eBook - ePub

International Money and Finance

Michael Melvin, Stefan C. Norrbin

This is a test

Partager le livre

- 344 pages

- English

- ePUB (adapté aux mobiles)

- Disponible sur iOS et Android

eBook - ePub

International Money and Finance

Michael Melvin, Stefan C. Norrbin

Détails du livre

Aperçu du livre

Table des matières

Citations

À propos de ce livre

International Money and Finance, Ninth Edition presents an institutional and historical overview of international finance and international money, illustrating how key economic concepts can illuminate real world problems.

With three substantially revised chapters, and all chapters updated, it functions as a finance book that includes an international macroeconomics perspective in its final section. It emphasizes the newest trends in research, neatly defining the intersection of macro and finance.

Successfully used worldwide in both finance and economics departments at both undergraduate and graduate levels, the book features current data, revised test banks, and sharp insights about the practical implications of decision-making.

- Includes current events, such as the LIBOR and Greek crises

- increases emphasis on countries other than the US

- Minimizes prerequisites to encourage use by students from varied backgrounds

Foire aux questions

Comment puis-je résilier mon abonnement ?

Il vous suffit de vous rendre dans la section compte dans paramètres et de cliquer sur « Résilier l’abonnement ». C’est aussi simple que cela ! Une fois que vous aurez résilié votre abonnement, il restera actif pour le reste de la période pour laquelle vous avez payé. Découvrez-en plus ici.

Puis-je / comment puis-je télécharger des livres ?

Pour le moment, tous nos livres en format ePub adaptés aux mobiles peuvent être téléchargés via l’application. La plupart de nos PDF sont également disponibles en téléchargement et les autres seront téléchargeables très prochainement. Découvrez-en plus ici.

Quelle est la différence entre les formules tarifaires ?

Les deux abonnements vous donnent un accès complet à la bibliothèque et à toutes les fonctionnalités de Perlego. Les seules différences sont les tarifs ainsi que la période d’abonnement : avec l’abonnement annuel, vous économiserez environ 30 % par rapport à 12 mois d’abonnement mensuel.

Qu’est-ce que Perlego ?

Nous sommes un service d’abonnement à des ouvrages universitaires en ligne, où vous pouvez accéder à toute une bibliothèque pour un prix inférieur à celui d’un seul livre par mois. Avec plus d’un million de livres sur plus de 1 000 sujets, nous avons ce qu’il vous faut ! Découvrez-en plus ici.

Prenez-vous en charge la synthèse vocale ?

Recherchez le symbole Écouter sur votre prochain livre pour voir si vous pouvez l’écouter. L’outil Écouter lit le texte à haute voix pour vous, en surlignant le passage qui est en cours de lecture. Vous pouvez le mettre sur pause, l’accélérer ou le ralentir. Découvrez-en plus ici.

Est-ce que International Money and Finance est un PDF/ePUB en ligne ?

Oui, vous pouvez accéder à International Money and Finance par Michael Melvin, Stefan C. Norrbin en format PDF et/ou ePUB ainsi qu’à d’autres livres populaires dans Economics et Banks & Banking. Nous disposons de plus d’un million d’ouvrages à découvrir dans notre catalogue.

Informations

Part I

The International Monetary Environment

Outline

Chapter 1

The Foreign Exchange Market

Abstract

Foreign exchange trading refers to trading one country’s money for that of another country. The kind of money specifically traded takes the form of bank deposits or bank transfers of deposits denominated in foreign currency. The foreign exchange market typically refers to large commercial banks in financial centers, such as New York or London, that trade foreign-currency-denominated deposits with each other. This chapter provides a big picture of foreign exchange trading and particularly covers the details of the “spot market,” which is the buying and selling of foreign exchange to be delivered on the spot as opposed to paying at some future date. Major issues discussed are trading volume, geographic trading patterns, spot exchange rates, currency arbitrage, and short- and long-term foreign exchange rate movements. Specific examples illustrate the discussions of broad concepts. Two appendices further elaborate on exchange rate indexes and the top foreign exchange dealers.

Keywords

Arbitrage; asymmetric information; bid/offer spread; currency arbitrage; currency cross rate; exchange rate movement; foreign exchange market; inventory control; rogue trader; spot exchange rate; spot market; trade flow model; triangular arbitrage; two-point arbitrage

Foreign exchange trading refers to trading one country’s money for that of another country. The need for such trade arises because of tourism, the buying and selling of goods internationally, or investment occurring across international boundaries. The kind of money specifically traded takes the form of bank deposits or bank transfers of deposits denominated in foreign currency. The foreign exchange market, as we usually think of it, refers to large commercial banks in financial centers, such as New York or London, that trade foreign-currency-denominated deposits with each other. Actual bank notes like dollar bills are relatively unimportant insofar as they rarely physically cross international borders. In general, only tourism or illegal activities would lead to the international movement of bank notes.

Foreign Exchange Trading Volume

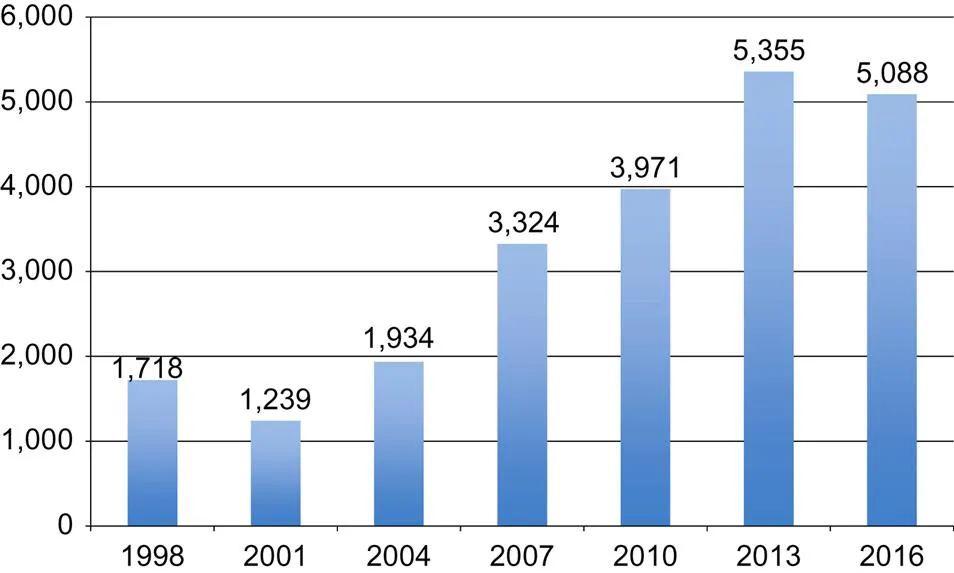

The foreign exchange market is the largest financial market in the world. Every 3 years the Bank for International Settlements conducts a survey of trading volume around the world and in the 2016 survey the average amount of currency traded each business day was $5,088 billion. Thus the foreign exchange market is an enormous market. Fig. 1.1 shows that the foreign exchange market has been growing rapidly in the last decade. In 2001 the trading volume of foreign exchange was $1,239 billion. In 2007 the foreign exchange market had almost tripled in volume, and by 2013 the foreign exchange market had grown another $2 trillion.

The US dollar is by far the most important currency, and has remained so even with the introduction of the euro. The dollar is involved in 87% of all trades. Since foreign exchange trading involves pairs of currencies, it is useful to know which currency pairs dominate the market. Table 1.1 reports the share of market activity taken by different currencies. The largest volume occurs in dollar/euro trading, accounting for 23% of the total. The next closest currency pair, the dollar/yen, accounts for slightly less than 18%. After these two currency pairs, the volume drops off dramatically. For example, the dollar/UK pound is roughly half as much foreign currency trading as the dollar/yen. The US dollar is represented in nine of the top ten currency pairs. Thus, the currency markets are dominated by dollar trading.

Table 1.1

Top ten currency pairs by share of foreign exchange trading volume

| Currency pair | Percent of total |

| US dollar/euro | 23.0 |

| US dollar/Japanese yen | 17.7 |

| US dollar/UK pound | 9.2 |

| US dollar/Australian dollar | 5.2 |

| US dollar/Canadian dollar | 4.3 |

| US dollar/China yuan renminbi | 3.8 |

| US dollar/Swiss franc | 3.5 |

| US dollar/Mexico peso | 2.1 |

| Euro/UK pound | 2.0 |

| US dollar/Singapore dollar | 1.9 |

Source: Bank for International Settlements, Triennial Central Bank Sur...