![]()

Stacking Your Brand’s Deck on Amazon

Free will and determinism, I was told, are like a game of cards. The hand that is dealt you represents determinism. The way you play your hand represent[s] free will.

—NORMAN COUSINS, AMERICAN POLITICAL JOURNALIST, AUTHOR, AND WORLD PEACE ADVOCATE (1915–1990)

Amazon recorded its first noncompany customer sale on April 3, 1995 when John Wainwright, an Australian software engineer (and a friend of Shel Kaphan, Amazon’s first employee), purchased Fluid Concepts and Creative Analogies: Computer Models of the Fundamental Mechanisms of Thought by Douglas Hofstadter. Within two months, Amazon’s book sales were up to $20,000 per week with sales to all 50 states and 45 countries.

Just 23 months after that, on May 15, 1997, Amazon issued its IPO at a price of $18 per share (after three stock splits in the late 1990s, that’s the equivalent today of $1.50 per share).

By 2018, 21 years after its IPO, Amazon recorded about $7,385 in revenue per second, or almost $27 million in revenue per hour, as customers around the world purchased an astronomical amount of goods and services from the site. And that means there are huge opportunities for your brand on Amazon—you just need to know the lay of the land.

In this chapter, you’ll learn to what extent American consumers use Amazon as their preferred search engine for products, the impact of advertising (both as a revenue generator for Amazon and a channel for you) throughout the Amazon ecosystem, how to optimally align your company with Amazon as a brand owner, and the path to sustainable success once you’ve made that alignment.

AMAZON: THE SEARCH ENGINE FOR PRODUCTS

Today, Amazon has become the “everything store” for 310 million customers worldwide, but just as significant, it has eclipsed Google as the place where U.S. consumers start online product searches. According to a Jumpshot report published in September 2018, 54 percent of consumers now start their product searches (the searches consumers make when they know what products they want) on Amazon, not Google.

AMAZON’S ADVERTISING BUSINESS AND YOU

If your brand already advertises on U.S. search engines, can you afford to miss out on more than 50 percent of product searches by not advertising on Amazon?

Amazon may not be considered an ad-supported company (like Google), but according to market research company eMarketer, they are now the third largest generator of digital ad revenue (behind Google and Facebook) in the U.S. In 2018, eMarketer estimates Amazon will bring in $4.61 billion in ad revenue in the U.S., which is more than either Twitter or Snapchat. As Amazon leverages its position as the dominant product search engine in the U.S., over time it will enjoy stronger overall profits.

Consider how Amazon’s success as an online ad platform is factored into your current digital marketing strategy. If you’re still deciding whether to use Amazon as a key marketing engine for your brand, don’t worry—you haven’t missed the boat.

Amazon’s greatest promotional opportunity for brands big and small is still in its early days, with the use of various categories like Sponsored Products, Sponsored Brands, and, for brands that sell directly to Amazon, Product Display ads. You’ll learn more about each of these ad types throughout this book.

As Google has demonstrated, launching paid advertising placements atop a robust organic search engine is nothing short of transformative. Retailers and brands that use search engine text ads and Google Shopping aren’t at the mercy of complex, ever-changing ranking algorithms (those results that most closely match the user’s search query). Advertising brings predictability and scale to the channel, driving new customer acquisition and revenue growth.

AMAZON IS BRAND CENTRAL

While there are plenty of resellers on the Amazon marketplace who sell products made by other brands, the people who will get the most value from this book will be the brand owners themselves.

In the traditional sense, a brand is a product manufactured by one company under a particular name. More than a century ago, cattle ranchers used a unique branding iron to indicate which cattle were theirs. With the rise of mass-market consumer products, manufacturers and marketers began putting their names on their products to stand out from their competitors. Today, a brand is a collection of promises, both logical and emotional, including qualities and attributes that help consumers inform their purchase.

Whether you are a massive, century-old, well-recognized consumer brand or simply a college student getting started with a line of bamboo fabric surfer T-shirts, you are invisible to almost half of all U.S. consumers if you do not have an Amazon presence.

With your unique brand, you can capitalize on Amazon’s continued dominance by either selling to Amazon or selling on the Amazon marketplace.

Amazon’s strong growth pattern, born of vision, innovation, and methodical action, makes it the dominant force in online retail, which filters down to benefit your brand. Consumers who previously tolerated sloppy and inconsistent customer service, poor product selection, unexpected back orders, or incomplete product descriptions were impatiently waiting for something better.

The growth of Amazon over the past 24 years should not have taken any smart retailer by surprise. Almost everyone who paid attention to the nexus of the Internet and Amazon could see it coming as plain as day.

KEY BUSINESS DRIVERS FOR AMAZON’S RETAIL GROWTH

From my perspective, there are three key business drivers of Amazon’s astonishing rise from an online bookseller to the retail behemoth it is today: Amazon Prime, Fulfillment by Amazon, and the various iterations of AmazonFresh. Let’s dive into each of these one by one.

Amazon Prime

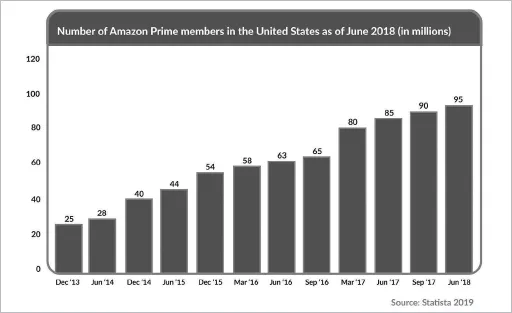

In my mind, one of the strongest drivers for Amazon’s consumer growth in the U.S. has been its Prime membership. Prime gives members access to free two-day shipping, unlimited video streaming of thousands of popular movies and TV shows, and exclusive shopping deals. Figure 1–1 below, from Morgan Stanley’s Amazon Disruption Symposium, shows just how fast Amazon Prime has been growing in the U.S. According to research conducted by Morgan Stanley and reported by Forbes in March 2018, U.S. Prime members spend $2,486 a year with Amazon vs. $544 per year for customers without a Prime membership. That’s a whopping 4.6 times more.

FIGURE 1–1. Amazon Prime U.S. Household Penetration

In the U.S. alone, 95 million households (out of 125 million total) have an active Amazon Prime membership. That’s more than two-thirds of all U.S. households. Amazon is where Americans buy.

Fulfillment by Amazon

Fulfillment by Amazon, introduced on September 19, 2006, allows Amazon marketplace sellers to leverage Amazon’s order fulfillment and customer service infrastructure—including the ability to store their products in Amazon’s distribution centers. Prime customers can take advantage of free two-day shipping when purchasing products in Amazon warehouses, regardless of whether Amazon owns the inventory or a merchant does.

AmazonFresh

Launched in August 2007, AmazonFresh was Amazon’s first move toward the grocery business. By this and by its subsequent grocery investments (including its purchase of Whole Foods in 2017), Amazon has showed the business community that being in the grocery business is key for them.

Mastering the grocery business (especially online) boosts Amazon up a significant level from being a seller of packaged goods; after all, not everyone needs to buy books and other “hard” goods, but everyone has to eat.

UNSTACKING AMAZON’S DECK

As I write this, there are 59,721 decks of playing cards for sale on Amazon. Already have a deck of cards? Well, there are about 562 million other items you can buy instead.

In an attempt to understand the scope of Amazon’s immense catalog, someone once posted an interesting question on Quora:

“How much would it cost to buy one of everything on Amazon?”

Business researcher Kynan Eng performed some impressive calculations in early 2016 to arrive at a solid estimate: $12.86 billion. That’s some number!

But when considering Amazon’s scope, one critical fact is hidden from the average consumer: Amazon only makes about half their sales as a first-party retailer. As of Q3, 2018, 53 percent of all paid units on the site were sold by third-party marketplace sellers.

So Amazon takes half the deck and then splits the other half among roughly 2 million sellers competing in their marketplace. If you want to know how to get a piece of either deck, you should understand how the infrastructure for selling on or to Amazon caters primarily to brand owners.

STACKING YOUR DECK

The first step toward stacking the revenue growth deck in your favor is to realize that consumers are loyal to brands, not retailers or sellers. Resellers make one-off sales. Brands can create loyal customers. So you are already one step ahead if your company owns one or more brands.

If you are a reseller of products in a specific category, why not begin the journey toward building your own brand?

Early last fall, as I was traveling for one of our ecommerce events, I spent time in the warehouses of two different clients. They were in two distinct parts of New Jersey, and both sold highly commoditized products in their respective categories. Both had been selling on the Amazon marketplace for at least five years. Each had independently switched to branding their products so that they were no longer reselling someone else’s products; their packaging now carried their respective logos, brand colors, web addresses, and even their phone numbers.

DON’T HAVE YOUR OWN PRODUCT BRAND?

For retailers of products made by other brands, selling on Amazon isn’t as compelling an opportunity. When you sell on Amazon, you’re building their brand (both the manufacturer’s and Amazon’s). Amazon and the brand own the relationship with the customer. And, with lower product margins compared to that of the brand owner’s, it often isn’t profitable to pay Amazon sellers’ fees and ad click costs.

Unless you realistically have a shot at becoming a major distribution player in your field (e.g., Walmart, Target, PetSmart, etc.) or have products that due to their size, weight, or need for customization, cannot get marginalized (or outmaneuvered) by Amazon, you want to manufacture products under your own brand. Even major distribution players do this over ...