![]()

CHAPTER 1

Background Issues for Regression Analysis

Chapter 1 Preview

When you have completed reading this chapter you will:

- Realize that this is a practical guide to regression not a theoretical discussion.

- Know what is meant by cross-sectional data.

- Know what is meant by time-series data.

- Know to look for trend and seasonality in time-series data.

- Know about the three data sets that are used the most for examples in the book.

- Know how to differentiate between nominal, ordinal, interval, and ratio data.

- Know that you should use interval or ratio data when doing regression.

- Know how to access the “Data Analysis” functionality in Excel.

Introduction

The importance of the use of regression models in modern business and economic analysis can hardly be overstated. In this book, you will see exactly how such models can be developed. When you have completed the book you will understand how to construct, interpret, and evaluate regression models. You will be able to implement what you have learned by using “Data Analysis” in Excel to build basic mathematical models of business and economic relationships.

You will not know everything there is to know about regression; however, you will have a thorough understanding about what is possible and what to look for in evaluating regression models. You may not ever actually build such a model in your own work but it is very likely that you will, at some point in your career, be exposed to such models and be expected to understand models that someone else has developed.

Initial Data Issues

Before beginning to look at the process of building and evaluating regression models, first note that nearly all of the data used in the examples in this book are real data, not data that have been contrived to show some purely academic point. The data used are the kind of data one is faced with in the real world. Data that are used in business applications of regression analysis are either cross-sectional data or time-series data. We will use examples of both types throughout the text.

Cross-Sectional Data

Cross-sectional data are data that are collected across different observational units but in the same time period for each observation. For example, we might do a customer (or employee) satisfaction study in which we survey a group of people all at the same time (e.g., in the same month).

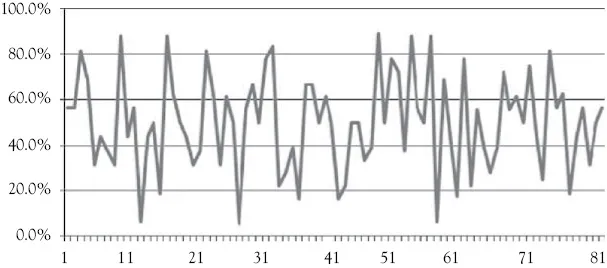

A cross-sectional data set that you will see in this book is one for which we gathered data about college basketball teams. In this data set, we have many variables concerning 82 college basketball teams all for the same season. The goal is to try to model what influences the conference winning percentage (WP) for such a team. You might think of this as a “production function” in which you want to know what factors will help produce a winning team.

Each of the teams represents one observation. For each observation, we have a number of potential variables that might influence (in a causal manner) a team’s winning percent in their conference games. In Figure 1.1, you see a graph of the conference winning percentage for the 82 teams in the sample. These teams came from seven major sport conferences: ACC, Big 12, Big East, Big 10, Mountain West, PAC 10, and SEC.

Figure 1.1 The conference winning percentage for 82 basketball teams: An example of cross-sectional data

Source: Statsheet at http://statsheet.com/mcb.

Time-series Data

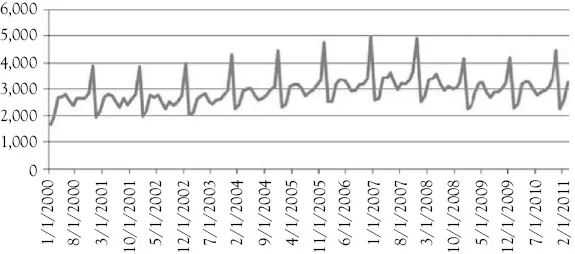

Time-series data are data that are collected over time for some particular variable. For example, you might look at the level of unemployment by year, by quarter, or by month. In this book, you will see examples that use two primary sets of time-series data. These are women’s clothing sales in the United States and the occupancy for a hotel.

A graph of the women’s clothing sales is shown in Figure 1.2. When you look at a time-series graph, you should try to see whether you observe a trend (either up or down) in the series and whether there appears to be a regular seasonal pattern to the data. Much of the data that we deal with in business has either a trend or seasonality or both. Knowing this can be helpful in determining potential causal variables to consider when building a regression model.

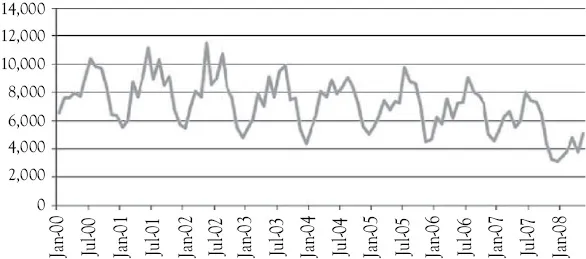

The other time-series used frequently in the examples in this book is shown in Figure 1.3. This series represents the number of rooms occupied per month in a large independent motel. During the time period being considered, there was a considerable expansion in the number of casinos in the State, most of which had integrated lodging facilities. As you can see in Figure 1.3, there is a downward trend in occupancy. The owners wanted to evaluate the causes for the decline. These data are proprietary so the numbers are somewhat disguised as is the name of the hotel. But the data represent real business data and a real business problem.

Figure 1.2 Women’s clothing sales per month in the United States in millions of dollars: An example of time-series data

Source: www.economagic.com.

Figure 1.3 Stoke’s Lodge occupancy per month: A second example of time-series data.

Source: Proprietary.

To help you understand regression analysis, these three sets of data will be discussed repeatedly throughout the book. Also, in Chapter 10, you will see complete examples of model building for quarterly Abercrombie & Fitch sales and quarterly U.S. retail jewelry sales (both time-series data). These examples will help you understand how to build regression models and how to evaluate the results.

An Additional Data Issue

Not all data are appropriate for use in building regression models. This means that before doing the statistical work of developing a regression model you must first consider what types of data you have. One way data are often classified is to use a hierarchy o...