![]()

Part I

Comparative Perspectives on Housing Reforms

![]()

Chapter 1

Housing Reforms and Market Performance

Robert M. Buckley and Sasha Tsenkova

Housing Reform Challenges: Emerging Policy Issues

In virtually every reforming socialist economy in Europe, housing markets collapsed as the economies went into recessions and production shifted away from public sector production. Because housing services are responsive to changes in income, and particularly interest rates, a reduction in demand was to be expected given the turmoil of the transition. In addition, because housing services are overwhelmingly provided by the private sector in market countries, and had been largely provided by the public sector in transition economies, one might, as a result, expect an even larger shift. However, in many of the transition countries a decade after the collapse of these markets, production and transactions remain at very low levels even in countries where economic growth has been restored for a number of years.1

Besides the low level of housing market activity, there has been an even lower level of mortgage lending. Instead, the levels of transfers provided by governments are often multiples of those provided in most industrialized economies with well-established market-based housing systems. At present, it appears that most government resources are being used to provide poorly targeted subsidies rather than contribute to the development of the financial and legal infrastructure of private finance. In addition, an extensive privatization of public assets – including public rental stock and state construction enterprises – has taken place (Clapham et al., 1996). While privatization of the industry essentially has lead to the emergence of a more competitive system of private producers of building materials, housing and housing services, the privatization of housing has left a lot of ‘unfinished business’. As the flagship of real estate reforms, it fuelled the expansion of home ownership, particularly in Lithuania, Slovenia and Russia. At least half of the countries in Central and Eastern Europe have reached levels of home ownership of over 80 per cent and could validly be regarded as ‘nations of home owners’ (Tsenkova, 2000a). Studies suggest that, due to ‘the give away’ prices, a large share of economically marginalized households have become homeowners. Major difficulties in maintaining utility payments and property maintenance fees are frequently cited problems, particularly in multifamily buildings (Tsenkova, 2000b). While the objective of privatization was to improve the economic and social efficiency of the housing sector, it might well be the case that it has created long-term imbalances in the distribution and consumption of housing.

In sum, while the reductions in income have caused sharp reductions in demand for housing and housing services, as would be expected in a recession, the recovery has been prolonged (United Nations Economic Commission for Europe, 1997). Scaling back on the production of long-lived goods – such as housing and related infrastructure – may have been an effective way to cushion economic and social shocks. However, the cut backs in production have been large even if the housing sector served as a ‘shock absorber’ which could help to bear the costs of the transition, as suggested by Struyk (1996).

Objectives of the Study

The objectives of this study are threefold: First, to undertake a comparative analysis of the policy reforms and performances of housing market systems in as many of the reforming economies as possible. Can a comparative analysis allow inferences to be drawn about the policy reforms that are instrumental in improving performance? In other words, can a set of indicators be developed to show why a policy maker should be interested in undertaking reforms? Can indicators illustrate, for example, how far behind a particular country is from the performance level typical of more market-oriented countries,2 as well as suggest how a reform program might affect that performance?

The second objective is to develop a set of performance and policy indicators whose data requirements are informationally simple, but which can nevertheless provide a robust basis for quick and accurate assessment of the strengths and weaknesses of sector performance and policy environment. The objective, then, is to design a set of simple, comprehensive and quantifiable indicators, which would be able to inform policy rapidly and inexpensively. Ideally, the indicators should ultimately be a sort of a checklist that provides a quick perspective, as well as one that assures that all the major policy issues are being considered.

The final objective of the study is to see whether such comparative indicators could be used to make judgments and/or recommendations about the strategy and sequencing of reform. Do the countries’ experiences suggest patterns of behavior and links between specific types of reforms and performance? Is there a reform path that countries have to go through to successfully improve performance? And finally, how much do the initial sectoral conditions affect the types of reforms undertaken? That is, can the indicators frame a decision on how to proceed with a reform program?

The Analytical Model

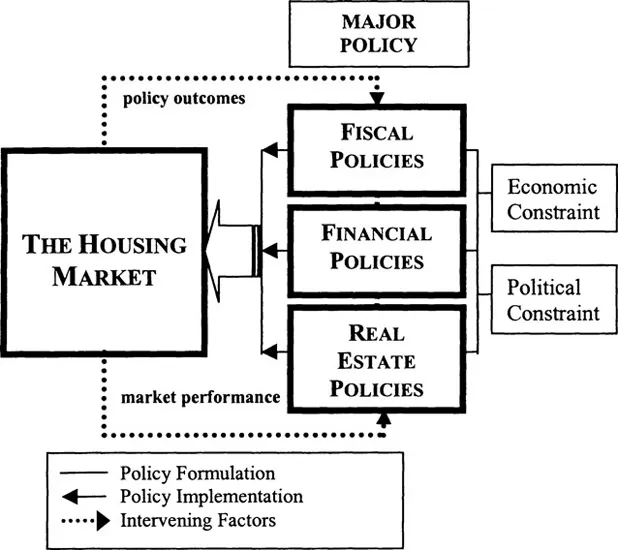

The model used in the study defines three distinct policy arenas, each governing not only policy outcomes, but instruments and types of intervention as well. To the extent that the policy arena is dependent on exogenous factors such as economic and policy constraints, the specific choices of instruments will be made (see Figure 1.1).

Figure 1.1 Model for Evaluation of Policy Reforms and Housing Market Performance

According to the model, the most significant policies that affect the housing sector in reforming socialist economies are fiscal, financial and real estate policies. It is recognized that in addition to those main policy arenas, there are other kinds of policies that have immense and often unintended impacts on market performance. The latter would include shifts in macroeconomic policies, taxation, structural reforms, changes in political regimes and systems of governance. It has been argued, for example, that the influence of economic shocks across the region is still felt long after their first impact (European Bank for Reconstruction and Development, 2000). Moreover, economic and political instability has eroded investor confidence by creating additional risks associated with unpredictability of government policies. Often, due to external pressures, different political regimes have responded in an ad hoc manner, creating an incoherent policy framework for the operation of housing markets.

Despite these constraints, the housing sector has managed to emerge out of the transition with modest prospects for growth. Privatization and rapid institutional transformation, in addition to its internal dynamics, have and will continue to affect its performance. These rapid changes, manifested in a series of market outcomes, correspondingly reshape the context for policy formulation and implementation, as well as generate new policy intervention. The model provides a dynamic perspective, where the different parts act, react, and interact to produce change. Since the aim of this comparison is to offer practical solutions to reforming economies, the analysis evades the fallacy of ‘policy centrism’ and does not view policies as the only driving force of the transformation process. The policy content in the three major policy arenas is given the same analytical status as the other indicators related to the arena of impact – the housing market. Given the diversity of policy responses across the reforming socialist economies, the analysis explores the organized and/or poorly orchestrated complexity of fiscal, financial and real estate policy reforms through evaluation of policy outcomes and the way they relate to market performance. The emphasis is therefore on results, rather than analysis of policy intervention and alternative policy instruments. The model is then operationalized through a set of policy and performance indicators to assess the strengths and weaknesses of sector performance.3

It should be noted, perhaps admitted, at the outset that this work supports the hypothesis that housing services and housing finance are almost certainly more effective, if provided through a competitive market. Such a hypothesis is clearly a bit disingenuous in an analysis that attempts to bring together a cumulative ‘picture’ of performance and the effect of policy on that performance. The underlying philosophical ‘bias’ of this hypothesis to some extent affects the characteristics of the ‘ideal market-based housing system’ used as a benchma...