eBook - ePub

Modern Derivatives Pricing and Credit Exposure Analysis

Theory and Practice of CSA and XVA Pricing, Exposure Simulation and Backtesting

Roland Lichters, Roland Stamm, Donal Gallagher

This is a test

Condividi libro

- English

- ePUB (disponibile sull'app)

- Disponibile su iOS e Android

eBook - ePub

Modern Derivatives Pricing and Credit Exposure Analysis

Theory and Practice of CSA and XVA Pricing, Exposure Simulation and Backtesting

Roland Lichters, Roland Stamm, Donal Gallagher

Dettagli del libro

Anteprima del libro

Indice dei contenuti

Citazioni

Informazioni sul libro

This book provides a comprehensive guide for modern derivatives pricing and credit analysis. Written to provide sound theoretical detail but practical implication, it provides readers with everything they need to know to price modern financial derivatives and analyze the credit exposure of a financial instrument in today's markets.

Domande frequenti

Come faccio ad annullare l'abbonamento?

È semplicissimo: basta accedere alla sezione Account nelle Impostazioni e cliccare su "Annulla abbonamento". Dopo la cancellazione, l'abbonamento rimarrà attivo per il periodo rimanente già pagato. Per maggiori informazioni, clicca qui

È possibile scaricare libri? Se sì, come?

Al momento è possibile scaricare tramite l'app tutti i nostri libri ePub mobile-friendly. Anche la maggior parte dei nostri PDF è scaricabile e stiamo lavorando per rendere disponibile quanto prima il download di tutti gli altri file. Per maggiori informazioni, clicca qui

Che differenza c'è tra i piani?

Entrambi i piani ti danno accesso illimitato alla libreria e a tutte le funzionalità di Perlego. Le uniche differenze sono il prezzo e il periodo di abbonamento: con il piano annuale risparmierai circa il 30% rispetto a 12 rate con quello mensile.

Cos'è Perlego?

Perlego è un servizio di abbonamento a testi accademici, che ti permette di accedere a un'intera libreria online a un prezzo inferiore rispetto a quello che pagheresti per acquistare un singolo libro al mese. Con oltre 1 milione di testi suddivisi in più di 1.000 categorie, troverai sicuramente ciò che fa per te! Per maggiori informazioni, clicca qui.

Perlego supporta la sintesi vocale?

Cerca l'icona Sintesi vocale nel prossimo libro che leggerai per verificare se è possibile riprodurre l'audio. Questo strumento permette di leggere il testo a voce alta, evidenziandolo man mano che la lettura procede. Puoi aumentare o diminuire la velocità della sintesi vocale, oppure sospendere la riproduzione. Per maggiori informazioni, clicca qui.

Modern Derivatives Pricing and Credit Exposure Analysis è disponibile online in formato PDF/ePub?

Sì, puoi accedere a Modern Derivatives Pricing and Credit Exposure Analysis di Roland Lichters, Roland Stamm, Donal Gallagher in formato PDF e/o ePub, così come ad altri libri molto apprezzati nelle sezioni relative a Volkswirtschaftslehre e Ökonometrie. Scopri oltre 1 milione di libri disponibili nel nostro catalogo.

Informazioni

Argomento

VolkswirtschaftslehreCategoria

ÖkonometrieI

Discounting

1 |  | Discounting Before the Crisis |

1.1 The risk-free rate

The main ingredient for pricing is the zero curve r(t) which assigns an interest rate to any given maturity t > 0. It tells us what the value of 1 currency unit will be at time t if invested at the risk-free rate. For most theoretical applications, the zero rate is expressed as continuously compounding, so the value at time t will be given by

Other conventions are also common. Linear compounding is typically used for short-term interest (less than one year):

Simple compounding takes interest on interest into account, in particular for maturities beyond one year:

Conversely, today’s value of one currency unit paid in t years is given by

P(0,t) is the price of a risk-free zero bond with maturity t, as seen today (at time 0). It is also referred to as the (deterministic) discount factor for time t, dft.

This immediately raises the question: What is the risk-free rate, which is the compensation to lenders for not using their money for consumption immediately? The person or institution making the promise of paying back the money would have to be seen as non-defaultable, no matter what happens. Obviously, such an entity does not exist, so people use proxies like certain highly rated governments or supra-national institutions. Before the near-default of Bear Stearns, people viewed banks that were rated AA or higher as virtually default-free, and therefore used the LIBOR rate as proxies for the risk-free rate.

1.2 Pricing linear instruments

1.2.1 Forward rate agreements

The most important building block in interest rate modelling is the forward rate agreement, or FRA for short. This is a contract by which two parties agree today (at t = 0) on an interest rate f(0;t1,t2) to be paid in t2 for a loan spanning a future period t1 to t2. If the market (i.e. LIBOR) rate L(t1,t2) which is fixed in t1 for that period exceeds f(0;t1,t2), the payer of the rate has made a profit. Otherwise, the receiver gains more than the market rate.

Market practice is that the payment is actually paid in t1 by computing the cash flow in t2 and discounting it to t1 with the fixed LIBOR rate. For pricing purposes, this is virtually irrelevant (see [117]), so we ignore this distinction.

Pricing this correctly is obviously equivalent to predicting the LIBOR rate in a market-accepted manner.

What rate can we expect in three months’ time if we want to borrow money for six months at that time? Calculate the forward rate of a 3M into 9M FRA as follows:

• Borrow df0.25 = P(0,0.25) units for three months at the risk-free three-month rate

• Invest the money for nine months at the risk-free rate for nine months

• Borrow 1 unit in an FRA in three months (maturing six months later) to pay back the loan with interest

• After another six months, pay back the loan with the df0.25/df0.75 from the investment

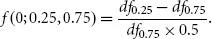

• By the no-arbitrage principle, the combination has to be worth 0. The forward rate therefore has to be

Note that, in general, the period lengths are not exactly a quarter or half a year but rather depend on the day count fraction of the rates used. In Euroland, this would be ACT/360, for example.

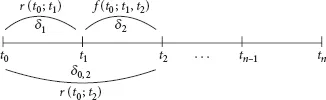

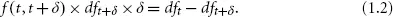

In Figure 1.1, we must have (assuming linear compounding, as is the market custom for periods of less than one year)

Figure 1.1 Replication of the forward rate

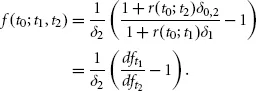

In other words

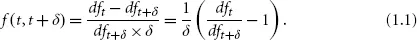

In general, the forward rate for time t (in years from today) for a period of δ (in years) is given by

The present value of the forward rate paid on a notional of 1 unit is therefore

Note that this is true because we use the same discount factors in the forward rate replication as when discounting cash flows. The main assumption in this replication argument is that I (at least a bank) can borrow and lend arbitrary amounts at the risk-free (LIBOR) rate.

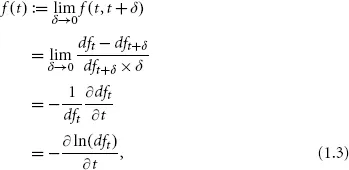

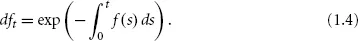

We can take a look at what happens if we let δ approach 0 in formula (1.1), under the assumption that the discount curve is differentiable:

which also implies that

Forward rates are used as expected values for the LIBOR fixing for a future time period. Most importantly, this is done in interest rate swaps.

1.2.2 Interest rate swaps

An interest rate swap, or swap for short, is a contract by which two parties agree to exchange interest payments on a predetermined notional on a regular basis. One party pays the fixed rate with the frequency which is standard in the chosen currency. For EUR, for instance, this is annually; for USD, on the other hand, this is semi-annually. The other party pays a floating rate linked to LIBOR of some given frequency (1, 3, 6 or 12 months), possibly with a spread. There is also a standard frequency for floating legs in most currencies: in EUR, this is six months, and in USD, it is three months, for instance.

At inception, the v...