eBook - ePub

Modern Derivatives Pricing and Credit Exposure Analysis

Theory and Practice of CSA and XVA Pricing, Exposure Simulation and Backtesting

Roland Lichters, Roland Stamm, Donal Gallagher

This is a test

Buch teilen

- English

- ePUB (handyfreundlich)

- Über iOS und Android verfügbar

eBook - ePub

Modern Derivatives Pricing and Credit Exposure Analysis

Theory and Practice of CSA and XVA Pricing, Exposure Simulation and Backtesting

Roland Lichters, Roland Stamm, Donal Gallagher

Angaben zum Buch

Buchvorschau

Inhaltsverzeichnis

Quellenangaben

Über dieses Buch

This book provides a comprehensive guide for modern derivatives pricing and credit analysis. Written to provide sound theoretical detail but practical implication, it provides readers with everything they need to know to price modern financial derivatives and analyze the credit exposure of a financial instrument in today's markets.

Häufig gestellte Fragen

Wie kann ich mein Abo kündigen?

Gehe einfach zum Kontobereich in den Einstellungen und klicke auf „Abo kündigen“ – ganz einfach. Nachdem du gekündigt hast, bleibt deine Mitgliedschaft für den verbleibenden Abozeitraum, den du bereits bezahlt hast, aktiv. Mehr Informationen hier.

(Wie) Kann ich Bücher herunterladen?

Derzeit stehen all unsere auf Mobilgeräte reagierenden ePub-Bücher zum Download über die App zur Verfügung. Die meisten unserer PDFs stehen ebenfalls zum Download bereit; wir arbeiten daran, auch die übrigen PDFs zum Download anzubieten, bei denen dies aktuell noch nicht möglich ist. Weitere Informationen hier.

Welcher Unterschied besteht bei den Preisen zwischen den Aboplänen?

Mit beiden Aboplänen erhältst du vollen Zugang zur Bibliothek und allen Funktionen von Perlego. Die einzigen Unterschiede bestehen im Preis und dem Abozeitraum: Mit dem Jahresabo sparst du auf 12 Monate gerechnet im Vergleich zum Monatsabo rund 30 %.

Was ist Perlego?

Wir sind ein Online-Abodienst für Lehrbücher, bei dem du für weniger als den Preis eines einzelnen Buches pro Monat Zugang zu einer ganzen Online-Bibliothek erhältst. Mit über 1 Million Büchern zu über 1.000 verschiedenen Themen haben wir bestimmt alles, was du brauchst! Weitere Informationen hier.

Unterstützt Perlego Text-zu-Sprache?

Achte auf das Symbol zum Vorlesen in deinem nächsten Buch, um zu sehen, ob du es dir auch anhören kannst. Bei diesem Tool wird dir Text laut vorgelesen, wobei der Text beim Vorlesen auch grafisch hervorgehoben wird. Du kannst das Vorlesen jederzeit anhalten, beschleunigen und verlangsamen. Weitere Informationen hier.

Ist Modern Derivatives Pricing and Credit Exposure Analysis als Online-PDF/ePub verfügbar?

Ja, du hast Zugang zu Modern Derivatives Pricing and Credit Exposure Analysis von Roland Lichters, Roland Stamm, Donal Gallagher im PDF- und/oder ePub-Format sowie zu anderen beliebten Büchern aus Volkswirtschaftslehre & Ökonometrie. Aus unserem Katalog stehen dir über 1 Million Bücher zur Verfügung.

Information

Thema

ÖkonometrieI

Discounting

1 |  | Discounting Before the Crisis |

1.1 The risk-free rate

The main ingredient for pricing is the zero curve r(t) which assigns an interest rate to any given maturity t > 0. It tells us what the value of 1 currency unit will be at time t if invested at the risk-free rate. For most theoretical applications, the zero rate is expressed as continuously compounding, so the value at time t will be given by

Other conventions are also common. Linear compounding is typically used for short-term interest (less than one year):

Simple compounding takes interest on interest into account, in particular for maturities beyond one year:

Conversely, today’s value of one currency unit paid in t years is given by

P(0,t) is the price of a risk-free zero bond with maturity t, as seen today (at time 0). It is also referred to as the (deterministic) discount factor for time t, dft.

This immediately raises the question: What is the risk-free rate, which is the compensation to lenders for not using their money for consumption immediately? The person or institution making the promise of paying back the money would have to be seen as non-defaultable, no matter what happens. Obviously, such an entity does not exist, so people use proxies like certain highly rated governments or supra-national institutions. Before the near-default of Bear Stearns, people viewed banks that were rated AA or higher as virtually default-free, and therefore used the LIBOR rate as proxies for the risk-free rate.

1.2 Pricing linear instruments

1.2.1 Forward rate agreements

The most important building block in interest rate modelling is the forward rate agreement, or FRA for short. This is a contract by which two parties agree today (at t = 0) on an interest rate f(0;t1,t2) to be paid in t2 for a loan spanning a future period t1 to t2. If the market (i.e. LIBOR) rate L(t1,t2) which is fixed in t1 for that period exceeds f(0;t1,t2), the payer of the rate has made a profit. Otherwise, the receiver gains more than the market rate.

Market practice is that the payment is actually paid in t1 by computing the cash flow in t2 and discounting it to t1 with the fixed LIBOR rate. For pricing purposes, this is virtually irrelevant (see [117]), so we ignore this distinction.

Pricing this correctly is obviously equivalent to predicting the LIBOR rate in a market-accepted manner.

What rate can we expect in three months’ time if we want to borrow money for six months at that time? Calculate the forward rate of a 3M into 9M FRA as follows:

• Borrow df0.25 = P(0,0.25) units for three months at the risk-free three-month rate

• Invest the money for nine months at the risk-free rate for nine months

• Borrow 1 unit in an FRA in three months (maturing six months later) to pay back the loan with interest

• After another six months, pay back the loan with the df0.25/df0.75 from the investment

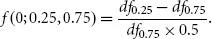

• By the no-arbitrage principle, the combination has to be worth 0. The forward rate therefore has to be

Note that, in general, the period lengths are not exactly a quarter or half a year but rather depend on the day count fraction of the rates used. In Euroland, this would be ACT/360, for example.

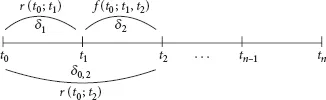

In Figure 1.1, we must have (assuming linear compounding, as is the market custom for periods of less than one year)

Figure 1.1 Replication of the forward rate

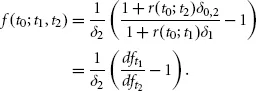

In other words

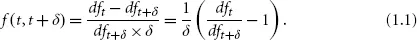

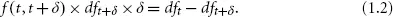

In general, the forward rate for time t (in years from today) for a period of δ (in years) is given by

The present value of the forward rate paid on a notional of 1 unit is therefore

Note that this is true because we use the same discount factors in the forward rate replication as when discounting cash flows. The main assumption in this replication argument is that I (at least a bank) can borrow and lend arbitrary amounts at the risk-free (LIBOR) rate.

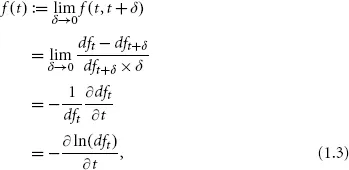

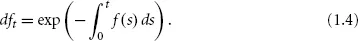

We can take a look at what happens if we let δ approach 0 in formula (1.1), under the assumption that the discount curve is differentiable:

which also implies that

Forward rates are used as expected values for the LIBOR fixing for a future time period. Most importantly, this is done in interest rate swaps.

1.2.2 Interest rate swaps

An interest rate swap, or swap for short, is a contract by which two parties agree to exchange interest payments on a predetermined notional on a regular basis. One party pays the fixed rate with the frequency which is standard in the chosen currency. For EUR, for instance, this is annually; for USD, on the other hand, this is semi-annually. The other party pays a floating rate linked to LIBOR of some given frequency (1, 3, 6 or 12 months), possibly with a spread. There is also a standard frequency for floating legs in most currencies: in EUR, this is six months, and in USD, it is three months, for instance.

At inception, the v...