Multivariate Time Series Analysis

With R and Financial Applications

Ruey S. Tsay

- English

- ePUB (handyfreundlich)

- Über iOS und Android verfügbar

Multivariate Time Series Analysis

With R and Financial Applications

Ruey S. Tsay

Über dieses Buch

An accessible guide to the multivariate time series tools used in numerous real-world applications

Multivariate Time Series Analysis: With R and Financial Applications is the much anticipated sequel coming from one of the most influential and prominent experts on the topic of time series. Through a fundamental balance of theory and methodology, the book supplies readers with a comprehensible approach to financial econometric models and their applications to real-world empirical research.

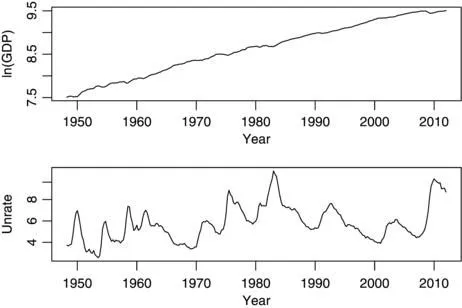

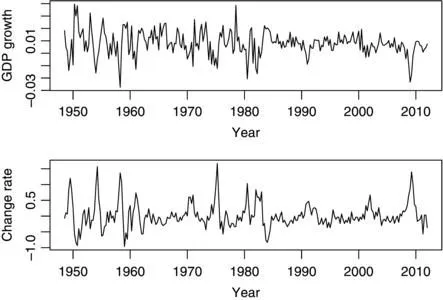

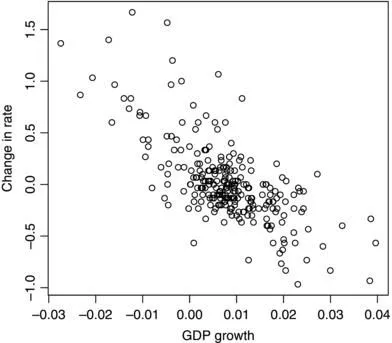

Differing from the traditional approach to multivariate time series, the book focuses on reader comprehension by emphasizing structural specification, which results in simplified parsimonious VAR MA modeling. Multivariate Time Series Analysis: With R and Financial Applications utilizes the freely available R software package to explore complex data and illustrate related computation and analyses. Featuring the techniques and methodology of multivariate linear time series, stationary VAR models, VAR MA time series and models, unitroot process, factor models, and factor-augmented VAR models, the book includes:

• Over 300 examples and exercises to reinforce the presented content

• User-friendly R subroutines and research presented throughout to demonstrate modern applications

• Numerous datasets and subroutines to provide readers with a deeper understanding of the material

Multivariate Time Series Analysis is an ideal textbook for graduate-level courses on time series and quantitative finance and upper-undergraduate level statistics courses in time series. The book is also an indispensable reference for researchers and practitioners in business, finance, and econometrics.

Häufig gestellte Fragen

Information

CHAPTER 1

Multivariate Linear Time Series

1.1 INTRODUCTION