eBook - ePub

FinTech For Dummies

Steven O'Hanlon, Susanne Chishti, Brendan Bradley, James Jockle, Dawn Patrick

This is a test

Condividi libro

- English

- ePUB (disponibile sull'app)

- Disponibile su iOS e Android

eBook - ePub

FinTech For Dummies

Steven O'Hanlon, Susanne Chishti, Brendan Bradley, James Jockle, Dawn Patrick

Dettagli del libro

Anteprima del libro

Indice dei contenuti

Citazioni

Informazioni sul libro

Examine the depth and breadth of financial technology This comprehensive, hands-on guide is the go-to source for everything you need to confidently navigate the ever-changing scene of this booming industry. FinTech For Dummies will shed light on this rapidly changing landscape making it an invaluable source of information for anybody working in or interested in this space. This book provides insights, knowledge and guidance from industry experts Steve O'Hanlon and Susanne Chishti on the following:

- Gaining insight fastest growing market segment of the financial markets

- Learning the core decision making to effect a growth plan

- Securing knowledge of the fastest growing fintech companies in the world

- Navigating the fintech world

- The ingredients into building a FinTech company

Domande frequenti

Come faccio ad annullare l'abbonamento?

È semplicissimo: basta accedere alla sezione Account nelle Impostazioni e cliccare su "Annulla abbonamento". Dopo la cancellazione, l'abbonamento rimarrà attivo per il periodo rimanente già pagato. Per maggiori informazioni, clicca qui

È possibile scaricare libri? Se sì, come?

Al momento è possibile scaricare tramite l'app tutti i nostri libri ePub mobile-friendly. Anche la maggior parte dei nostri PDF è scaricabile e stiamo lavorando per rendere disponibile quanto prima il download di tutti gli altri file. Per maggiori informazioni, clicca qui

Che differenza c'è tra i piani?

Entrambi i piani ti danno accesso illimitato alla libreria e a tutte le funzionalità di Perlego. Le uniche differenze sono il prezzo e il periodo di abbonamento: con il piano annuale risparmierai circa il 30% rispetto a 12 rate con quello mensile.

Cos'è Perlego?

Perlego è un servizio di abbonamento a testi accademici, che ti permette di accedere a un'intera libreria online a un prezzo inferiore rispetto a quello che pagheresti per acquistare un singolo libro al mese. Con oltre 1 milione di testi suddivisi in più di 1.000 categorie, troverai sicuramente ciò che fa per te! Per maggiori informazioni, clicca qui.

Perlego supporta la sintesi vocale?

Cerca l'icona Sintesi vocale nel prossimo libro che leggerai per verificare se è possibile riprodurre l'audio. Questo strumento permette di leggere il testo a voce alta, evidenziandolo man mano che la lettura procede. Puoi aumentare o diminuire la velocità della sintesi vocale, oppure sospendere la riproduzione. Per maggiori informazioni, clicca qui.

FinTech For Dummies è disponibile online in formato PDF/ePub?

Sì, puoi accedere a FinTech For Dummies di Steven O'Hanlon, Susanne Chishti, Brendan Bradley, James Jockle, Dawn Patrick in formato PDF e/o ePub, così come ad altri libri molto apprezzati nelle sezioni relative a Business e Trading. Scopri oltre 1 milione di libri disponibili nel nostro catalogo.

Informazioni

Part 1

Getting to Know FinTech

IN THIS PART …

Check out what FinTech is, understand its impact, and look at the FinTech landscape.

Find out how FinTech has been disrupting the financial industry, challenging traditional financial institutions to “grow or die,” and creating opportunities for innovative start-up companies to claim a share of the pie.

Discover the role of regulation in FinTech, examine recent regulatory changes, and meet regulators in the United States and Europe.

Chapter 1

Navigating the FinTech Landscape

IN THIS CHAPTER

FinTech has undoubtedly become one of the hottest topics in business. Web searches for the term fintech in Google have grown exponentially in the last several years, so it’s obvious that people are curious about it. But what is it, and why is it relevant to today’s financial industry? This chapter looks at those very basic questions, helping prepare you for the more detailed information you discover later in this book.

What Is FinTech, Anyway?

FinTech is also frequently used as an umbrella term for various subcategories, such as WealthTech and RegTech. You find out more about these subcategories in Chapter 2.

Analyzing FinTech’s Dimensions

- Which part of finance is being impacted (financial sector)?

- Which business model is being used?

- Which technology is being used?

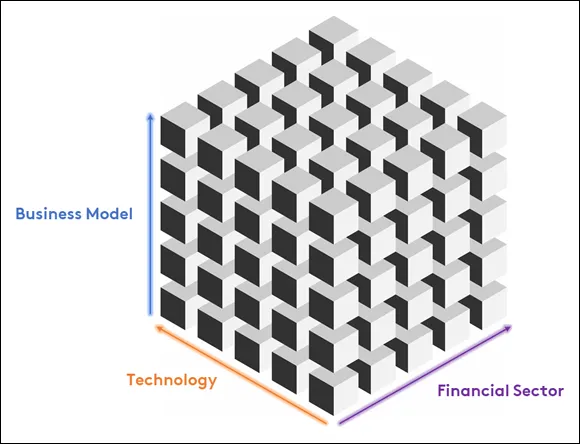

FINTECH Circle has coined the term Fintech Cube to describe the intersections of these factors. Figure 1-1 illustrates this cube, in which there are three axes: the financial sector on the x-axis, the business model on the y-axis, and technology on the z-axis.

Source: FINTECH Circle, 2020

FIGURE 1-1: The Fintech Cube combines financial sector, business model, and technology factors.

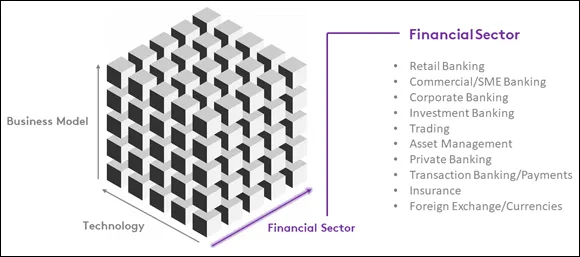

Each of these dimensions can be further categorized. For example, Figure 1-2 expands on the concept by adding key areas of financial services that can benefit from FinTech. All financial sectors are shown on one side of the cube, including retail banking, trading, and insurance (among others).

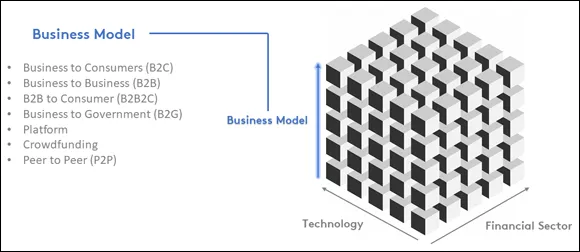

Figure 1-3 summarizes the most important business models from business-to-consumer (B2C), business-to-business (B2B), business-to-business-to-consumer (B2B2C), to business-to-government/regulator (B2G), to platform-based business models, crowdfunding, and peer-to-peer (P2P) lending.

Source: The Fintech Cube, FINTECH Circle, 2020

FIGURE 1-2: Key areas of financial services that benefit from FinTech.

Source: The Fintech Cube, FINTECH Circle, 2020

FIGURE 1-3: A dimension of main business models.

Figure 1-4 shows the third dimension — the technology being used, which can range from cloud computing, big data, artificial intelligence (AI)/machine learning (ML), blockchain (distributed ledger technologies), the Internet of Things (IoT), and quantum computing, to augmented and virtual reality. Part 2 covers these technologies in more detail.

FinTech start-ups, for example, can now be more easily categorized and compared. For example, you may have a retail banking (financial sector x-axis) solution focused on the business model of B2C and using various technologies, such as cloud, big data analytics, and AI. Such a company would be called a challenger bank, sometimes also referred to as digital bank or neo-bank.