- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

Dive into algo trading with step-by-step tutorials and expert insight

Machine Trading is a practical guide to building your algorithmic trading business. Written by a recognized trader with major institution expertise, this book provides step-by-step instruction on quantitative trading and the latest technologies available even outside the Wall Street sphere. You'll discover the latest platforms that are becoming increasingly easy to use, gain access to new markets, and learn new quantitative strategies that are applicable to stocks, options, futures, currencies, and even bitcoins. The companion website provides downloadable software codes, and you'll learn to design your own proprietary tools using MATLAB. The author's experiences provide deep insight into both the business and human side of systematic trading and money management, and his evolution from proprietary trader to fund manager contains valuable lessons for investors at any level.

Algorithmic trading is booming, and the theories, tools, technologies, and the markets themselves are evolving at a rapid pace. This book gets you up to speed, and walks you through the process of developing your own proprietary trading operation using the latest tools.

- Utilize the newer, easier algorithmic trading platforms

- Access markets previously unavailable to systematic traders

- Adopt new strategies for a variety of instruments

- Gain expert perspective into the human side of trading

The strength of algorithmic trading is its versatility. It can be used in any strategy, including market-making, inter-market spreading, arbitrage, or pure speculation; decision-making and implementation can be augmented at any stage, or may operate completely automatically. Traders looking to step up their strategy need look no further than Machine Trading for clear instruction and expert solutions.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

CHAPTER 1

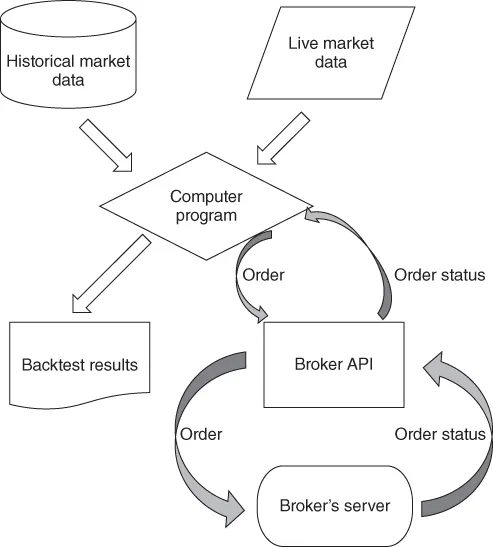

The Basics of Algorithmic Trading

Historical Market Data

Table of contents

- Cover

- Table of Contents

- Copyright

- Dedication

- Preface

- Chapter 1: The Basics of Algorithmic Trading

- Chapter 2: Factor Models

- Chapter 3: Time‐Series Analysis

- Chapter 4: Artificial Intelligence Techniques

- Chapter 5: Options Strategies

- Chapter 6: Intraday Trading and Market Microstructure

- Chapter 7: Bitcoins

- Chapter 8: Algorithmic Trading Is Good for Body and Soul

- Bibliography

- About the Author

- Index

- End User License Agreement

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app