eBook - ePub

Practical SAP US Payroll

Satish Badgi

This is a test

Buch teilen

- 464 Seiten

- English

- ePUB (handyfreundlich)

- Über iOS und Android verfügbar

eBook - ePub

Practical SAP US Payroll

Satish Badgi

Angaben zum Buch

Buchvorschau

Inhaltsverzeichnis

Quellenangaben

Häufig gestellte Fragen

Wie kann ich mein Abo kündigen?

Gehe einfach zum Kontobereich in den Einstellungen und klicke auf „Abo kündigen“ – ganz einfach. Nachdem du gekündigt hast, bleibt deine Mitgliedschaft für den verbleibenden Abozeitraum, den du bereits bezahlt hast, aktiv. Mehr Informationen hier.

(Wie) Kann ich Bücher herunterladen?

Derzeit stehen all unsere auf Mobilgeräte reagierenden ePub-Bücher zum Download über die App zur Verfügung. Die meisten unserer PDFs stehen ebenfalls zum Download bereit; wir arbeiten daran, auch die übrigen PDFs zum Download anzubieten, bei denen dies aktuell noch nicht möglich ist. Weitere Informationen hier.

Welcher Unterschied besteht bei den Preisen zwischen den Aboplänen?

Mit beiden Aboplänen erhältst du vollen Zugang zur Bibliothek und allen Funktionen von Perlego. Die einzigen Unterschiede bestehen im Preis und dem Abozeitraum: Mit dem Jahresabo sparst du auf 12 Monate gerechnet im Vergleich zum Monatsabo rund 30 %.

Was ist Perlego?

Wir sind ein Online-Abodienst für Lehrbücher, bei dem du für weniger als den Preis eines einzelnen Buches pro Monat Zugang zu einer ganzen Online-Bibliothek erhältst. Mit über 1 Million Büchern zu über 1.000 verschiedenen Themen haben wir bestimmt alles, was du brauchst! Weitere Informationen hier.

Unterstützt Perlego Text-zu-Sprache?

Achte auf das Symbol zum Vorlesen in deinem nächsten Buch, um zu sehen, ob du es dir auch anhören kannst. Bei diesem Tool wird dir Text laut vorgelesen, wobei der Text beim Vorlesen auch grafisch hervorgehoben wird. Du kannst das Vorlesen jederzeit anhalten, beschleunigen und verlangsamen. Weitere Informationen hier.

Ist Practical SAP US Payroll als Online-PDF/ePub verfügbar?

Ja, du hast Zugang zu Practical SAP US Payroll von Satish Badgi im PDF- und/oder ePub-Format sowie zu anderen beliebten Büchern aus Computer Science & Computer Science General. Aus unserem Katalog stehen dir über 1 Million Bücher zur Verfügung.

Information

Before we get into the detailed discussion and learn about US Payroll, a discussion of the components of US Payroll and the associated conceptual figures will familiarize you with the terminology and overall architecture of SAP US Payroll.

1 Objectives and Purpose

Even if you don’t work with a payroll system (SAP Payroll or otherwise), you’re probably familiar with your paycheck and the overall nature of how important a top-notch payroll system is for a company. When employees talk among themselves, or when you interview candidates for new jobs, a predictable conversation arises about payroll and benefits, especially in the United States. Challenges specific to payroll in the United States include multilayer taxation, collective bargaining agreements, the Fair Labor Standard Act (FLSA), garnishments, and similar examples. Consequently, payroll and benefits have regulatory and compliance impacts, in addition to affecting employees. Employees are interested in learning about benefits and deductions as much as they are about their annual salary.

In our day-to-day life, we often use the terms take-home pay or money in the pocket. It is natural for us to think about taxes and the net money we will take home at the end of the pay period. Similarly, in SAP implementations, when you talk about Human Resources (HR) or Human Capital Management (HCM), then payroll, taxes, and benefits often become an integral part of the discussion. SAP’s Payroll component is well integrated with other SAP Financials and SAP HCM subcomponents. Payroll processing also varies greatly, depending on the country, thanks to differing tax structures, employment laws, and various regulations.

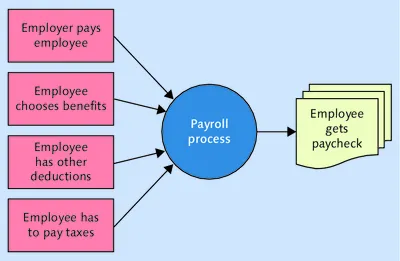

Before we start the discussion of US Payroll, consider a simple concept diagram for the payroll process. Figure 1.1 is a simple representation of the US Payroll process and shows that:

- Employees get paid by their employer.

- Employees pay taxes and deductions.

- Employees receive a paycheck through the payroll process.

Later in this chapter, we will move the discussion to SAP’s US Payroll process and provide you with more detailed information.

Figure 1.1 The US Payroll Process—Simple Representation

US Payroll is very unique in that you need to understand it from both a functional and a technical perspective. This chapter identifies the unique aspects of US Payroll. It gives you a necessary basic background for pay frequency, payroll control records, and overall payroll processes in the United States.

1.1 What Makes US Payroll Unique?

Before realizing that US Payroll is different, we wondered about its uniqueness when first starting to work with it. Why is it so special? The differences can be categorized into two broad areas: functional and technical.

1.1.1 Functional Uniqueness

US Payroll has many unique requirements. SAP’s Payroll component addresses these and other functional requirements along with help from other components, such as PA and US Benefits. We have categorized these requirements for simplicity:

- Unions

Many U.S. states and industries have unions, and US Payroll creates challenges when handling union agreements (otherwise known as collective bargaining agreements) and the calculation complexities involved. They have a multi-faceted impact on US Payroll:- SAP provides specific infotypes to maintain union dues.

- You need to adjust payroll calculations based on union agreements and write custom rules.

- You need to configure wage types appropriately.

- Usually, the hourly workforce uses time-clocking, and the time data comes into payroll for paying the employees.

-

- Taxes

The multitier tax structure of the United States has three layers: federal, state, and local. In addition, tax regulations differ from state to state. The impact on US Payroll includes:- Specific infotypes for tax structures relevant in the United States

- Specific tax calculation schemas

- Specific tax wage types that are generated

- Configuration of tax models

- The tax calculation engine that SAP US Payroll uses

- Tax reporter functionality for end-of-year tax documents like W-2s

- Compliance reporting and annual reporting

- Business processes built around a typical tax year of January through December, with a tax return filing date of April 15

- Corrections and year-end adjustments for employee tax results

The United States is the only country that uses the BSI Tax Factory product for tax calculations. -

- Benefits integration

U.S. employers offer benefits such as health insurance (medical, dental, vision, etc.), life insurance, pensions, 401(k) plans, and flexible spending accounts. These benefits and their processing are very tightly coupled with payroll processing. In addition, some employers also allow employees to purchase U.S. savings bonds as a standard payroll deduction. The impact of these factors on US Payroll includes:- Deductions for benefits being handled through payroll

- Wage types configured for specific benefit plans

- Pre- and post-tax nature of benefit deductions

- Remittance to benefit providers done through payroll

- Regulations concerning flexible spending accounts

- Regulations concerning 401(k) plans such as annual limits and catch-up contributions

-

- Garnishments

Many countries don’t even have the concept of garnishments, and U.S. laws and regulations are very stringent in the way employers handle them. SAP US Payroll provides comprehensive relevant functionality, which includes:- Calculations of an employee’s disposable net income

- Built-in models for calculations, including state-based differentiators

- Reporting and remittance to the authorities

-

- Accrua...