Chapter 7. Alerts

Sudden, sharp movements in a particular company’s share price are quite commonplace. The market is rife with rumours, some true and some false. It is virtually impossible for investors to determine at first sight whether a leap or slump in a share is due to fact or fiction.

Over time it probably works out 50:50 whether share price movements are based on fact or fiction. When there is plenty of action it is harder for rumours to attract attention, while quiet weeks or months give greater scope for idle tongues.

Sometimes, despite the best endeavours of the regulators to maintain a level playing field, news of some major development leaks out. This is usually when a takeover bid is in the offing: too many people need to know about it to gag everyone.

Unfortunately, less scrupulous investors take advantage of the fact that rumours sometimes turn out to be true. They peddle credible reports, often on website bulletin boards, to drive prices so that they can dump stock or buy in cheaply.

As with the rumour mongers, the press sometimes gets it right and sometimes wrong. Press comment is particularly potent in those sectors selling directly to the public, such as retailers, where spending patterns can change dramatically over a few months or even weeks and companies are constantly comparing sales now with those of a year ago. Even if nothing is leaked from the companies concerned, newspapers can speculate on who is buying what on the High Street.

Companies are obliged to offer clarification when the share price moves substantially. There is no set figure for what constitutes a substantial movement, although 10% is widely regarded as the norm. Quoted companies are, on the whole, pretty conscientious in keeping the market informed and they can be prompted to do the decent thing by the stock exchange if necessary.

False alarms

In many cases, companies are as baffled as shareholders by a sudden share price movement. In these cases the ensuing statement will be to the point, as is this one from Alecto Energy, which invests in energy projects.

Share price movement

Alecto Energy has noted the recent movement in its share price and confirms that the Board is not aware of any reason for this movement.

Alecto is a curious case of how companies these days err on the side of making announcements even when nothing much is happening. (The share price, which had barely risen above 3p since the company joined AIM in 2006, sunk to a measly 0.03p when it suddenly trebled to 0.1p!)

To the point

As an example of getting to the point, this offering from property developer Eatonfield is what we want:

Statement re share price increase

The Directors of Eatonfield note the recent substantial increase in the Company’s share price and wish to notify the market that they are not aware of any reason for such a movement. The Directors are also satisfied that all information of a price-sensitive nature has previously been notified to the market.

Full marks to Eatonfield for making it clear that the share price movement was up rather than down (most companies leave you to check what has happened for yourself) and for the clarity of its statement. Price sensitive information means news that could cause the share price to move.

Eatonfield had gone through a torrid patch as property prices fell in the credit crunch and its shares had slumped from a peak of 188p to a measly 2.5p in little over a year. Then, within the space of three days, they shot up to 25p, ten times their previous value.

The denial that anything was afoot eventually brought them back to 14p but that took several hours and alert shareholders had the chance to get out if they wished at a higher price in the meantime.

When one talks of a sharp movement in a company’s share price caused by press reports one tends to think of scare stories. However, reports can drive share prices up as well as down.

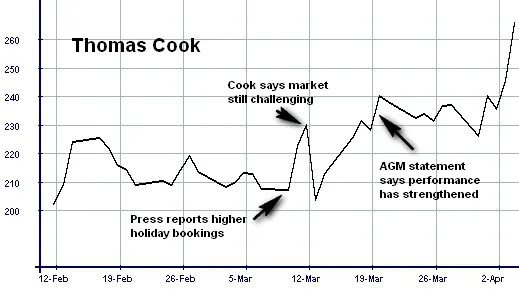

Case study: Thomas Cook

Travel company Thomas Cook was one case of a share price being moved by press reports, although one has to say that its response to favourable comment was a masterpiece of divulging nothing:

Thomas Cook notes the recent press comment and share price movement

- Thomas Cook notes that the performance of the Group overall continues to be in line with the performance outlined at the time of releasing its Interim Management Statement on 12 February 2009. Whilst the market continues to be challenging, the Board remains confident in achieving its expectations for the year as a whole and believes that the Group remains well positioned for the future.

Phrases such as ‘the market continues to be challenging’ and ‘well positioned for the future’ are pretty meaningless. The only thing we have to go on here is the fact that nothing has apparently changed since Cook issued a trading update about a month earlier.

A check back to the previous pronouncement showed that it had been somewhat downbeat. Cook had said that bookings were well down on the previous year and it was reaching its financial targets only because it had reduced capacity.

The travel company had also warned that it was struggling with higher fuel bills as it had fixed prices on its supplies up to 14 months in advance, so it was not benefiting from recent falls in the price of crude oil.

Analysts had calculated that the company needed to increase prices by 6% in the UK to cover fuel costs and offset the fall in the value of the pound.

Investors had to choose between Cook’s indication that the tourist industry was suffering in the credit crunch or believing press reports suggesting that holiday bookings for the following summer were improving. In these circumstances the market will generally accept the company line.

From a low of 130p, the shares had been recovering and they shot up from 208p to 230p on the favourable press comment. Thomas Cook’s noncommittal response promptly dragged them back down to 204p.

Frankly, there are no rights and wrongs in his type of situation. Investors must use their own judgement and keep an eye on how the situation develops. In this case the press were vindicated, as Cook proved in its next update:

- Despite the challenging trading environment we are pleased the business performance has strengthened.

- Winter: The clear trend towards later bookings continues. Despite the distorting impact of a later Easter, bookings have improved significantly in the last four weeks, particularly in our Continental and Northern European segments. Average selling prices are up year on year and load factors on departed flights remain at least at last year’s levels.

- Summer: Summer trading in the UK has been robust. Cumulative bookings are tracking in line with capacity reductions of 11%, and we have now sold 52% of our capacity, in line with the prior year. Having successfully focused on selling the months on either side of the July/August peak, we now have 14% less left to sell than last year in these shoulder months. Given that mix we are pleased to have driven average selling prices up 9% overall.

Ups and downs

Let us look at two cases where companies were prompted to make unequivocal statements after share price movements, one where the shares when down and the other where shares went up.

In such cases the resulting statement from the company may be quite brief, especially if plans are at an early stage, and will read something like this one from industrial property landlord Brixton:

Response to share price movement

- The Board of Brixton notes the recent movement in the Company’s share price.

- Given the ongoing challenging market conditions in the real estate and financial markets, the Board of Brixton is pursuing a range of options to provide additional financial flexibility, including disposals from its investment portfolio, as well as considering an equity raising. No decision on any course of action has been taken at this stage.

- A further announcement will be made as and when appropriate.

Brixton’s shares had been on the slide since peaking at 575p at the start of 2007 and the well publicised travails of the property market had pushed them well below 100p by early 2009.

It was a fall of 19p from 67p to 48p – over 28% – on the previous day that prompted the announcement.

Brixton shares continued on their downward path to 15p three weeks later, by which time the chief executive had been ousted by the rest of the board.

Strategic review

In contrast, healthcare group Claimar Care’s prompt reaction was in response to a rise in its share price:

- Claimar Care confirms that it is in the early stages of undertaking a strategic review to consider how best to take the business forward.

- The strategic review has been initiated by the Board as it is disappointed with the Company’s depressed share price, which it feels does not fairly reflect the Company’s strong market position and growth prospects.

- As part of this review, the Claimar Care Board will be considering a number of options available to the Company to maximise shareholder value including the possible sale of all or p...