Summary: Smart Pricing

Review and Analysis of Raju and Zhang's Book

- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

The must-read summary of Jagmohan Raju and W. John Zhang's book: `Smart Pricing: How Google, Priceline, and Leading Businesses Use Pricing Innovation for Profitability`.

This complete summary of the ideas from Jagmohan Raju and W. John Zhang's book `Smart Pricing` demonstrates that many companies fail to establish a deliberate pricing strategy. In fact, many managers rarely give pricing much thought at all. In their book, the authors explain that this is a huge mistake as pricing offers an opportunity to move ahead. This summary provides readers with an insight into the possibilities of different pricing strategies and how some of the biggest companies have used them to push their companies forward.

Added-value of this summary:

• Save time

• Understand key concepts

• Expand your business knowledge

To learn more, read `Smart Pricing` and discover the key to establishing innovative pricing strategies that create value and capture customers.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

Summary of Smart Pricing (Jagmohan Raju and Z. John Zhang)

1. Price – the forgotten business lever

- Cost-plus pricing – specify a sales target, figure out whatyour costs will be at that volume and then add your company’s normal margin to come up with the retail price. The problems with this method of setting prices are:

- When customers like what you have to offer, they don’t care about your costs. All they look at is its value to them. You might be leaving lots of money on the table.

- It’s arbitrary to decide in advance what a “fair” margin is or isn’t. Too many factors can come into play here.

- Cost-plus is inward looking. It’s based solely on your operations, not on what customers are willing to pay.

- Competition-based pricing – look at what everyone else is charging and set prices a few percent below their price. Again, there are potential problems here:

- You end up becoming passive rather than focusing on creating something customers will love. Instead of seizing the bull by the horns and figuring out how to price your offering so as to maximize profits, you merely monitor what everyone else is doing and mimic that.

- You may lower your prices to protect market share and thereby generate some big losses. Sometimes pricing becomes a high stakes game of chicken where you wait to see who will blink first. Almost inevitably, the outcome of this kind of scenario is losses all round.

- Consumer-based pricing – figure out what customers are willing to pay for what you have to offer and set your prices just below that threshold. Potential problems with consumer-led pricing:

- Admittedly, this gives you the option to charge different prices to different customers but it also encourages comparison shopping. You end up training your customers to behave badly in order to save a few bucks.

- Discriminatory pricing almost always disadvantages your best customers because you end up giving deep discounts to attract new business. Rewarding your best customers with rock-bottom prices is a much more pleasant way to do business.

- You end up training good customers to behave badly in order to get lower prices. Negotiations become aggressive and unpleasant rather than focused on creating added value.

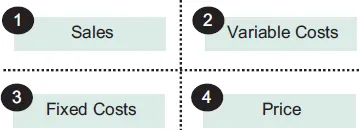

- When fixed costs are lowered by 1%, profitability increases by an average of 2.45%

- A1% increase in sales generally leads to a 3.28% increase in the firm’s overall profitability.

- The effect of lowering variable costs by 1% is a 6.25% increase in profitability.

- Improving the firm’s prices by 1% leads to a 10.29% increase in profitability.

Table of contents

- Title page

- Book Presentation

- Summary of Smart Pricing (Jagmohan Raju and Z. John Zhang)

- About the Summary Publisher

- Copyright