eBook - ePub

No B.S. Marketing to the Affluent

No Holds Barred, Take No Prisoners, Guide to Getting Really Rich

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

No B.S. Marketing to the Affluent

No Holds Barred, Take No Prisoners, Guide to Getting Really Rich

About this book

- Identifies and provides in-depth market research AND marketing strategies for today's up-and-coming affluent market—half the work is done!

- Globally and specifically defines the affluent market and market strategies

- Clearly outlined sales strategies and tools designed to help businesses adapt in the coming years by tapping into the affluent consumer segment(s) and gives examples of companies already doing so

- Teaches readers how to master the Business Trifecta®: The Magic Formula for Marketing to the Affluent

- Presents a blueprint for Story Selling through various media and for countless products and services that the affluent actually want

- Emphasizes the importance of choosing your words and prices carefully to perfectly target your ideal affluent "tribe"

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access No B.S. Marketing to the Affluent by Dan S. Kennedy in PDF and/or ePUB format, as well as other popular books in Business & Marketing. We have over one million books available in our catalogue for you to explore.

Information

BOOK ONE

Who Are These People

Who Have All the Money?

Who Have All the Money?

Understanding Mass-Affluent, Affluent, and Ultra-Affluent Buyers

CHAPTER 1

Why You MUST Move—Now

© CHARLES BARSOTTI/THE NEW YORKER COLLECTION/THE CARTOON BANK. ALL RIGHTS RESERVED.

Most businesses have historically made themselves for middle-income, middle-class consumers. This began post World War II, with the great rise and expansion of the middle class in America. This was the “keeping up with the Joneses” majority, so it made perfect sense to tailor advertising, marketing, businesses, products, and services to the move-to-the-suburbs, get-a-house-with-a-white-picket-fence, a new-car-on-view-in-the-driveway crowd. And a crowd it was.

But, in more recent times, while the economic facts of American life went through great changes that hollowed out the middle class, business didn’t catch on or catch up to this, essentially continuing to gather around a watering hole that was drying up fast.

Everything about the availability of consumer spending capability was changing much faster and much more dramatically than most businesses acknowledged.

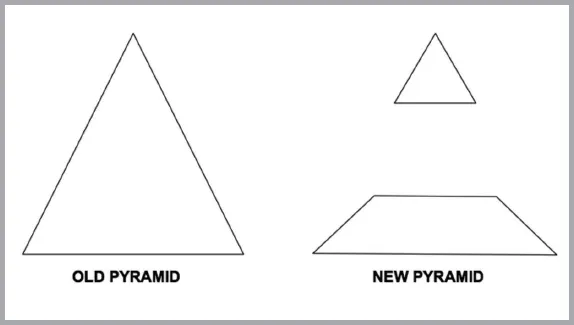

It wasn’t a difficult prophecy. In 2007, I first showed, publicly, the “new economy pyramid,” in the first edition of No B.S. Ruthless Management of People and Profits (now in the second edition). A few years before then, I began describing it to private clients and talking about it in closed-door mastermind meetings and seminars. I forecasted a literal genocide of the American middle class. And I meant: genocide, for I view a lot of it as intentional, deliberate, and orchestrated by political and certain corporate interests. But with or without that, the evolutionary disappearance of the middle class was certain. This was not difficult to foresee. The writing was on the wall, in big letters and numbers, in blood red ink. Many refused and still refuse to see it. There were denialists—in government, in media, on Wall Street. There were the ignorant, eyes wide shut. But I saw everything there was to see and made my dire prediction. Here it is, in the same visual:

This prophecy has come to pass, but it is not yet done. There is a lot more carnage to come. Temporarily, President Trump has introduced new dynamics, pulling the middle class—particularly its blue-collar members—back from the cliff’s edge. As of this writing, he has an agreement on restructuring NAFTA, pending Congress’s approval, and is otherwise dragging jobs back from Mexico and overseas, releasing manufacturing, drilling, and other industries from regulatory burdens and otherwise restarting a robust domestic industrial economy. More people now have jobs than at any other time in the past 20 years, wages are up and rising, and the middle class’ compelled savings, like 401(k) accounts, have soared. Of course, to some extent, labor shortages, open jobs, and competition for workers is inflationary, so much of the gains to those in the middle are only “on paper,” while gains toward the top are more real because of less impact by inflation. A significantly affluent person may spend only 5% to 20% of current income on necessities, so a big raise in income actually reduces the percentage spent on necessities, and the inflation becomes a voluntary tax. This ironically liberates spending more on luxury goods, services, and experiences, as we’ll discuss. The middle-income earner may spend 70% to 90% of his income on necessities or even above 100% by dependence on credit, so a modest pay raise still goes largely to necessity purchases, where the inflation offsets it very directly. In other words, everything done to rescue and preserve the middle class, while an admirable effort within the “Make America Great Again” vision, cannot alter the fact that it is an endangered species being made to die out more slowly, but dying out nonetheless.

The impact of tech, automation, and robot-ization alone guarantees a middle-class shrinkage that has to, again, pick up speed. In the Industrial Revolution, job replacement vs. job elimination was close to one-to-one. Not so with the tech revolution.

So, now, writing the third edition of this book, 12 years after the first one, I contend that moving your business’s target range up to mass-affluent and, better still, affluent clientele is all the more important and will soon, again, also be urgent.

The Two Requirements for Your Prosperity

Ultimately, to prosper you need an ample supply of customers with two attributes: ABILITY to buy and WILLINGNESS to buy. Both as a constant. Whether the economy continues to expand or reverses and shrinks, whether unemployment holds onto Trump Economy all-time lows or returns to 10- or 20-year-average norms, whether the middle class’s destruction slows to a crawl or resumes a fast pace—no matter what external conditions occur, you need a bastion of consumers with both constant, uninterruptible ability and willingness to buy. Such customers can only be found among people of affluence—not just in income, but in their net worth and emotional state. Organizing a business around any other population is, bluntly, self-sabotage. A business otherwise organized is always fragile. When heavy rains come, its crops and buildings are washed away. This book is all about building your bastion.

To move you from curiosity and half-hearted, tentative action on the advice and strategies in this book to whole-hearted, passionate, courageous, aggressive, and urgent action, I want to take a few minutes to summarize the facts of this middle-class shrinkage, provide some evidence of its impact so far, and try to paint a vivid picture in your mind of this as a present and accelerating reality.

We can begin with a few statistics. These are compiled from various authoritative sources. I have not footnoted each fact separately, but I have listed many of the sources at the end of this chapter.

How Bad Did This Get? How Bad Will It Get?

Beginning with the recession that was triggered in 2007–2008 and lasted through 2013, with the damage accelerating and peaking during the Obama years, the median U.S. household net worth plummeted by 43%. This manifested in many ways, with the upside down home mortgages being the most visible, and retirement savings accounts 401(k) the clearest loss to many. In these and many other ways, wealth—and with it the ability and willingness to buy things for years, even decades to come—erased. This damage at the top of the economic pyramid, while harsh, was and is far from devastating. If you have $10 million and lose 43% of it, you still have $5.7 million. It didn’t and doesn’t matter much to the bottom of the pyramid. If you have zero and lose 43%, you still have zero. But in the middle, it murdered and is a murderer. There it forcibly moves a middle-class consumer to a low-class consumer. There it changes a frequent discretionary spender into a buyer only of essential commodities. As it slaughtered those in the middle, it sucked the very life right out of the economy.

More important, these lost years of lost wealth and spending capability will never be recovered from by these slaughtered middle-income consumers, so in your own business lifetime you will not see a rebound of their best spending. To add insult to injury, generational replacement spending by Millennials is defying historic trends, is at a minimum, and is concentrated into few categories. Where are the first-time home buyers, home furnishings buyers, new insurance customers, etc.? Buried under a stunning $1.5 TRILLION of college debt, in their parents’ basements.

In those years, we saw a drop in net worth in almost all income categories, from the top 5% to the near bottom. Only the bottom 25th percentile saw an increase—but that is deceptive because in calculating, the government counts the earned income tax credit and food stamps as income, and Mr. Obama was the food stamp president. There are profound differences in how people in different income categories react and can react to net-worth losses. Toward the top, most high earners have options for amping up their earnings to replace net-worth losses. The high six-figure income professional can raise fees, take on more clients or patients, maybe cut overhead or staff. They have a great deal of control. My own earning capability has a dial like a thermostat on it, that I can adjust by my own hand. I always have options: writing three books in a year instead of two, accepting a few more speaking engagements I now turn down, promoting more and attracting more clients. Some top income earners have reacted that way. Others did not—but didn’t need to, and their discretionary spending capability and willingness still remained intact. They had ample money.

Toward the bottom, they traded down in price. There was a bleed from Walmart to “dollar stores” as examples under economic stress. These consumers cut where they can. They may add a low-wage job to the household. They file bankruptcy in large numbers, expunge accumulated debt, and start over with some restored spending ability. But by and large, their total spending contribution to us marketers and to the economy as a whole varies only a little, because in bad or good times, they are still spending nearly all their income on essentials, holding nothing back, neither saving or investing.

It is in the middle where stagnated and falling wages, loss of one of two jobs in the household, and cutting of hours—in part, the result of Affordable Care Act threats, uncertainties, and realities—had its most savage effects. The median income, in the 50th percentile, went from $98,872.00 in 2007 to $70,801.00 in 2009 to $56,335.00 in 2013. Take $40,000.00 out of a $90,000.00 household income and watch everything that happens. It was no surprise that home ownership dropped to a two-decade low, real estate values were slow to recover, the real estate market was poor in all but a handful of places, real estate agents’ incomes dropped, the population of active agents shrunk, and the mortgage broker and agent industry fast became a sad shadow of its former self. No surprise that roughly one-third of middle-class households fell out of that category. In short, not only did the middle-class consumer population shrink with far more falling down than climbing up, but its remaining population had shrinking buying power and had to use more and more of its buying power in fewer and fewer categories, probably excluding you and what you sell.

All of this can happen again. Never lose sight of that.

The middle class’s economic activity has always been what makes and keeps the rich folks rich and growing ever richer and what creates an uplifting opportunity for the bottom levels to move up. Small business provides most jobs and most low-skill, entry-level jobs, but most small businesses are started, grown, and owned by middle-class people, who were, for nearly ten years, severely limited in their ability to start or grow such businesses. The first year in two decades with a decline in the number of new businesses started was 2013. Middle-class consumer spending is what created and sustains suburbs, shopping malls, and the huge and wide middle of every business category: retail, restaurants, service providers. Temporarily, some of these categories can appear as healthy as ever by simply raising prices on fewer numbers of die-hard middle-class consumers. Movie industry revenues are up even as movie theater attendance has fallen and is falling. But this is the “failing condominium tower strategy”: five move out, so monthly dues are raised on the remaining 50. Five more leave, dues are raised again. Eventually, there’s one sod left with a monthly service fee of $50,000.00.

The September 17, 2014, issue of The Wall Street Journal included a report headlined: “Incomes End A 6-Year Decline, Just Barely.” Any good news was welcome. But popping champagne corks or even beer can tabs was not called for!

In 2014, the time of my writing of the prior edition of this book, there was little reason for anything but a gloomy forecast for, at best, a mud-uphill-slow recovery of the economy and a slowing of middle-class erasure.

Trump has changed all that, to an extent, in ways, and at a speed, few economists could imagine, and for which he gets far too little credit from most media and other observers and beneficiaries. I expected a significant reversal of bad fortunes and some sort of boom by Trump, but even I have been pleasantly surprised by all he has wrought. However, it is very dangerous to let this lull you into complacency. Macro forces continue their work. All things carefully considered, my forecast is for a brief Indian summer inevitably followed by a long, long, bitter cold winter for the middle class and its consumerism. If and when liberals get control of the levers of power, they will try warming up the shivering masses with socialism-lite, which will, as it always has, make things worse and lengthen the economic winter until another Trump arrives.

So, I tell you: Use this Indian summer and these good days to proactively and creatively recraft your business to move up the ladders of income, net worth, and stability of ability and willingness to buy.

There are two considerations that should govern your strategy, dictate where you sell and who you sell to. One is Comparative ABILITY to Buy. The other is Comparative WILLINGNESS to Buy. Nothing else matters more.

A Look at Comparative Ability to Buy

Consider three households—the Joneses, with low-wage jobs, combined putting just $30,000.00 a year into the coffers; the Smiths, with one at a good-paying job, the other at a low-wage job, combined $65,000.00 a year; and the Barons, who own a very profitable business from which they each draw a good salary and bonuses, and who have significant investment income, totaling $300,000.00 a year. All three households include two kids.

What is the same about all three?

The amount of money they ha...

Table of contents

- Cover

- Title Page

- Copyright

- Contents

- Book One: Who Are These People Who Have All The Money?

- Book Two: What Are They Spending Their Money On?

- Book Three: How Can I Get Them to Give Me Their Money?

- Book Four: Examples

- About the Author

- Index

- The No B.S. Guide to Direct Marketing, Third Edition