eBook - ePub

Practical SAP US Payroll

Satish Badgi

This is a test

Partager le livre

- 464 pages

- English

- ePUB (adapté aux mobiles)

- Disponible sur iOS et Android

eBook - ePub

Practical SAP US Payroll

Satish Badgi

Détails du livre

Aperçu du livre

Table des matières

Citations

Foire aux questions

Comment puis-je résilier mon abonnement ?

Il vous suffit de vous rendre dans la section compte dans paramètres et de cliquer sur « Résilier l’abonnement ». C’est aussi simple que cela ! Une fois que vous aurez résilié votre abonnement, il restera actif pour le reste de la période pour laquelle vous avez payé. Découvrez-en plus ici.

Puis-je / comment puis-je télécharger des livres ?

Pour le moment, tous nos livres en format ePub adaptés aux mobiles peuvent être téléchargés via l’application. La plupart de nos PDF sont également disponibles en téléchargement et les autres seront téléchargeables très prochainement. Découvrez-en plus ici.

Quelle est la différence entre les formules tarifaires ?

Les deux abonnements vous donnent un accès complet à la bibliothèque et à toutes les fonctionnalités de Perlego. Les seules différences sont les tarifs ainsi que la période d’abonnement : avec l’abonnement annuel, vous économiserez environ 30 % par rapport à 12 mois d’abonnement mensuel.

Qu’est-ce que Perlego ?

Nous sommes un service d’abonnement à des ouvrages universitaires en ligne, où vous pouvez accéder à toute une bibliothèque pour un prix inférieur à celui d’un seul livre par mois. Avec plus d’un million de livres sur plus de 1 000 sujets, nous avons ce qu’il vous faut ! Découvrez-en plus ici.

Prenez-vous en charge la synthèse vocale ?

Recherchez le symbole Écouter sur votre prochain livre pour voir si vous pouvez l’écouter. L’outil Écouter lit le texte à haute voix pour vous, en surlignant le passage qui est en cours de lecture. Vous pouvez le mettre sur pause, l’accélérer ou le ralentir. Découvrez-en plus ici.

Est-ce que Practical SAP US Payroll est un PDF/ePUB en ligne ?

Oui, vous pouvez accéder à Practical SAP US Payroll par Satish Badgi en format PDF et/ou ePUB ainsi qu’à d’autres livres populaires dans Computer Science et Computer Science General. Nous disposons de plus d’un million d’ouvrages à découvrir dans notre catalogue.

Informations

Before we get into the detailed discussion and learn about US Payroll, a discussion of the components of US Payroll and the associated conceptual figures will familiarize you with the terminology and overall architecture of SAP US Payroll.

1 Objectives and Purpose

Even if you don’t work with a payroll system (SAP Payroll or otherwise), you’re probably familiar with your paycheck and the overall nature of how important a top-notch payroll system is for a company. When employees talk among themselves, or when you interview candidates for new jobs, a predictable conversation arises about payroll and benefits, especially in the United States. Challenges specific to payroll in the United States include multilayer taxation, collective bargaining agreements, the Fair Labor Standard Act (FLSA), garnishments, and similar examples. Consequently, payroll and benefits have regulatory and compliance impacts, in addition to affecting employees. Employees are interested in learning about benefits and deductions as much as they are about their annual salary.

In our day-to-day life, we often use the terms take-home pay or money in the pocket. It is natural for us to think about taxes and the net money we will take home at the end of the pay period. Similarly, in SAP implementations, when you talk about Human Resources (HR) or Human Capital Management (HCM), then payroll, taxes, and benefits often become an integral part of the discussion. SAP’s Payroll component is well integrated with other SAP Financials and SAP HCM subcomponents. Payroll processing also varies greatly, depending on the country, thanks to differing tax structures, employment laws, and various regulations.

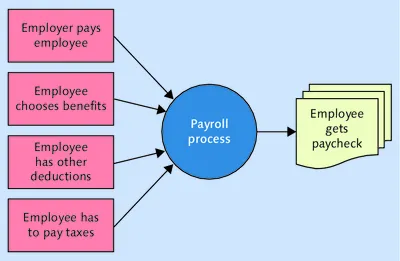

Before we start the discussion of US Payroll, consider a simple concept diagram for the payroll process. Figure 1.1 is a simple representation of the US Payroll process and shows that:

- Employees get paid by their employer.

- Employees pay taxes and deductions.

- Employees receive a paycheck through the payroll process.

Later in this chapter, we will move the discussion to SAP’s US Payroll process and provide you with more detailed information.

Figure 1.1 The US Payroll Process—Simple Representation

US Payroll is very unique in that you need to understand it from both a functional and a technical perspective. This chapter identifies the unique aspects of US Payroll. It gives you a necessary basic background for pay frequency, payroll control records, and overall payroll processes in the United States.

1.1 What Makes US Payroll Unique?

Before realizing that US Payroll is different, we wondered about its uniqueness when first starting to work with it. Why is it so special? The differences can be categorized into two broad areas: functional and technical.

1.1.1 Functional Uniqueness

US Payroll has many unique requirements. SAP’s Payroll component addresses these and other functional requirements along with help from other components, such as PA and US Benefits. We have categorized these requirements for simplicity:

- Unions

Many U.S. states and industries have unions, and US Payroll creates challenges when handling union agreements (otherwise known as collective bargaining agreements) and the calculation complexities involved. They have a multi-faceted impact on US Payroll:- SAP provides specific infotypes to maintain union dues.

- You need to adjust payroll calculations based on union agreements and write custom rules.

- You need to configure wage types appropriately.

- Usually, the hourly workforce uses time-clocking, and the time data comes into payroll for paying the employees.

-

- Taxes

The multitier tax structure of the United States has three layers: federal, state, and local. In addition, tax regulations differ from state to state. The impact on US Payroll includes:- Specific infotypes for tax structures relevant in the United States

- Specific tax calculation schemas

- Specific tax wage types that are generated

- Configuration of tax models

- The tax calculation engine that SAP US Payroll uses

- Tax reporter functionality for end-of-year tax documents like W-2s

- Compliance reporting and annual reporting

- Business processes built around a typical tax year of January through December, with a tax return filing date of April 15

- Corrections and year-end adjustments for employee tax results

The United States is the only country that uses the BSI Tax Factory product for tax calculations. -

- Benefits integration

U.S. employers offer benefits such as health insurance (medical, dental, vision, etc.), life insurance, pensions, 401(k) plans, and flexible spending accounts. These benefits and their processing are very tightly coupled with payroll processing. In addition, some employers also allow employees to purchase U.S. savings bonds as a standard payroll deduction. The impact of these factors on US Payroll includes:- Deductions for benefits being handled through payroll

- Wage types configured for specific benefit plans

- Pre- and post-tax nature of benefit deductions

- Remittance to benefit providers done through payroll

- Regulations concerning flexible spending accounts

- Regulations concerning 401(k) plans such as annual limits and catch-up contributions

-

- Garnishments

Many countries don’t even have the concept of garnishments, and U.S. laws and regulations are very stringent in the way employers handle them. SAP US Payroll provides comprehensive relevant functionality, which includes:- Calculations of an employee’s disposable net income

- Built-in models for calculations, including state-based differentiators

- Reporting and remittance to the authorities

-

- Accrua...