eBook - ePub

FinTech For Dummies

Steven O'Hanlon, Susanne Chishti, Brendan Bradley, James Jockle, Dawn Patrick

This is a test

Buch teilen

- English

- ePUB (handyfreundlich)

- Über iOS und Android verfügbar

eBook - ePub

FinTech For Dummies

Steven O'Hanlon, Susanne Chishti, Brendan Bradley, James Jockle, Dawn Patrick

Angaben zum Buch

Buchvorschau

Inhaltsverzeichnis

Quellenangaben

Über dieses Buch

Examine the depth and breadth of financial technology This comprehensive, hands-on guide is the go-to source for everything you need to confidently navigate the ever-changing scene of this booming industry. FinTech For Dummies will shed light on this rapidly changing landscape making it an invaluable source of information for anybody working in or interested in this space. This book provides insights, knowledge and guidance from industry experts Steve O'Hanlon and Susanne Chishti on the following:

- Gaining insight fastest growing market segment of the financial markets

- Learning the core decision making to effect a growth plan

- Securing knowledge of the fastest growing fintech companies in the world

- Navigating the fintech world

- The ingredients into building a FinTech company

Häufig gestellte Fragen

Wie kann ich mein Abo kündigen?

Gehe einfach zum Kontobereich in den Einstellungen und klicke auf „Abo kündigen“ – ganz einfach. Nachdem du gekündigt hast, bleibt deine Mitgliedschaft für den verbleibenden Abozeitraum, den du bereits bezahlt hast, aktiv. Mehr Informationen hier.

(Wie) Kann ich Bücher herunterladen?

Derzeit stehen all unsere auf Mobilgeräte reagierenden ePub-Bücher zum Download über die App zur Verfügung. Die meisten unserer PDFs stehen ebenfalls zum Download bereit; wir arbeiten daran, auch die übrigen PDFs zum Download anzubieten, bei denen dies aktuell noch nicht möglich ist. Weitere Informationen hier.

Welcher Unterschied besteht bei den Preisen zwischen den Aboplänen?

Mit beiden Aboplänen erhältst du vollen Zugang zur Bibliothek und allen Funktionen von Perlego. Die einzigen Unterschiede bestehen im Preis und dem Abozeitraum: Mit dem Jahresabo sparst du auf 12 Monate gerechnet im Vergleich zum Monatsabo rund 30 %.

Was ist Perlego?

Wir sind ein Online-Abodienst für Lehrbücher, bei dem du für weniger als den Preis eines einzelnen Buches pro Monat Zugang zu einer ganzen Online-Bibliothek erhältst. Mit über 1 Million Büchern zu über 1.000 verschiedenen Themen haben wir bestimmt alles, was du brauchst! Weitere Informationen hier.

Unterstützt Perlego Text-zu-Sprache?

Achte auf das Symbol zum Vorlesen in deinem nächsten Buch, um zu sehen, ob du es dir auch anhören kannst. Bei diesem Tool wird dir Text laut vorgelesen, wobei der Text beim Vorlesen auch grafisch hervorgehoben wird. Du kannst das Vorlesen jederzeit anhalten, beschleunigen und verlangsamen. Weitere Informationen hier.

Ist FinTech For Dummies als Online-PDF/ePub verfügbar?

Ja, du hast Zugang zu FinTech For Dummies von Steven O'Hanlon, Susanne Chishti, Brendan Bradley, James Jockle, Dawn Patrick im PDF- und/oder ePub-Format sowie zu anderen beliebten Büchern aus Business & Trading. Aus unserem Katalog stehen dir über 1 Million Bücher zur Verfügung.

Information

Part 1

Getting to Know FinTech

IN THIS PART …

Check out what FinTech is, understand its impact, and look at the FinTech landscape.

Find out how FinTech has been disrupting the financial industry, challenging traditional financial institutions to “grow or die,” and creating opportunities for innovative start-up companies to claim a share of the pie.

Discover the role of regulation in FinTech, examine recent regulatory changes, and meet regulators in the United States and Europe.

Chapter 1

Navigating the FinTech Landscape

IN THIS CHAPTER

FinTech has undoubtedly become one of the hottest topics in business. Web searches for the term fintech in Google have grown exponentially in the last several years, so it’s obvious that people are curious about it. But what is it, and why is it relevant to today’s financial industry? This chapter looks at those very basic questions, helping prepare you for the more detailed information you discover later in this book.

What Is FinTech, Anyway?

FinTech is also frequently used as an umbrella term for various subcategories, such as WealthTech and RegTech. You find out more about these subcategories in Chapter 2.

Analyzing FinTech’s Dimensions

- Which part of finance is being impacted (financial sector)?

- Which business model is being used?

- Which technology is being used?

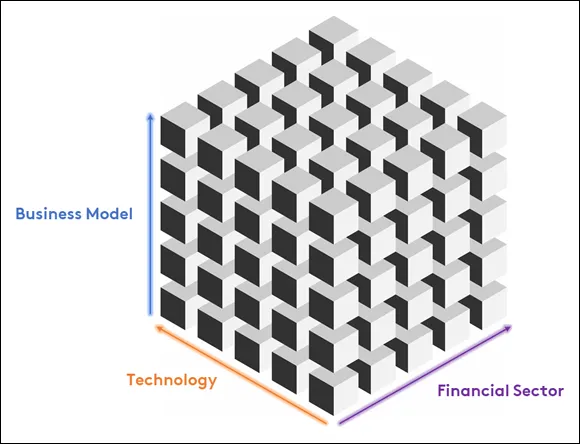

FINTECH Circle has coined the term Fintech Cube to describe the intersections of these factors. Figure 1-1 illustrates this cube, in which there are three axes: the financial sector on the x-axis, the business model on the y-axis, and technology on the z-axis.

Source: FINTECH Circle, 2020

FIGURE 1-1: The Fintech Cube combines financial sector, business model, and technology factors.

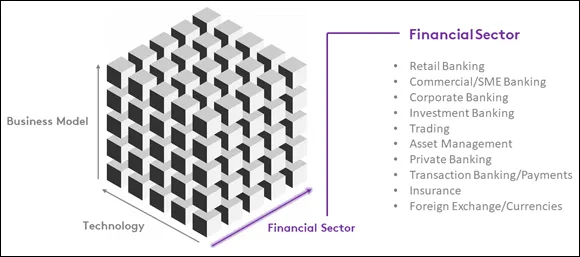

Each of these dimensions can be further categorized. For example, Figure 1-2 expands on the concept by adding key areas of financial services that can benefit from FinTech. All financial sectors are shown on one side of the cube, including retail banking, trading, and insurance (among others).

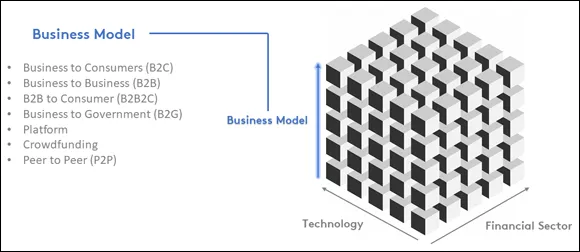

Figure 1-3 summarizes the most important business models from business-to-consumer (B2C), business-to-business (B2B), business-to-business-to-consumer (B2B2C), to business-to-government/regulator (B2G), to platform-based business models, crowdfunding, and peer-to-peer (P2P) lending.

Source: The Fintech Cube, FINTECH Circle, 2020

FIGURE 1-2: Key areas of financial services that benefit from FinTech.

Source: The Fintech Cube, FINTECH Circle, 2020

FIGURE 1-3: A dimension of main business models.

Figure 1-4 shows the third dimension — the technology being used, which can range from cloud computing, big data, artificial intelligence (AI)/machine learning (ML), blockchain (distributed ledger technologies), the Internet of Things (IoT), and quantum computing, to augmented and virtual reality. Part 2 covers these technologies in more detail.

FinTech start-ups, for example, can now be more easily categorized and compared. For example, you may have a retail banking (financial sector x-axis) solution focused on the business model of B2C and using various technologies, such as cloud, big data analytics, and AI. Such a company would be called a challenger bank, sometimes also referred to as digital bank or neo-bank.