eBook - ePub

An Option Greeks Primer

Building Intuition with Delta Hedging and Monte Carlo Simulation using Excel

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

An Option Greeks Primer

Building Intuition with Delta Hedging and Monte Carlo Simulation using Excel

About this book

This book provides a hands-on, practical guide to understanding derivatives pricing. Aimed at the less quantitative practitioner, it provides a balanced account of options, Greeks and hedging techniques avoiding the complicated mathematics inherent to many texts, and with a focus on modelling, market practice and intuition.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access An Option Greeks Primer by Jawwad Farid in PDF and/or ePUB format, as well as other popular books in Business & Business Mathematics. We have over one million books available in our catalogue for you to explore.

Information

Part I

Refresher

Introduction: Context

1 Options

A vanilla option is a derivative instrument that gives us the right to buy or sell an underlying security on a future date at a price agreed upon today. Unlike a forward or future contract, an option gives us the right to walk away if the market price is not in our favour. If we do decide to walk away, our loss is limited to the upfront premium we paid when we purchased the option.

The right to buy an underlying security is known as a call. The right to sell an underlying security is known as a put. When we sell an option we write it, and our obligation is very different from that of the buyer; while the buyer has the right to walk away, the writer is obligated to perform.

For a more detailed treatment of the Options and derivatives world, see John C. Hull, Paul Wilmott and Jawwad Farid.1

2 Option price drivers

Option prices are determined by a range of methods. Three of the methods that we will refer to in this book are the Black–Scholes equation (also known as the Black–Scholes–Merton Model or BSM for short) for European options; Binomial Trees for American options; and the Monte Carlo simulation.

Irrespective of the method used, the price of an option is determined by the following factors:2

A natural follow-up question is: How does the price of an option change when any of the above variables changes? And then: Which of these variables has the biggest price impact, and which the least?

3 Greeks

Greeks are approximations used to determine the change in price of the option due to a unit change in the value of one of the above drivers. They are also known as option price sensitivities (OPS) or option factor sensitivities. They are called Greeks because their names reference the Greek alphabet: Delta, Gamma, Vega, Theta and Rho.

If you are familiar with the world of fixed income investment you will have heard of the terms ‘duration’ and ‘convexity’, which measure the change in the value of a treasury bond for a change in the underlying interest rates. Duration is a first-order (linear) rate of change in the price of an interest-rate-sensitive instrument (a bond) because of a change in the yield to maturity or reference rate of the instrument. Convexity is a second-order (non-linear) derivative that adjusts the linear sensitivity measure to account for the curvature in the price–yield relationship. In like manner, there are multiple option price sensitivities because of multiple option price drivers. Some, like duration for fixed income securities, are linear (e.g. Delta). Others, like convexity for fixed income securities, are non-linear (e.g. Gamma).

4 Hedging and squaring

Trading desks make money by taking (running) positions for their account, buying and selling at a spread (buying low, selling high) or market making (providing liquidity by holding an instrument on their balance sheet temporarily). In order for them to buy and sell at a spread they need to offset (hedge) their client positions. This process of matching or offsetting positions is called squaring. The spread is booked and realized when they buy (long) from the client at a slightly lower price and then sell (short) in the market at a slightly higher price, and vice versa.

If no appropriate counterparty or security is available to hedge a position, a trader needs to hedge their exposure by using basic principles. An unhedged position is known as an open (or naked) position.

5 Empirical and implied volatility

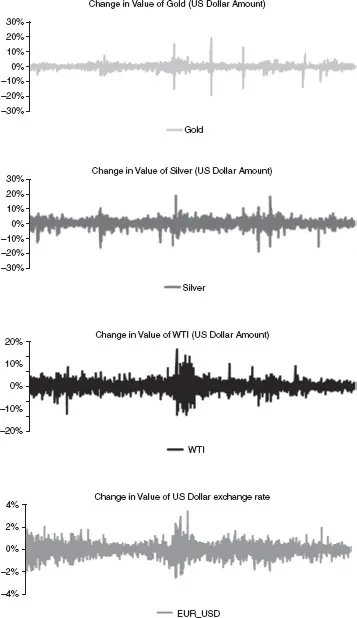

Within the options world, volatility is a measure of relative price changes. These changes can be measured on a daily, weekly, monthly or annualized basis. When volatility is measured using actual historical price data, we call it empirical or historical volatility. Figure 1 illustrates the behaviour of historical volatility for Gold, Silver, WTI and the EUR-USD exchange rate.

The volatility used as an input to determine option prices is not historical or empirical volatility, but implied volatility. While historical volatility is the historical average, implied volatility represents a mixture of future expectations of realized volatility and the level of volatility at which a trader is comfortable taking a position.

Figure 1 Changes in gold, silver, WTI and US dollar prices

Source: The Greeks against Spot. FinanceTrainingCourse.com

...Table of contents

- Cover

- Title

- Part I Refresher

- Part II Delta Hedging

- Part III Building Surfaces in Excel

- Part IV Hedging Higher-Order Greeks

- Part V Applications

- Notes

- Further Reading

- Index