eBook - ePub

International Money and Finance

Michael Melvin, Stefan C. Norrbin

This is a test

Buch teilen

- 344 Seiten

- English

- ePUB (handyfreundlich)

- Über iOS und Android verfügbar

eBook - ePub

International Money and Finance

Michael Melvin, Stefan C. Norrbin

Angaben zum Buch

Buchvorschau

Inhaltsverzeichnis

Quellenangaben

Über dieses Buch

International Money and Finance, Ninth Edition presents an institutional and historical overview of international finance and international money, illustrating how key economic concepts can illuminate real world problems.

With three substantially revised chapters, and all chapters updated, it functions as a finance book that includes an international macroeconomics perspective in its final section. It emphasizes the newest trends in research, neatly defining the intersection of macro and finance.

Successfully used worldwide in both finance and economics departments at both undergraduate and graduate levels, the book features current data, revised test banks, and sharp insights about the practical implications of decision-making.

- Includes current events, such as the LIBOR and Greek crises

- increases emphasis on countries other than the US

- Minimizes prerequisites to encourage use by students from varied backgrounds

Häufig gestellte Fragen

Wie kann ich mein Abo kündigen?

Gehe einfach zum Kontobereich in den Einstellungen und klicke auf „Abo kündigen“ – ganz einfach. Nachdem du gekündigt hast, bleibt deine Mitgliedschaft für den verbleibenden Abozeitraum, den du bereits bezahlt hast, aktiv. Mehr Informationen hier.

(Wie) Kann ich Bücher herunterladen?

Derzeit stehen all unsere auf Mobilgeräte reagierenden ePub-Bücher zum Download über die App zur Verfügung. Die meisten unserer PDFs stehen ebenfalls zum Download bereit; wir arbeiten daran, auch die übrigen PDFs zum Download anzubieten, bei denen dies aktuell noch nicht möglich ist. Weitere Informationen hier.

Welcher Unterschied besteht bei den Preisen zwischen den Aboplänen?

Mit beiden Aboplänen erhältst du vollen Zugang zur Bibliothek und allen Funktionen von Perlego. Die einzigen Unterschiede bestehen im Preis und dem Abozeitraum: Mit dem Jahresabo sparst du auf 12 Monate gerechnet im Vergleich zum Monatsabo rund 30 %.

Was ist Perlego?

Wir sind ein Online-Abodienst für Lehrbücher, bei dem du für weniger als den Preis eines einzelnen Buches pro Monat Zugang zu einer ganzen Online-Bibliothek erhältst. Mit über 1 Million Büchern zu über 1.000 verschiedenen Themen haben wir bestimmt alles, was du brauchst! Weitere Informationen hier.

Unterstützt Perlego Text-zu-Sprache?

Achte auf das Symbol zum Vorlesen in deinem nächsten Buch, um zu sehen, ob du es dir auch anhören kannst. Bei diesem Tool wird dir Text laut vorgelesen, wobei der Text beim Vorlesen auch grafisch hervorgehoben wird. Du kannst das Vorlesen jederzeit anhalten, beschleunigen und verlangsamen. Weitere Informationen hier.

Ist International Money and Finance als Online-PDF/ePub verfügbar?

Ja, du hast Zugang zu International Money and Finance von Michael Melvin, Stefan C. Norrbin im PDF- und/oder ePub-Format sowie zu anderen beliebten Büchern aus Economics & Banks & Banking. Aus unserem Katalog stehen dir über 1 Million Bücher zur Verfügung.

Information

Part I

The International Monetary Environment

Outline

Chapter 1

The Foreign Exchange Market

Abstract

Foreign exchange trading refers to trading one country’s money for that of another country. The kind of money specifically traded takes the form of bank deposits or bank transfers of deposits denominated in foreign currency. The foreign exchange market typically refers to large commercial banks in financial centers, such as New York or London, that trade foreign-currency-denominated deposits with each other. This chapter provides a big picture of foreign exchange trading and particularly covers the details of the “spot market,” which is the buying and selling of foreign exchange to be delivered on the spot as opposed to paying at some future date. Major issues discussed are trading volume, geographic trading patterns, spot exchange rates, currency arbitrage, and short- and long-term foreign exchange rate movements. Specific examples illustrate the discussions of broad concepts. Two appendices further elaborate on exchange rate indexes and the top foreign exchange dealers.

Keywords

Arbitrage; asymmetric information; bid/offer spread; currency arbitrage; currency cross rate; exchange rate movement; foreign exchange market; inventory control; rogue trader; spot exchange rate; spot market; trade flow model; triangular arbitrage; two-point arbitrage

Foreign exchange trading refers to trading one country’s money for that of another country. The need for such trade arises because of tourism, the buying and selling of goods internationally, or investment occurring across international boundaries. The kind of money specifically traded takes the form of bank deposits or bank transfers of deposits denominated in foreign currency. The foreign exchange market, as we usually think of it, refers to large commercial banks in financial centers, such as New York or London, that trade foreign-currency-denominated deposits with each other. Actual bank notes like dollar bills are relatively unimportant insofar as they rarely physically cross international borders. In general, only tourism or illegal activities would lead to the international movement of bank notes.

Foreign Exchange Trading Volume

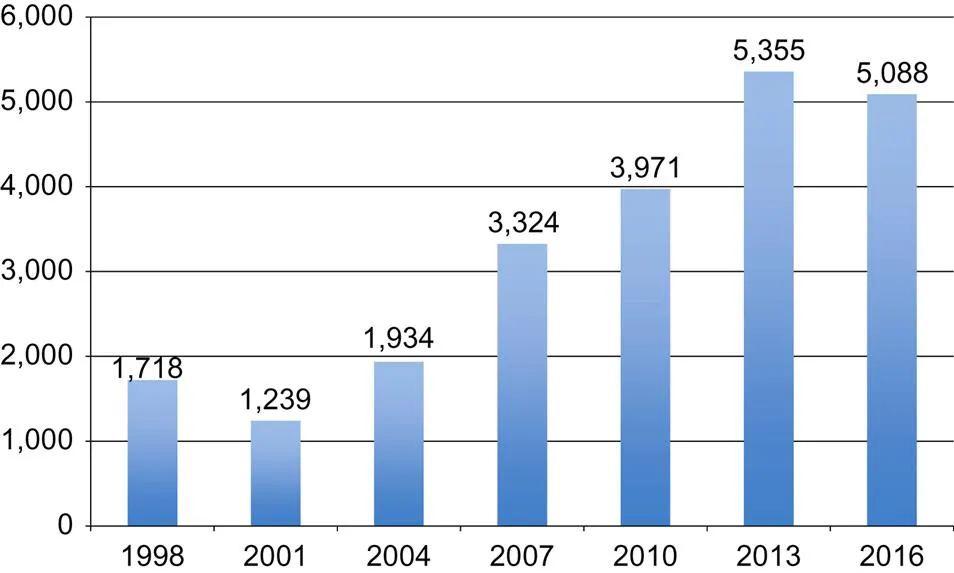

The foreign exchange market is the largest financial market in the world. Every 3 years the Bank for International Settlements conducts a survey of trading volume around the world and in the 2016 survey the average amount of currency traded each business day was $5,088 billion. Thus the foreign exchange market is an enormous market. Fig. 1.1 shows that the foreign exchange market has been growing rapidly in the last decade. In 2001 the trading volume of foreign exchange was $1,239 billion. In 2007 the foreign exchange market had almost tripled in volume, and by 2013 the foreign exchange market had grown another $2 trillion.

The US dollar is by far the most important currency, and has remained so even with the introduction of the euro. The dollar is involved in 87% of all trades. Since foreign exchange trading involves pairs of currencies, it is useful to know which currency pairs dominate the market. Table 1.1 reports the share of market activity taken by different currencies. The largest volume occurs in dollar/euro trading, accounting for 23% of the total. The next closest currency pair, the dollar/yen, accounts for slightly less than 18%. After these two currency pairs, the volume drops off dramatically. For example, the dollar/UK pound is roughly half as much foreign currency trading as the dollar/yen. The US dollar is represented in nine of the top ten currency pairs. Thus, the currency markets are dominated by dollar trading.

Table 1.1

Top ten currency pairs by share of foreign exchange trading volume

| Currency pair | Percent of total |

| US dollar/euro | 23.0 |

| US dollar/Japanese yen | 17.7 |

| US dollar/UK pound | 9.2 |

| US dollar/Australian dollar | 5.2 |

| US dollar/Canadian dollar | 4.3 |

| US dollar/China yuan renminbi | 3.8 |

| US dollar/Swiss franc | 3.5 |

| US dollar/Mexico peso | 2.1 |

| Euro/UK pound | 2.0 |

| US dollar/Singapore dollar | 1.9 |

Source: Bank for International Settlements, Triennial Central Bank Sur...