eBook - ePub

MS Excel, Second Edition

Let's Advance to the Next Level

Anurag Singa

This is a test

- 114 pages

- English

- ePUB (adapté aux mobiles)

- Disponible sur iOS et Android

eBook - ePub

MS Excel, Second Edition

Let's Advance to the Next Level

Anurag Singa

Détails du livre

Aperçu du livre

Table des matières

Citations

À propos de ce livre

MS Excel is one of the most powerful tools available to a business manager. In this book, the author provides an advanced level of skill sets and brings actionable insights to the user. Hence, the material in this version has been organized as follows: Financial functions; Conditional math and statistical functions; Data analysis; Decision making; Data cleaning and use of macros; Auditors.

The objective is to give readers a flavor of how the vast array of functions can be used to make life easier and more efficient. Amazing results can be achieved by mastering Excel at a basic level. Readers who execute the given functions on a workbook simultaneously and experience the journey will find the learning curve the steepest.

Foire aux questions

Comment puis-je résilier mon abonnement ?

Il vous suffit de vous rendre dans la section compte dans paramètres et de cliquer sur « Résilier l’abonnement ». C’est aussi simple que cela ! Une fois que vous aurez résilié votre abonnement, il restera actif pour le reste de la période pour laquelle vous avez payé. Découvrez-en plus ici.

Puis-je / comment puis-je télécharger des livres ?

Pour le moment, tous nos livres en format ePub adaptés aux mobiles peuvent être téléchargés via l’application. La plupart de nos PDF sont également disponibles en téléchargement et les autres seront téléchargeables très prochainement. Découvrez-en plus ici.

Quelle est la différence entre les formules tarifaires ?

Les deux abonnements vous donnent un accès complet à la bibliothèque et à toutes les fonctionnalités de Perlego. Les seules différences sont les tarifs ainsi que la période d’abonnement : avec l’abonnement annuel, vous économiserez environ 30 % par rapport à 12 mois d’abonnement mensuel.

Qu’est-ce que Perlego ?

Nous sommes un service d’abonnement à des ouvrages universitaires en ligne, où vous pouvez accéder à toute une bibliothèque pour un prix inférieur à celui d’un seul livre par mois. Avec plus d’un million de livres sur plus de 1 000 sujets, nous avons ce qu’il vous faut ! Découvrez-en plus ici.

Prenez-vous en charge la synthèse vocale ?

Recherchez le symbole Écouter sur votre prochain livre pour voir si vous pouvez l’écouter. L’outil Écouter lit le texte à haute voix pour vous, en surlignant le passage qui est en cours de lecture. Vous pouvez le mettre sur pause, l’accélérer ou le ralentir. Découvrez-en plus ici.

Est-ce que MS Excel, Second Edition est un PDF/ePUB en ligne ?

Oui, vous pouvez accéder à MS Excel, Second Edition par Anurag Singa en format PDF et/ou ePUB ainsi qu’à d’autres livres populaires dans Économie et Statistiques pour les entreprises et l'économie. Nous disposons de plus d’un million d’ouvrages à découvrir dans notre catalogue.

Informations

CHAPTER 1

Excel for Personal Financial Decisions

PV and FV

Excel has several financial functions:

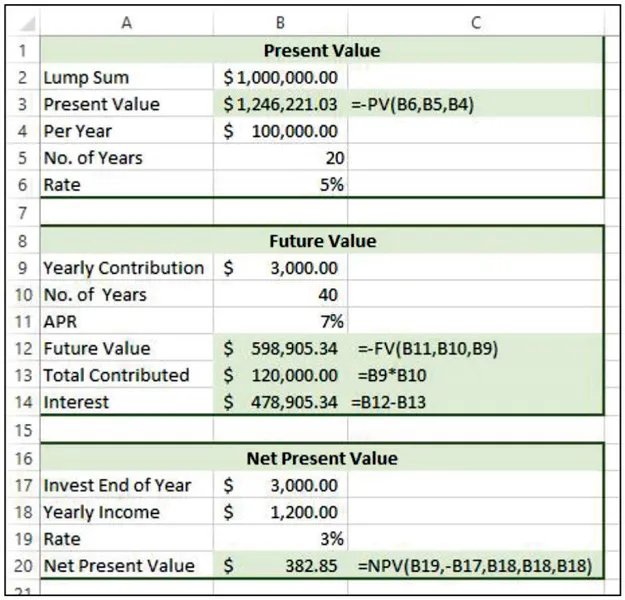

A) The PV (Present Value) function calculates the total present (current) value of an investment with a fixed rate, specified number of payment periods, and a series of identical payments that will be made in the future.

B) The FV (Future Values) function calculates the future value of an investment, given a fixed interest rate, term, and identical periodic payments.

C) The NPV (Net Present Value) function calculates the net present value of an investment, given a fixed rate (rate of return) and future payments that may be identical or different.

Internal Rate of Return (IRR)

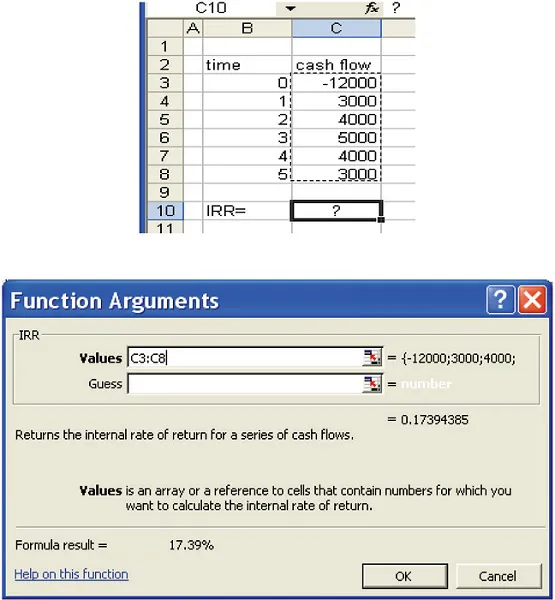

This returns the internal rate of return for a series of cash flows represented by the numbers in values. These cash flows do not have to be even, as they would be for an annuity. However, the cash flows must occur at regular intervals, such as monthly or annually. The internal rate of return is the interest rate received for an investment consisting of payments (negative values) and income (positive values) that occur at regular periods.

Determine # Periods in Bond Problem

Yield to Maturity

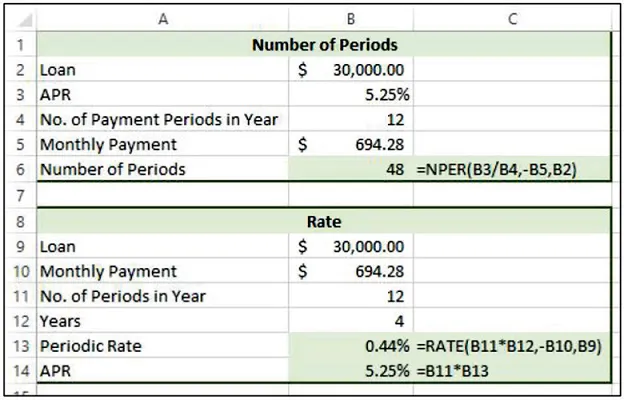

NPER and RATE

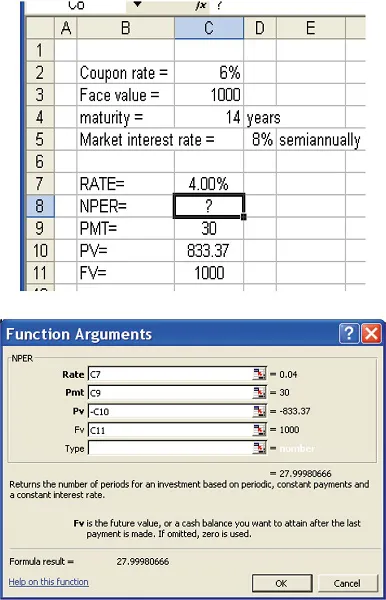

The NPER (Number of PERiods) function calculates the number of payment periods for an investment or loan given a fixed interest rate, periodic payment, and present value.

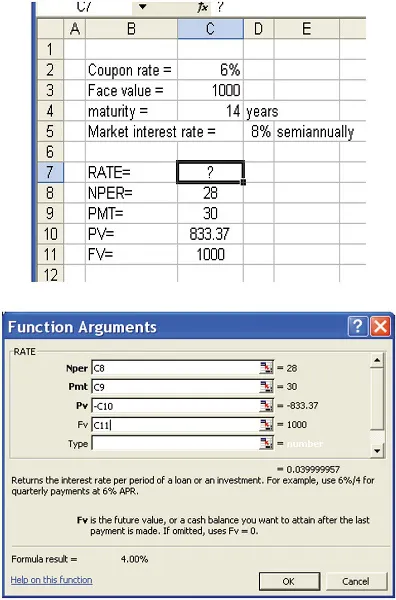

The RATE function calculates the periodic rate for an investment or loan given the number of payment periods, a fixed periodic payment, and present value.

This slide shows specific examples of how the number of periods (NPER) and rate (RATE functions) have been applied in a worksheet.

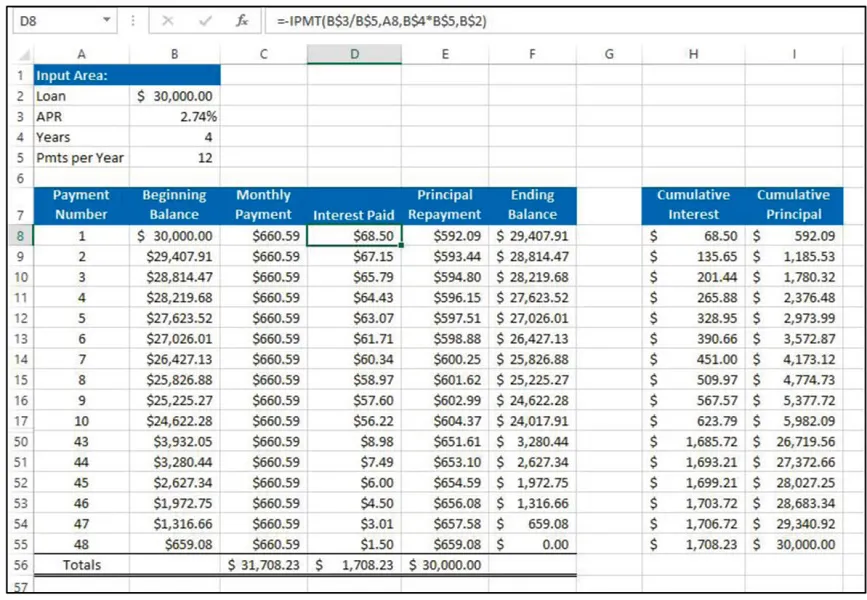

Create a Loan Amortization Table

Suppose you want to create a payment schedule that shows the interest per payment period, principal repayment for each payment, and the balance after each payment is made. This is called a loan amortization table, and a partial table is shown in the slide. Because this example is for a car loan over 4 years or 48 monthly payments, the complete schedule cannot be viewed in its entirety.

Let’s look at the financial functions that are needed to generate this amortization table.

IPMT

The IPMT function calculates the periodic interest for a specified payment period on a loan or an investment given a fixed interest rate, specified term, and identical periodic payments.

=IPMT(rate,per,nper,pv,[fv],[type])

The PPMT function calculates the principal payment for a specified payment period on a loan or an investment given a fixed interest rate, specified term, and identical periodic payments.

=IPMT(rate,per,nper,pv,[fv],[type])

The arguments for these two functions are:

A) The rate argument is the periodic interest rate. If the APR is 6 percent and the payments are made monthly, then the rate is 6 percent/12 or 0.5 percent.

B) The per argument is the specific payment or investment period to use to calculate the interest where the first payment period is 1.

C) The nper argument represents the total number of payment or investment periods. With a 4-year loan consisting of monthly payments, the number of payment periods is 48.

D) The pv argument represents the present value of the loan or investment.

E) The optional fv argument represents the future value of the loan or investment. If you omit this argument, Excel defaults to 0.

F) The optional type argument represents the timing of the payments. Enter 0 if the payments are made at the end of the period, or enter 1 if the payments are made at the beginning.

Cumulative Calculation Functions

• The CUMIPMT function calculates the cumulative interest through a specified payment period.

=CUMIPMT(rate,nper,pv,start_period,end_period,type)

=CUMIPMT(rate,nper,pv,start_period,end_period,type)

• The CUMPRINC function calculates the cumulative principal through a specified payment period.

=CUMPRINC(rate,nper,pv,start_period,end_period,type)

=CUMPRINC(rate,nper,pv,start_period,end_period,type)

The only two new arguments are the start_period argument, which specifies the first period you want to start accumulating the interest, and the end_period argument, which specifies the last payment period you want to include.

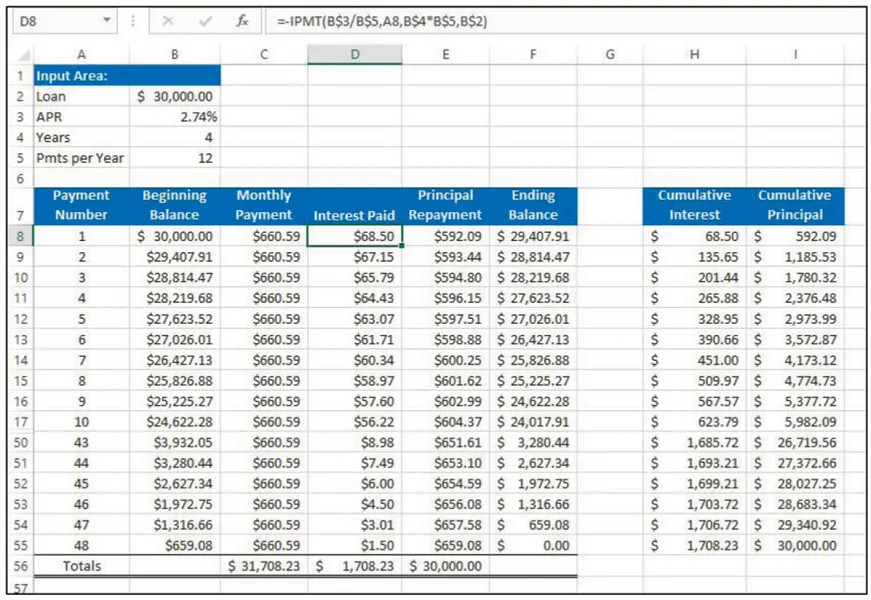

The amortization table is shown once again so you can see how the various functions were applied.

CHAPTER 2

Excel for Conditional Math and Statistical Functions

As against specialist software packages for statistical analysis like SPSS, R, SAS, and Minitab, the reason we often use Excel for statistical analysis is

A) Convenience as it’s already installed on our PCs. It is to be noted that unless the statistical computational needs are highly advanced, for beginners Excel is quite user-friendly and eliminates the need to learn another software. Excel also integrates easily into other Microsoft Office software prod...

Table des matières

Normes de citation pour MS Excel, Second Edition

APA 6 Citation

Singa, A. (2018). MS Excel, Second Edition (2nd ed.). Business Expert Press. Retrieved from https://www.perlego.com/book/859249/ms-excel-second-edition-lets-advance-to-the-next-level-pdf (Original work published 2018)

Chicago Citation

Singa, Anurag. (2018) 2018. MS Excel, Second Edition. 2nd ed. Business Expert Press. https://www.perlego.com/book/859249/ms-excel-second-edition-lets-advance-to-the-next-level-pdf.

Harvard Citation

Singa, A. (2018) MS Excel, Second Edition. 2nd edn. Business Expert Press. Available at: https://www.perlego.com/book/859249/ms-excel-second-edition-lets-advance-to-the-next-level-pdf (Accessed: 14 October 2022).

MLA 7 Citation

Singa, Anurag. MS Excel, Second Edition. 2nd ed. Business Expert Press, 2018. Web. 14 Oct. 2022.