In the next 23 chapters, which are divided into 4 parts, we will provide an analysis of the issues that venture capital and private equity market participants face during the fund-raising process (Part II), investment process (Part III), and divestment process (Part IV). A common theme across all issues involves agency costs, and hence agency theory is reviewed after this introductory chapter in Chapter 2 (Part I). All the issues addressed in this book are analyzed from an empirical law and finance perspective, with a focus on financial contracting. Financial contracts are central to the establishment of the relationship between venture capital and private equity funds and their investors. Financial contracts also govern the relationship between venture capital and private equity funds and their investee entrepreneurial firms, as well as determine the efficacy of the divestment process. In most chapters we refer to datasets to grasp the real-world aspects of the venture capital and private equity process. Further, it is important to consider international evidence to grasp the impact of laws and institutions on the respective venture capital and private equity markets. The empirical methods and legal and institutional settings in this book are overviewed in Chapter 3.

1.1 What is Venture Capital and Private Equity?

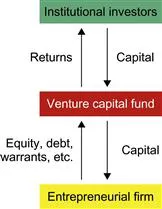

At the outset, it is important to discuss what is meant by the terms venture capital and private equity. Venture capital and private equity funds are financial intermediaries between sources of funds (typically institutional investors) and high-growth and high-tech entrepreneurial firms. Funds are typically established as limited partnerships, but as discussed herein, there are other types of funds. A limited partnership is in essence a contract between institutional investors who become limited partners (pension funds, banks, life insurance companies, and endowments who have rights as partners but trade “management” rights over the fund for limited liability) and the fund manager who is designated the general partner (the partner that takes on the responsibility of the day-to-day operations and management of the fund and assumes total liability in return for negligible buyin). Chapter 5 examines in detail the structure of limited partnerships and limited partnership contracts. The basic intermediation structure of venture capital and private equity funds is graphically summarized in Figure 1.1.

Figure 1.1 Venture capital financial intermediation.

Venture capital funds are typically set up with at least US$50 million in capital committed from institutional investors and often exceed US$100 million. Some of the larger private equity funds raised more than US$10 billion in 2006.1 Fund managers typically receive compensation in the form of a management fee (often 1–2% of committed capital, depending on the fund size) and a performance fee or carried interest (20% of capital gains). Chapter 6 discusses factors related to fund manager compensation. Venture capital funds invest in start-up entrepreneurial firms that typically require at least US$1 million and up to US$20 million in capital. Private equity funds invest in more established firms, as discussed further below.

Venture capital is often referred to as the “money of invention” (see, e.g., Black and Gilson, 1998; Gompers and Lerner, 1999, 2001; Kortum and Lerner, 2000) and venture capital fund managers as those that provide value-added resources to entrepreneurial firms. Venture capital fund managers play a significant role in enhancing the value of their entrepreneurial investments as they provide financial, administrative, marketing, and strategic advice to entrepreneurial firms, as well as facilitate a network of support for an entrepreneurial firm with access to accountants, lawyers, investment bankers, and organizations specific to the industry in which the entrepreneurial firm operates (Gompers and Lerner, 1999; Leleux and Surlemount, 2003; Manigart et al., 2002a, b; Sahlman, 1990; Sapienza et al., 1996; Wright and Lockett, 2003). Academic studies have shown us that venture capital-backed entrepreneurial firms are on average significantly more successful than nonventure capital-backed entrepreneurial firms in terms of innovativeness (Kortum and Lerner, 2000), profitability, and share price performance upon going public (Gompers and Lerner, 1999, 2001).

Venture capital and private equity investments carried out by a fund typically last over a period of 2–7 years. A venture capital limited partnership envisages this extended investment horizon and hence is structured over a 10-year horizon (with an option to continue for an additional 3 years) so that the fund manager can select investments over the first few years and then bring those investments to fruition over the remaining life of the fund. Investments are made with a view toward capital gains upon an exit event (a sale transaction), as entrepreneurial firms typically are not able to pay interest on debt or dividends on equity. The terms of the investment often give the venture capital fund significant cash flow rights in the form of equity and priority in the event of liquidation. As well, the venture capital fund typically receives significant veto and control rights over decisions made by the management of the entrepreneurial firm.

The terms venture capital and private equity differ primarily with respect to the stage of development of the entrepreneurial firm in which they invest. Venture capital refers to investments in earlier-stage firms (seed or start-up firms), whereas private equity is a broader term that also encompasses later-stage investments as well as buyouts and turnaround investments. In this book, unless explicitly stated otherwise, for ease of exposition we use the term “private equity” to encompass all private investment stages including venture capital. The various financing stages are defined as follows.

• Seed

− Financing provided to entrepreneurs to research, assess, and develop an initial concept before a business has reached the start-up phase.

• Start-up

− Financing provided to firms for product development and initial marketing. Firms may be in the process of being set up or may have been in business for a short time but have not sold their product commercially.

• Other early stage

− Financing to firms that have completed the product development stage and require further funds to initiate commercial manufacturing and sales. They will not yet be generating a profit.

• Expansion

− Financing provided for the growth and expansion of a firm which is breaking even or trading profitably. Capital may be used to finance increased production capacity, market or product development, and/or to provide additional working capital.

• Bridge financing

− Financing made available to a firm in the period of transition from being privately owned to being publicly quoted.

• Secondary purchase/replacement capital

− Purchase of existing shares in a firm from another private equity investment organization or from another shareholder or shareholders.

• Rescue/turnaround

− Financing made available to an existing firm which has experienced trading difficulties (firm is not earning its cost of capital (WACC)), with a view to reestablishing prosperity.

• Refinancing bank debt

− To reduce a firm’s level of gearing.

• Management buyout

− Financing provided to enable current operating management and investors to acquire an existing product line or business.

• Management buyin

− Financing provided to enable a manager or group of managers from outside the firm to buyin to the firm with the support of private equity investors.

• Venture purchase of quoted shares

− Purchase o...