eBook - ePub

Employee Engagement and Communication Research

Measurement, Strategy and Action

- 240 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

There's a well-known saying: what doesn't get measured doesn't get done. So it is no surprise that communicators, human resource and change managers and other professionals recognise the need to measure and evaluate their work, particularly its worth to their organization and seek the most effective ways to achieve this. Whether you're already involved in research, planning your first project or commissioning an external research company, Employee Engagement and Communication Research covers everything you need to know in order to conduct robust, reliable research. Whether it's a full-scale employee survey or research focusing on a particular subject area such as communication, engagement, change or corporate social responsibility, Employee Engagement and Communication Research is your essential guide covering all the tools, strategy and actions to make your project a success.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Conversation 1

In the beginning – a conversation with Sir Robert Worcester, pioneer of employee research

In the beginning – a conversation with Sir Robert Worcester, pioneer of employee research

As the best-known pollster in Britain, Sir Robert Worcester, founder of Market & Opinion Research International (MORI), is often quoted in the media. However, he may be less well-recognized as pioneer of a branch of research that rarely hits the headlines: employee surveys.

Sir Robert first joined the research field with Opinion Research Corporation in Princeton, New Jersey, USA. When he came to the UK in 1969, he arrived with three great research passions: corporate image, financial and employee. In this he was prescient. It soon became clear that the success of a business in terms of these three is closely linked: financial performance with corporate image, which in turn relates to those who contribute to both – the employees.

When Sir Robert founded MORI, why did he pioneer employee surveys as an integral part of his business? ‘There was virtually no such research then,’ he explains. ‘Some studies looked at the company newspaper – but no real attention [was] paid to wider issues like upward communication. I felt that employee surveys had the potential to do good in the workplace – it was an opportunity for employees to come up with ideas and suggestions and to tell the boss what they really thought – sometimes for the first time.’

Early experience showed that bringing market research techniques to create effective employee surveys was not enough – the commitment and interest of the ‘boss’ was an essential ingredient. ‘Our first large-scale survey was for Barclays, which then employed 54 thousand people … its success was largely due to the fact we had full co-operation from the chairman and the personnel director throughout.’ So one of Sir Robert’s key advice points before embarking on employee research is to ensure that senior management is fully engaged. He also quotes the example of another early MORI survey about the Five Principles of the Mars Company: ‘It was clear from the outset that the two owners, John and Forrest Mars, would be personally involved in every stage of the project – this proved integral to producing feedback which helped to bring the principles alive throughout the business.’

What does Sir Robert see as the main pitfalls threatening the success of employee research? ‘Don’t assume that you know what the results will be,’ he says. To avoid this preconception, he introduced his ‘guesstimate’ – a short prediction questionnaire:

The best way to stop senior management claiming that they knew what the outcomes would be all along, is to ask them to predict what the figures will be for certain questions. The key figures from the guesstimate are the high and low figures, revealing how very different the perceptions are around the board table as well as their combined scores showing that as a group overall they are over optimistic or even in certain cases pessimistic.’

Some senior management teams have a not-invented-here attitude – I came across this in one large blue chip organization where managers had some firm views, refusing to listen to our professional advice and after one meeting it was clear that it would be impossible to continue – I was not prepared to compromise our principles for anyone.

A fundamental requirement of Sir Robert’s before embarking on a survey is for the organization to agree to communicate the results honestly to employees. Has he ever met with a refusal? ‘Yes, just once. It was a well-known media company – they would not commit to publishing the results so I told them straight: MORI would not carry out their survey.’

He does appreciate that senior management may fear hearing about aspects that they simply will not be able to address. ‘But I never advocate management by opinion poll,’ explains Sir Robert:

If the workforce believes that a particular benefit is poor, and it is poor, the company must improve that benefit – or explain clearly why that is not possible – or live with the consequences. But if, objectively, that benefit is wonderful but considered poor – a misconception – then a communication programme needs to correct that false impression.

In Sir Robert’s career he has met – and overcome – many research challenges. However, there is one type of research that, as he says, no investment can buy. That is the research which should have been done in the past. ‘You would be surprised at the clients who have asked for research into a campaign or initiative to see how effective it has been – but there is no “before” baseline to work from,’ he says. So further counsel from Sir Robert is to plan ahead and ensure that the relevant research has been undertaken so that the impact of any programme or project can be accurately assessed.

Back in 1973 in an address to a Market Research Society Conference Sir Robert asked: ‘Who can tell what good will flow from systematic, objective measurement of employee attitudes to help better decision making. We can only hope that over the next years we shall find out.’ The fact that listening to employees, in a developing number of ways as described in this book is now recognized as an integral part of creating a successful business is his answer.

Measurement

Fundamental tools for robust, reliable research

Defining your objectives | 01 |

This chapter sets the scene for clear objectives and approach for your project, looking at the why, who, where, when, what and how as part of the decisions to be made before proceeding.

Any research project – whether small or large – sets out on a journey. It usually starts with the notion that some form of measurement will be a good idea, either a new project or repeat of a regular study which continues through the process until its destination, when any issues raised will, it is hoped, be addressed.

Most journeys begin with the best of intentions. But if you are not sure about where you are going, there’s a strong possibility of getting lost along the way and arriving at the wrong destination. So firstly, draw up a clear direction in the form of a clear strategy and mission for your project from the start.

CASE STUDY 1 BP Lubricants: preparation is the key

When Simon Elliott decided to develop a fresh approach to BP Lubricants’ internal research to track strategy he first considered a quick, simple method. ‘But the more I looked at what we wanted – a sustainable measurement system that had depth and was tailored to BP Lubricants’ specific needs,’ he explains, ‘the clearer it became that time invested in preparation and development would be key to success.’

To achieve this, Simon brought in independent consultant Helen Coley-Smith, who contributed valuable strategic input. ‘First essential was to tie in with the business,’ says Helen. ‘Any measurement system had to demonstrate value, gain cultural acceptance in a global business and develop into a reliable tracking tool – not a one-off intervention.’

The first steps took twin paths: one internal, to fully understand how measurement could contribute to the needs of the business and the second external, to review the work already undertaken to determine the contribution of communication and engagement to business performance.

Simon and Helen looked at a range of research reports such as Towers Watson, IABC, Gallup and the Future Foundation. The Sears model (see Chapter 13) was particularly influential in their thinking.

At the same time, BP Lubricants’ ‘winning formula’ strategy needed clarity and meaning for employees so they could contribute to business goals. The external research proved useful but it was clear that a performance management approach specific to their business was needed. ‘I found it helpful to think about what should be in the final presentation at the end of the project – the information that the leadership team would want relating to business performance,’ explains Simon. ‘This gave us a goal to work towards and a clear direction to our thinking.’

Thus the next step was to establish a firm link between the measurement and Lubricants’ business strategy by relating communication and engagement interventions to practical business issues such as organization focus, customers and growth. ‘This became our communication and engagement value tree,’ adds Helen. ‘We found this made the important conversations with others in the business much easier as they were able to recognize the connection between these activities and business success.’

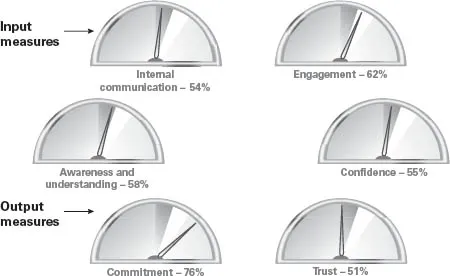

Now the thinking needed to be transformed into a measurement process that was, in Simon’s words: relevant, pure and simple. This resulted in six clear measures covering the relationship between Lubricants’ communication and engagement activities (inputs) and what employees think and feel (outputs). Under inputs are:

• Communication effectiveness.

• Engagement effectiveness.

And under outputs:

• Awareness and understanding (mainly about business strategy).

• Commitment to making the strategy a success.

• Confidence in leadership and future of the business.

• Trust in leadership and the strategy.

These then were the six key measures (key performance indicators, KPIs) of the research programme. Questions were developed to flesh out each KPI, each with a clearly defined purpose. ‘We realized how important the visual aspect would be,’ emphasizes Helen. ‘The leadership team would soon be bored by a set of the usual PowerPoint slides – we needed to present results in a clear compelling way.’ Using the KPIs, a communication ‘dashboard’ was developed that took the positive scores from the questions under each of the six headings to give an at-a-glance view of the business. This gave an initial overview that could also be used to summarize the results for different parts of the organization. With 17,500 employees across 60-plus countries involving 17 languages, this made a potentially complex task much easier to administer.

FIGURE 1.1 Communication and engagement dashboard

The success of this model for performance managing communication and engagement has become clear over the years providing input and insights for action. From initial planning to completion of the first measurement programme, took well over a year. Development of the thinking lasted several months but this was time well spent according to Simon: ‘I realized that previous research at Lubricants had not been strong enough to be sustainable – it lacked rigour. So I thought – now let’s crack it. Yes, development of our model took time, energy and effort but it resulted in a complete picture of communication and engagement activity as a strategic driver of business value.’ So based on their experience, what advice would Simon and Helen give to others embarking on a similar venture? ‘Preparation and planning is paramount,’ they agree.

Some organizations move directly to thinking about the ‘how’ to carry out the research and forget the five ‘Ws’. Don’t make that mistake. Ask these questions.

• Why is this research essential to our organization’s success?

• Who owns the research and do others need to be involved to ensure that the research meets the needs from a business/public value viewpoint?

• Where should that research be carried out: focused on a specific area/function or is it needed throughout our whole organization?

• When will be the best time to ensure that the management information gained can be fed effectively into our planning processes?

• What is the purpose? Is it intended (as some used to say) as a general temperature check or level of engagement? Or are we concentrating on a specific activity or initiative? Or do we want to look more widely, at beliefs and behaviours linked with business success? Or are we falling into the trap of saying: ‘We have always done an annual survey?’

Why do many research projects fall into that last snare: the sacred cow of the annual employee survey? This can lumber along faithfully year after year without question and little change. It is this stagnant...

Table of contents

- Employee Engagement & Communication Research

- Title Page

- Dedication

- Contents

- List of Figures

- List of Tables

- Acknowledgements

- Introduction

- Conversation 1

- Part 1 Measurement

- 01 Defining your objectives

- 02 Involving and communicating with employees

- 03 Data or discussion?

- Conversation 2

- 04 Qualitative techniques and methods

- 05 Lies, damned lies and statistics

- Conversation 3

- 06 Questionnaire development and design

- Conversation 4

- 07 Maximizing response rates

- Part 2 Strategy

- 08 Burning issues for your research to cover

- 09 Emerging issues

- Conversation 5

- 10 Understanding, interpreting and getting the most from your data

- 11 Turning the results into the organizational story

- 12 An international perspective

- Conversation 6

- 13 Making the business case

- Conversation 7

- Part 3 Implementation

- 14 Lights… Sound… Action!

- 15 The six key stages

- Conversation 8

- 16 Putting the action plan in place

- 17 Who is responsible for taking action?

- 18 Translating action points into action implementation

- 19 Keeping the research alive and well

- 20 What does the future hold?

- Appendix

- Index

- Copyright Page

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Employee Engagement and Communication Research by Susan Walker in PDF and/or ePUB format, as well as other popular books in Business & Human Resource Management. We have over one million books available in our catalogue for you to explore.