- 604 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Financial Valuation and Econometrics

About this book

This book is an introduction to financial valuation and financial data analyses using econometric methods. It is intended for advanced finance undergraduates and graduates. Most chapters in the book would contain one or more finance application examples where finance concepts, and sometimes theory, are taught.

This book is a modest attempt to bring together several important domains in financial valuation theory, in econometrics modelling, and in the empirical analyses of financial data. These domains are highly intertwined and should be properly understood in order to correctly and effectively harness the power of data and statistical or econometrics methods for investment and financial decision-making.

The contribution in this book, and at the same time, its novelty, is in employing materials in basic econometrics, particularly linear regression analyses, and weaving into it threads of foundational finance theory, concepts, ideas, and models. It provides a clear pedagogical approach to allow very effective learning by a finance student who wants to be well equipped in both theory and ability to research the data.

This is a handy book for finance professionals doing research to easily access the key techniques in data analyses using regression methods. Students learn all 3 skills at once — finance, econometrics, and data analyses. It provides for very solid and useful learning for advanced undergraduate and graduate students who wish to work in financial analyses, risk analyses, and financial research areas.

Request Inspection Copy

Contents:

- Probability Distribution and Statistics

- Statistical Laws and Central Limit Theorem / Application: Stock Return Distributions

- Two-Variable Linear Regression/Application: Financial Hedging

- Model Estimation / Application: Capital Asset Pricing Model

- Constrained Regression / Application: Cost of Capital

- Time Series Analysis / Application: Inflation Forecasting

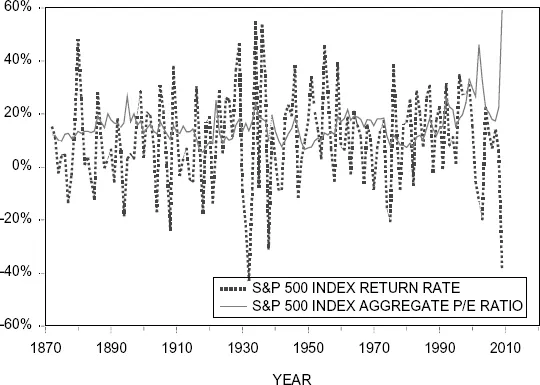

- Random Walk / Application: Market Efficiency

- Autoregression and Persistence / Application: Predictability

- Estimation Errors and T -Tests / Application: Event Studies

- Multiple Linear Regression and Stochastic Regressors

- Dummy Variables and ANOVA / Application: Time Effect Anomalies

- Specification Errors

- Cross-Sectional Regression / Application: Testing CAPM

- More Multiple Linear Regressions / Application: Multi-Factor Asset Pricing

- Errors-in-Variable / Application: Exchange Rates and Risk Premium

- Unit Root Processes / Application: Purchasing Power Parity

- Conditional Heteroskedasticity / Application: Risk Estimation

- Maximum Likelihood and Goodness of Fit / Application: Choice of Copulas

- Mean Reverting Continuous Time Process / Application: Bonds and Term Structures

- Implied Parameters / Application: Option Pricing

- Generalised Method of Moments / Application: Consumption-Based Asset Pricing

- Multiple Time Series Regression / Application: Term Structure of Volatilities

- Fixed and Random Effects Model / Application: Synchronicity of Stock Returns

- LOGIT and PROBIT Regressions / Application: Categorization and Prediction

Readership: Advanced undergraduates and 1st year post-graduate students in finance and econometrics.

Key Features:

- The book is a handy one for finance professionals doing research to easily access the key techniques in data analyses using regression methods

- Students learn all 3 skills at once — finance, econometrics, and data analyses

- It provides for very solid and useful learning for advanced undergraduate and graduate students who wish to work in financial analyses, risk analyses, and financial research areas

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

Chapter 1

PROBABILITY DISTRIBUTION AND STATISTICS

1.1PROBABILITY

Table of contents

- Cover Page

- Title Page

- Copyright

- Dedication

- Contents

- Preface to the Second Edition

- Preface to the First Edition

- From the First Edition

- About the Author

- Chapter 1: Probability Distribution and Statistics

- Chapter 2: Statistical Laws and Central Limit Theorem Application: Stock Return Distributions

- Chapter 3: Two-Variable Linear Regression Application: Financial Hedging

- Chapter 4: Model Estimation Application: Capital Asset Pricing Model

- Chapter 5: Constrained Regression Application: Cost of Capital

- Chapter 6: Time Series Analysis Application: Inflation Forecasting

- Chapter 7: Random Walk Application: Market Efficiency

- Chapter 8: Autoregression and Persistence Application: Predictability

- Chapter 9: Estimation Errors and T-Tests Application: Event Studies

- Chapter 10: Multiple Linear Regression and Stochastic Regressors

- Chapter 11: Dummy Variables and ANOVA Application: Time Effect Anomalies

- Chapter 12: Specification Errors

- Chapter 13: Cross-Sectional Regression Application: Testing CAPM

- Chapter 14: More Multiple Linear Regressions Application: Multi-Factor Asset Pricing

- Chapter 15: Errors-in-Variable Application: Exchange Rates and Risk Premium

- Chapter 16: Unit Root Processes Application: Purchasing Power Parity

- Chapter 17: Conditional Heteroskedasticity Application: Risk Estimation

- Chapter 18: Maximum Likelihood and Goodness-of-Fit Application: Choice of Copulas

- Chapter 19: Mean Reverting Continuous Time Process Application: Bonds and Term Structures

- Chapter 20: Implied Parameters Application: Option Pricing

- Chapter 21: Generalised Method of Moments Application: Consumption-Based Asset Pricing

- Chapter 22: Multiple Time Series Regression Application: Term Structure of Volatilities

- Chapter 23: Fixed and Random Effects Models Application: Synchronicity of Stock Returns

- Chapter 24: LOGIT and PROBIT Regressions Application: Categorization and Prediction

- Appendix A: Matrix Algebra

- Appendix B: EVIEWS Guide

- Appendix C: Linear Regression in EXCEL

- Appendix D: Multiple Choice Question Tests

- Appendix E: Solutions to Problem Sets

- Index