eBook - ePub

The Global Airline Industry

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The Global Airline Industry

About this book

Extensively revised and updated edition of the bestselling textbook, provides an overview of recent global airline industry evolution and future challenges

- Examines the perspectives of the many stakeholders in the global airline industry, including airlines, airports, air traffic services, governments, labor unions, in addition to passengers

- Describes how these different players have contributed to the evolution of competition in the global airline industry, and the implications for its future evolution

- Includes many facets of the airline industry not covered elsewhere in any single book, for example, safety and security, labor relations and environmental impacts of aviation

- Highlights recent developments such as changing airline business models, growth of emerging airlines, plans for modernizing air traffic management, and opportunities offered by new information technologies for ticket distribution

- Provides detailed data on airline performance and economics updated through 2013

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access The Global Airline Industry by Peter Belobaba, Amedeo Odoni, Cynthia Barnhart, Peter Belobaba,Amedeo Odoni,Cynthia Barnhart in PDF and/or ePUB format, as well as other popular books in Technology & Engineering & Mechanical Engineering. We have over one million books available in our catalogue for you to explore.

Information

1

Introduction and Overview

Peter P. Belobaba

This chapter presents a brief introduction to the global airline industry, its evolution and current status. The major forces shaping the industry are described, including deregulation and liberalization worldwide, along with some important recent industry challenges, such as the severe financial problems and restructuring of some of the industry's largest airlines since 2000. In 2015, the global airline industry is approaching six consecutive years of aggregate profitability for the first time since the late 1990s, although there remain large differences in financial performance among airlines in different regions of the world. The industry still faces major challenges, including historically high and volatile fuel prices, a weak economic recovery from the global financial crisis, and a variety of geopolitical and public health threats that could soon end this streak of moderate profitability. Infrastructure capacity poses a major constraint worldwide and threatens continued evolution and long-term profitability. The final section provides a brief overview of Chapters 2–17.

1.1 Introduction: The Global Airline Industry

The global airline industry provides service to virtually every country in the world, and has played an integral role in the creation of a global economy. The airline industry itself is a major economic force, in terms of both its own operations and its impacts on related industries such as aircraft manufacturing and tourism, to name but two. Few other industries generate the amount and intensity of attention given to airlines, not only by those directly engaged in its operations but also by government policy makers, the news media, as well as its billions of users, who almost to a person have an anecdote to relate about an unusual, good or bad, air travel experience.

During much of its development, the growth of the global airline industry was enabled by major technological innovations such as the introduction of jet airplanes for commercial use in the 1950s, followed by the development of wide-body “jumbo jets” in the 1970s. At the same time, airlines were heavily regulated throughout the world, creating an environment in which technological advances and government policy took precedence over profitability and efforts to promote competition in the industry. It has only been in the period since the economic deregulation of airlines, beginning with the United States in 1978, that cost efficiency, operating profitability, and competitive behavior have become the dominant issues facing airline management. Airline deregulation or, at least, “liberalization” has now spread far beyond the United States to most of the industrialized world, affecting both domestic air travel within each country and, perhaps more importantly, the continuing evolution of a highly competitive international airline industry.

Today, the global airline industry consists of over 1400 commercial airlines operating more than 25 000 commercial aircraft and providing service to over 3800 airports (ATAG, 2014). In 2013, the world's airlines flew more than 36 million commercial flights and transported roughly 3.1 billion passengers (IATA, 2014a). The growth of world air travel has averaged approximately 5% per year over the past 30 years, with substantial yearly variations due to both changing economic conditions and differences in economic growth in different regions of the world. Historically, the annual growth in air travel has been about twice the annual growth in gross domestic product (GDP), although this relationship has been weakening in advanced economies in recent years. Even under relatively conservative assumptions concerning economic growth over the next 10–15 years, a continued 4–5% annual growth in global air travel will lead to a doubling of total air travel during this period.

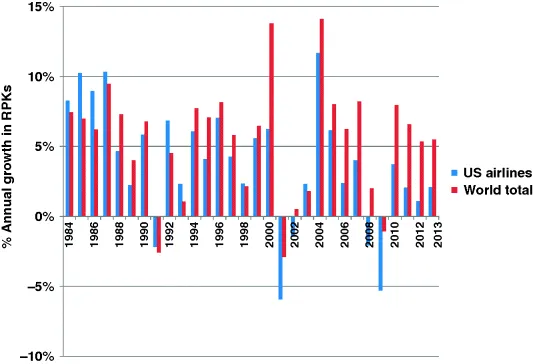

The annual growth rates in passenger air traffic, measured in revenue passenger kilometers (RPKs) (see Chapter 3 for definitions), are shown in greater detail in Figure 1.1, for the period 1984–2013. The principal driver of air travel demand is economic growth: over the period shown in Figure 1.1, the 5–6% average annual growth in air travel has been fed by an average 2–3% annual GDP growth worldwide. However, there has been substantial variability from year to year, as well as differences between US and non-US airlines. World passenger air traffic growth has been positive in all years shown, with only three exceptions. Traffic declined in 1991 due to the first Gulf War and the subsequent fuel crisis and economic recession, in 2001 due to the effects of the 9/11 terror attacks in the United States, and then again in 2009 during the global financial crisis. Figure 1.1 also shows that the annual growth rates experienced by non-US airlines have consistently outpaced those of US carriers. As a result, the proportion of world passenger traffic carried by US airlines has declined, from approximately 40% in the mid-1980s to less than 25% in 2013.

Figure 1.1 Annual RPK growth rates 1984–2013. (Data sources: Air Transport Association; ICAO)

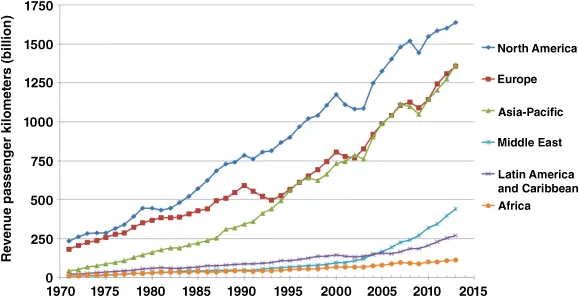

The growth of passenger air traffic by region of the world carried by all airlines (irrespective of their nationality) is illustrated in Figure 1.2. North America continues to represent the largest region in terms of air traffic, followed by Europe and Asia-Pacific. North American air travel was clearly the most affected by the terror attacks of 9/11, whereas traffic dropped in all three of the largest regions during the global financial crisis in 2009. Growth rates in the Asia-Pacific region during the 1980s and 1990s were substantially higher than those of North America and Europe, with the result that total passenger air traffic in the Asia-Pacific region has been at about the same level as in Europe for much of the time since 2005. With continued high growth rates expected, the Asia-Pacific region could soon become the second-largest world region for air traffic.

Figure 1.2 Growth of airline passenger traffic by world region. (Data sources: ICAO, 1971–2005; IATA, 2006–2013)

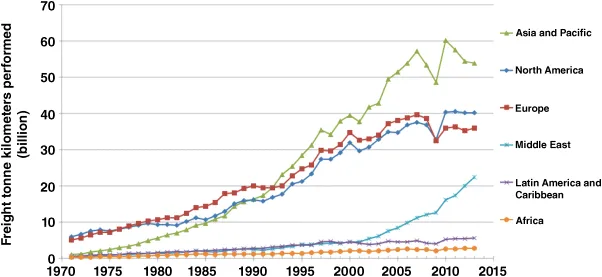

Figure 1.3 provides a similar plot of the growth of air freight by world region since 1971, measured in freight tonne kilometers (FTKs) – defined in Chapter 3. The relative size and growth of air freight in each world region differs from that of passenger air traffic, with Europe generating slightly more air freight than North America in the first part of the period shown in Figure 1.3. However, the growth of air freight in the Asia-Pacific region has surged over the past three decades and the region has led the world in terms of total air freight volume since 1992. The impacts of the global financial crisis on air freight were more dramatic than was the case for passenger traffic. After a partial recovery in 2010, air freight volumes have stagnated in North America and Europe, and have declined in the Asia-Pacific region. In contrast, they have increased consistently in the Middle East region. As shown in Figures 1.2 and 1.3, the Middle East has experienced rapid growth in both categories since 2000.

Figure 1.3 Growth of air freight volumes by world region. (Data sources: ICAO, 1971–2005; IATA, 2006–2013)

In the US airline industry, approximately 70 certificated passenger airlines operate close to 10 million flight departures per year, and carry approximately one-quarter of the world's total air passengers – US airlines enplaned 743 million passengers in 2013. US airlines (both cargo and passenger) reported $200 billion in total operating revenues, with approximately 580 000 employees and 6700 aircraft operating over 25 000 flights per day (Airlines for America, 2014a). The economic impacts of the airline industry range from its direct effects on airline employment, company profitability, and net worth to the less direct but very important effects on the aircraft manufacturing industry, airports, and tourism, not to mention the economic impact on virtually every other activity that the ability to travel by air generates.

Commercial aviation contributes 5% of the US GDP, according to recent estimates (Airlines for America, 2014a). Worldwide, the global economic impact of aviation has been estimated to be about 3.4% of world GDP or more than US$2.4 trillion in 2012 (ATAG, 2014). These estimates include direct, indirect, induced, and catalytic economic impacts, but do not include additional economic benefits such as employment or business activity made possible by air transportation.

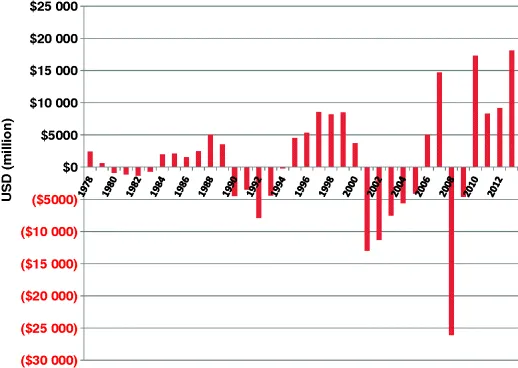

The economic importance of the airline industry, and, in turn, its repercussions on so many other major industries, makes the volatility of airline profits and their dependence on good economic conditions a serious national and international concern. As shown in Figure 1.4, the total net profits of world airlines have been cyclical and extremely variable since the start of deregulation in 1978. After the world airline industry posted four consecutive years of losses totaling over $22 billion from 1990 to 1993, as a result of the Gulf War and subsequent economic recession, it returned to record profitability in the late 1990s. Even more dramatic were the industry's plunges into record losses between 2001 and 2005, and then again in 2008–2009. The string of profitable years since 2010 gives the industry its first period of sustained profitability since the late 1990s.

Figure 1.4 World airline net profits 1978–2013. (Data sources: Airlines for America; ICAO)

1.1.1 Deregulation and Liberalization Worldwide

Since the deregulation of US airlines in 1978, the pressure on governments to reduce their involvement in the economic regulation of airlines has spread to most of the rest of the world. US airline deregulation is perceived as a success by most other countries, as the overall benefits to the vast majority of air travelers have been clearly demonstrated. While US domestic air travel grew at rates significantly greater than prior to deregulation, average real fares have declined significantly since deregulation and in 2013 were 40% below 1978 levels in constant prices (Airlines for America, 2014b). Successful new entrant and low-fare airlines had a great impact both on airline pricing practices and on the public's expectations of low-priced air travel. And, despite worries at the time of deregulation that competitive cost pressures might lead to reduced maintenance standards, there has been no statistical evidence that airline safety has deteriorated (Chapter 12).

At...

Table of contents

- Cover

- Aerospace Series List

- Title Page

- Copyright

- Notes on Contributors

- List of Contributors

- Series Preface

- Acknowledgments

- Chapter 1: Introduction and Overview

- Chapter 2: The International Institutional and Regulatory Environment

- Chapter 3: Overview of Airline Economics, Markets and Demand

- Chapter 4: Airline Pricing Theory and Practice

- Chapter 5: Airline Revenue Management

- Chapter 6: Airline Operating Costs and Measures of Productivity

- Chapter 7: The Airline Planning Process

- Chapter 8: Airline Schedule Optimization

- Chapter 9: Airline Flight Operations

- Chapter 10: Irregular Operations: Schedule Recovery and Robustness

- Chapter 11: Labor Relations and Human Resource Management in the Airline Industry*

- Chapter 12: Aviation Safety and Security

- Chapter 13: Airports

- Chapter 14: Air Traffic Control

- Chapter 15: Air Transport and the Environment

- Chapter 16: Information Technology in Airline Operations, Distribution and Passenger Processing

- Chapter 17: Critical Issues and Prospects for the Global Airline Industry

- Index

- End User License Agreement