eBook - ePub

Globalization and the Chinese Retailing Revolution

Competing in the World's Largest Emerging Market

- 300 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Globalization and the Chinese Retailing Revolution

Competing in the World's Largest Emerging Market

About this book

Chinese retailing serves 1.3 billion consumers and is developing with high economic growth rates. This detailed reference examines the following issues: the revolution happening in Chinese retailing; the evolution of the opening-up policy of Chinese retailing; the great opportunities brought about by the dramatic change in the Chinese retail industry particularly by China's entry to the World Trade Organisation (WTO); how to succeed in the Chinese retail market; successful models and strategies for both Chinese retailers and multinational retailers in China. The book also discusses the deep impact of China's entry to the WTO on the Chinese retail industry and the strategic importance of the industry in China's transitional economy.

- The first book to systematically study the Chinese retail industry and is written by someone who is from the inside of Chinese retailing and who understands western retailing well

- Includes many case studies of multinational retailer operations in China and valuable suggestions for success in China

- Wal-Mart's business model, internationalization and operations in emerging market, particularly in China

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Globalization and the Chinese Retailing Revolution by Yong Zhen in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Information

Part I

The Global Retail Industry

1

New trends in the world retail industry

Publisher Summary

This chapter discusses the new trends in the world retail industry. The most important development in global retailing in recent years has been retailing concentration and globalization. The maturity of retailing in developed countries has caused retailing concentration and made Mergers and Acquisitions (M&A) the main path for corporate growth. Retailers are becoming larger in size while smaller in numbers. To develop opportunities, some retailers take internationalization entering foreign markets, especially emerging markets. During their internationalization, cultural proximity and geographic proximity are often the key issues for choosing the market entered for low operation risks and easy operation model transfer. Meanwhile, compared with other industries, the globalization and concentration of retailing are just in their infancy, which may provide retailers from developing countries with more opportunities to catch up in this industry than other industries. In addition, there are some other significant trends in retailing, such as the diversification of retailers, the acceleration of retail format evolution, the fast development of Private Label (PL) products, and so on.

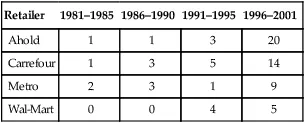

1.1 The globalization of world retailing

The last decade has witnessed many new trends emerging in world retailing, among which globalization and concentration are the most obvious. The globalization of retailing can be traced back to as early as the 1970s, when some successful national retailers, such as UK-based Marks & Spencer and Germany-based Metro, tried to extend their operations abroad. They focused mainly on the traditional Triad Market: USA, Japan and Western Europe. However, because of unfavorable conditions in the global operation at that time including higher trade barriers, expensive operation costs, little international experience, etc., many of the retailers failed, such as Marks Spencer, which failed in Canada at that time. With the accelerated globalization of the world economy and the development of technology, particularly information technology (IT), the globalization of retailing is becoming the main trend, led by Ahold and Carrefour since 1990s. From 1981 to 1990, Ahold only entered two countries; and Carrefour entered three countries. However, from 1991 to 2001, Ahold entered 23 countries and Carrefour entered 19 countries (Table 1.1). Retail giants not only enter the traditional Triad Market but also enter emerging markets, such as Mexico, China and Poland.

Table 1.1

The number of countries the main MNRs entered from 1980 to 2001

| Retailer | 1981–1985 | 1986–1990 | 1991–1995 | 1996–2001 |

| Ahold | 1 | 1 | 3 | 20 |

| Carrefour | 1 | 3 | 5 | 14 |

| Metro | 2 | 3 | 1 | 9 |

| Wal-Mart | 0 | 0 | 4 | 5 |

Global operation is becoming increasingly important for a corporate survival and business growth. In 1998, among the top 200 global retailers, only 94 retailers operated internationally; while by the end of 2005, the number reached 125. In 2005, 13 of the top 20 American retailers operated internationally. The globalization trend in retailing is intensifying.

However, although retailing is going global, the globalization is just in its infancy. In 2005, there were still 75 of the top 200 global retailers remained single-country merchants; even in the USA, the world most developed retail market, only 65 per cent of the top 20 retailers operated internationally. Comparing other industries such as pharmaceutical, automotive, and electronic industries, it can be found that as early as in 2000, the top 10 largest pharmaceutical companies averagely operated in 137 countries; the top 10 largest automotive companies averagely operated in 44 countries, while the top 10 largest retailers only averagely operated in 10 countries in 2000 and 13 in 2005. So, it can be argued that there may have huge potential in retailing industry for further global operation in the next decade.

1.1.1 Why go global?

Treadgold (1990) claims that it is the perception of a relative absence of growth opportunities in the home market and the perception of identifiable growth opportunities in international markets that motivate retailers to pursue internationalization. Stonehouse et al. (2000) argue that it is the four forces: social, political, economic and technical forces that drive industrial globalization. It can be argued that the globalization of retailing is mainly because of the following reasons: First, the globalization of retailing has resulted from the globalization of the world economy, which is directly driven by the liberation of economies in former communist countries and by the deregulations in international trade and investment that were caused by the launch of the North America Free Trade Agreement (NAFTA), the creation of the World Trade Organization (WTO) from the former General Agreement on Tariffs and Trade (GATT) and the International Trade Organization (ITO) and the formation of the European Union (EU). Globalization of the world economy makes the globalization of retailing possible because it brings the globalization of production and the formation of global supply chains. The formulation of economic blocs, such as NAFTA, stimulates retailers to expand within the blocs, cross-national boundaries becoming multinational retailers (MNRs). Second, the globalization of retailing has resulted from unfavorable environments in developed countries, such as the saturation of their domestic retail markets and restrictive planning legislation, which force retailers to seek growth opportunities abroad, and the favorable conditions in developing countries, such as the deregulation of retailing policies, fragmented retail markets, rising of middle class (M Class), growing population, changing lifestyles and shopping patterns, which provide MNRs with opportunities to exploit the great market potential. The deregulation of retailing in emerging markets creates opportunity windows for global retail giants; meanwhile, the saturation of retailing in developed countries motivates retailers to seek opportunities abroad to meet the request for high reward from shareholders. For example, the highly regulated environment in Western Europe forces its retailers to seek growth opportunities outside, such as in Eastern European markets. The rising M Class in emerging markets resulting from the high growth of emerging economies is formulating the segment with similar demands for similar products. Third, the globalization of retailing has resulted from the development and wide application of IT, which reduces operation costs and greatly improves management efficiency. The wide application of IT provides a powerful tool for managing the global operation with less expensive operation costs and is more rewarding, especially in supply chain management. Further, the motivations to become more competitive and more successful by achieving economies of scale and to avoid local economic downturns by being present in different markets also stimulate retailers to internationalization. Therefore, some retailers go global. Retailers’ global operation not only contributes to their sales growth and economies of scale but also creates value by procurement, obtaining knowledge about new markets and new operations, optimizing cost structure and improving corporate capability. Led by the global giants Carrefour and Wal-Mart, retailing is entering the global times.

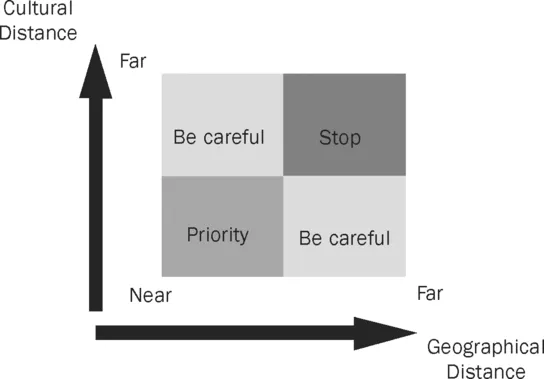

1.1.2 Where to go in the global market?

During the globalization of retailing, which market should retailers choose to enter? Wal-Mart first entered its neighbor countries, such as Mexico and Canada, followed by Argentina and Brazil in South America, then Germany and the UK in Europe, and China and Japan in Asia. Carrefour first entered Spain and other European countries, and then expanded to remote markets, such as Brazil and China. Many European retail giants often make the Eastern European countries their priority choices. From these cases, it can be found that in retail globalization, retailers normally first enter the markets that are either culturally proximal, or geographically proximal, or proximal in both; then expand to further markets in either of them (Figure 1.1.). Besides cultural and geographical issues, some other issues are also considered by the retailers in judging the attractiveness of the chosen markets. These include the regulatory environment in the markets, strategic location for further expansion, economic conditions of the markets including consumers, disposable incomes, retail sales per capita and retail profit potential in the markets, the structure of the retail markets, particularly the competitive level in the market, such as if consumer demands are met effectively. For example, many Western European retailers including Carrefour, Auchan, Metro, Ahold, Aldi, Makro, Tesco and Rewe have entered Eastern European countries, such as the Czech Republic, Poland and Hungary. This is not only because the markets are near in both cultural and geographical distance but also because the Eastern European markets have other favorable conditions, such as the high fragment of retail markets, fast growing disposable income potential, historically less competitive environments and great consumer demands for both goods and services. In Western Europe, although the British market has lower growth potential, it is still very attractive for less intensive competition compared with other European countries, which makes the UK to have one of the highest retail profit margins in the world.

1.1.3 Obstacles and difficulties in retailers’ internationalization

Over the past two decades, the global arena has proven extraordinarily difficult for many retailers going global. Few companies have succeeded in globalizing, and many barriers remain. These barriers include different institutional systems, specific government regulations, different cultures and traditions, unfamiliar rules, different distribution and logistics systems and different consumer behaviors. Further, the obstacles also include the shortage of key resources such as qualified managers; unfavourable tax and tariff structure; restriction on foreign ownership; and impenetrable established supplier relationships.

To succeed in an international market, retailers not only need to overcome these obstacles but also need to develop sustainable competitive advantages (CAs) by taking advantage of local resources. To win in international retailing, most MNRs will need to reinvent competitive advantage in each new market. Many internationalization cases fail because the retailers have failed to deal with the specific difference in economic systems in the first place, failed to understand the market diffe...

Table of contents

- Cover image

- Title page

- Table of Contents

- CHANDOS ASIAN STUDIES SERIES: CONTEMPORARY ISSUES AND TRENDS

- Copyright

- Dedication

- List of figures

- List of tables

- Preface

- About the author

- Acknowledgments

- Acronyms

- Introduction

- Part I: The Global Retail Industry

- Part II: The Revolution of Chinese Retailing

- Part III: Competing Chinese retailing

- Part IV: The WTO and Chinese retailing

- Some conditions for retail JVs

- Top 10 Chinese chain store operators in 2005

- Bibliography

- Index