Tax offenders can evade reality but they cannot evade the consequences of evading reality.1 The legal framework against tax crimes such as tax fraud and tax evasion, that paints this reality, must make tax criminals face the full rigour of the law.

Background

Markets and finances have become more globalised than ever. Countries across the world continue to increase their appetite for gaining a useful foothold against criminal exploitation of the increasing complexities associated with their interconnected systems and interests in the global marketplace. One of the critical areas of mutual concern and interest among jurisdictions is the complex disposition of tax crimes – including tax fraud, tax evasion and related financial crimes such as money laundering and fiscal corruption.

Indeed, tax crimes have notoriously taken an aversive international dimension, yet they continue to have national relevance since they are committed within the jurisdiction of states. With the international dimension, taxpayers leverage international opportunities to commit tax crimes in the national jurisdictions that provide the launching path opportunities. With the local dimension, resident taxpayers (both natural and legal persons) exploit the weaknesses in the law formulation and enforcement architecture to commit tax crimes, hoping that the long arm of the law will not catch them.

Essentially, tax criminals adeptly exploit loopholes and weaknesses (eg, the lack of a common definition of tax crimes) in local and international systems to commit tax crimes. As the loopholes are being closed and weaknesses are being addressed, tax criminals develop more sophisticated methods to override the efficacy of tax law enactment and enforcement strategies. These have serious social and economic consequences such as widening inequality and inadequate revenue for much-needed public services and socioeconomic development projects. Because of the huge adverse socioeconomic implications of tax crimes, it has become obvious that the search for remedies thereof must continue unabated.

The fight against tax crimes must use more sophisticated strategies, which are based on tenets such as effective and resilient principles, standards and enforcement mechanisms. These must stand the test of time and effectively counter the vagaries of sophistication of tax criminals. For instance, by virtue of the global and local disposition of tax crimes, there is the need for stronger inter-agency collaboration and cooperation – both domestically and internationally- in fighting tax crimes.

EU Member States appear to be individually demonstrating the desire, even if with unsettled political will, to take effective measures in countering tax crimes. Collectively too, under the umbrella of the OECD and the EU and as part of bilateral and multilateral cooperation, measures are being designed and implemented to counter tax crimes. For instance, the publication, in 2017, of the OECD’s Ten Global Principles (TGPs) for fighting tax crimes, with a claim to be global in nature, is a good example of such collective initiatives.

The TGPs were designed to be representative of essential international principles that could be effectively used to combat tax crimes. These principles, imbued with the strategic inputs from over 200 countries, do address pertinent concerns ranging from legal, administrative, institutional to operational areas that are germane to establishing a system that is, at least, efficient, in countering tax crimes. The disposition of the principles is designed in a way that gives space or opportunity for different countries to ‘benchmark their legal and operational framework and identify areas where improvements can be made’.2

The TGPs are situated within the framework of ‘a whole of government approach to fighting tax crimes’.3 It is premised on the understanding that tax crimes are dynamic, and criminals easily adapt themselves to generously benefit from any financial opportunities. Leveraging every available benefit any tax crimes can chance on, tax criminals also, all the more, usually outpace the legislative and enforcement modifications that have been put in place by the state machinery to effectively prevent, detect and prosecute these crimes. It is due deliberation to establish this framework that brought out the TGPs on countering tax crimes, which have three-layered purposes:

(i)to allow countries to be able to benchmark their legal and operational framework so as to identify tax practices that are deemed successful for the improvement of relevant systems in the areas that are essential ‘for an effective system to fight tax crimes’;

(ii)to allow progress of countries to be measured ‘through regular updates’; and

(iii)to allow countries to ‘articulate their needs for training’ or capacity-building on fighting tax crimes.4

The TGPs have established 10 global principles, covering the legal, strategic, administrative and operational aspects of addressing tax crimes.5 The TGPs include criminalisation of tax offences, effective strategies against tax crimes, adequate and effective resources and powers for LEAs, inter-agency and international cooperation, organisational structure with defined responsibilities, classification of tax crimes as predicate offences for money laundering as well as protection of fundamental rights of tax offenders.6 With their crosscutting and complementary nature, the TGPs can, at least, serve as a ‘minimum standard’ to finding durable solutions for tax crimes, internationally.

These set of principles, if implemented and practised accordingly, can act as a strong lever for success. This is partly because the OECD has made provision for the continuous improvement of the principles through a framework of broadening jurisdictional and institutional participation in the OECD forum on tax and crime (FTC).7 The FTC also fosters efforts towards developing more tools for countering tax crimes and money laundering.8

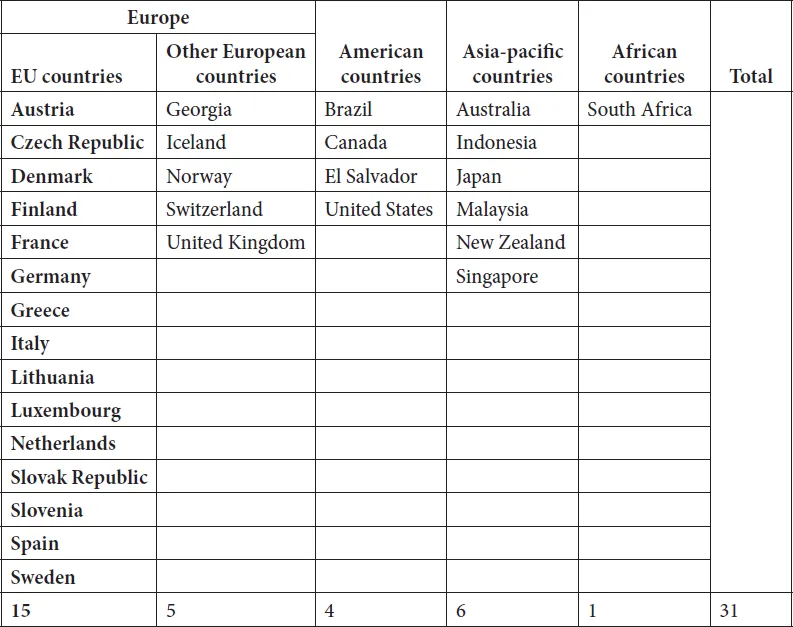

The OECD Task Force on Tax Crimes and other Crimes (TFTC),9 which prepared the TGPs, is expected to take stock of the TGPs in collaboration with the FTC10 and other partners. The TGPs have drawn on the experience of TFTC’s members and additional survey data provided by the 31 jurisdictions in Table 1.

Table 1 Countries surveyed by OECD to draw on for the TGPs11

Although the TGPs could become popular amongst OECD countries and their associates, the extent to which tax crime measures of various countries in the EU are effectively harmonious with the TGPs is unclear. This requires a critical analysis to determine:

i.if and to what extent the OECD countries are integrating the minimum standards of fighting tax crimes into the legal framework of their jurisdictions; and

ii.which robust pathways can effectively and sustainably counter the menace of tax crimes in OECD countries.

Meanwhile, as it were, in the archetypical legal framework of the European Union (EU), several tax crime counter-measures have been developed for its members, many of which are also members of the OECD.12 These measures include legal approaches to countering tax crimes in the EU. The EU Directives designed to harmonise the anti-money laundering regulations and anti-tax avoidance practices are typical of the legal approaches adopted by the EU.

In fact, in the past decade or so, there has been a degree of intensification in designing and developing policy, legislative and administrative initiatives that are geared towards fighting tax crimes in Europe. It is within the competence of the EU to facilitate cooperation and exchange of information among its Member States on diverse taxes, especially savings taxation and VAT.13 In this regard, tax authorities of EU Member States are being given the legal tools to collaborate in the exchange of information on matters relating to tax crimes. This is achieved through legal instruments such as the Directive on Administrative Cooperation (DAC) (2011/16/EU) regarding direct taxation,14 Anti-Tax Avoidance Directive (EU) 2016/1164 to protect the performance of the internal market,15 and Council Directive 2006/112/EC on VAT.16

Apart from utilising the legislative competences, the EU has also establish...