 1999 article, “The money taboo: Its effects in everyday life and in the practice of psychotherapy,” published in the Clinical Social Work Journal, Dr. Richard Trachtman describes money matters as “perhaps the most ignored subject in the practice, literature, and training of psychotherapy.”8 He argues that when psychotherapists “can not address our own money issues, we also can not control our own countertransference reactions to our patients’ money or their money related attitudes and behaviors.” In other words, if therapists have not addressed their own money issues, they will not be able to help clients address theirs. Perhaps therapists know this at a conscious or unconscious level, and therefore seldom explore the issue of money with their clients. In addition, therapists and coaches may feel inadequately trained to help clients deal with the more practical aspects of money, and thus avoid the topic.

Facilitating Financial Health provides tools to help therapists, counselors, and coaches work more effectively with a client’s money issues and also to help clarify and understand their own. It also provides guidelines to help these professionals decide when and how to refer a client to a financial planner, debt/credit counselor, or other financial advisor.

The Components of Integrated Financial Planning

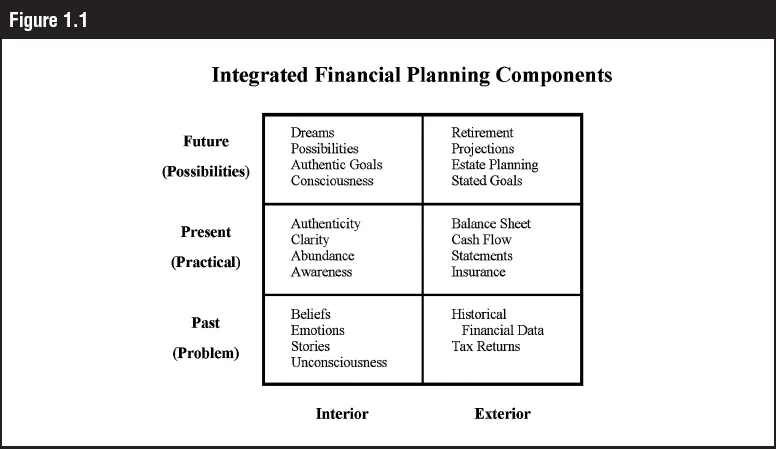

Cross-disciplinary training, collaboration, consulting, and understanding can help financial professionals address both the exterior and the interior aspects of a client’s financial health. Both areas, as combined in Integrated Financial Planning, are essential to creating and maintaining a client’s healthy relationship with money. To understand the concept of Integrated Financial Planning, it is helpful to see it in terms of the past, the present, and the future.

Exterior finance, the right-hand column, includes the mechanics of money—what we can see and touch. The past exterior includes historical financial data such as tax returns. The present exterior takes in such information as balance sheets, cash flow statements, insurance, and current investment statements. The future exterior involves retirement projections, estate planning, and stated goals. We traditionally view the exterior column as best taken care of by financial ...

Table of contents

- Cover

- Title Page

- Copyright Page

- About the National Underwriter Company

- Foreword

- Table of Contents

- Acknowledgements

- About the Authors

- Introduction

- Chapter 1: Integrated Financial Planning

- Chapter 2: Building a Trusting Relationship

- Chapter 3: Exquisite Listening™

- Chapter 4: Doing No Harm

- Chapter 5: Helping Clients Change: What Works and What Doesn’t

- Chapter 6: Money Scripts

- Chapter 7: Money Script Exercises

- Chapter 8: Money Disorders

- Chapter 9: Problematic Money Behaviors

- Chapter 10: Resistance

- Chapter 11: Tools for Helping Clients Change

- Chapter 12: Working With Couples

- Chapter 13: Strategies for Working with Couples

- Chapter 14: Creating an Integrated Financial Practice

- Chapter 15: The Financially Healthy Professional

- Appendix: Klontz Money Script Inventory (KMSI)

- Index