eBook - ePub

An Option Greeks Primer

Building Intuition with Delta Hedging and Monte Carlo Simulation using Excel

Jawwad Farid

This is a test

Buch teilen

- English

- ePUB (handyfreundlich)

- Über iOS und Android verfügbar

eBook - ePub

An Option Greeks Primer

Building Intuition with Delta Hedging and Monte Carlo Simulation using Excel

Jawwad Farid

Angaben zum Buch

Buchvorschau

Inhaltsverzeichnis

Quellenangaben

Über dieses Buch

This book provides a hands-on, practical guide to understanding derivatives pricing. Aimed at the less quantitative practitioner, it provides a balanced account of options, Greeks and hedging techniques avoiding the complicated mathematics inherent to many texts, and with a focus on modelling, market practice and intuition.

Häufig gestellte Fragen

Wie kann ich mein Abo kündigen?

Gehe einfach zum Kontobereich in den Einstellungen und klicke auf „Abo kündigen“ – ganz einfach. Nachdem du gekündigt hast, bleibt deine Mitgliedschaft für den verbleibenden Abozeitraum, den du bereits bezahlt hast, aktiv. Mehr Informationen hier.

(Wie) Kann ich Bücher herunterladen?

Derzeit stehen all unsere auf Mobilgeräte reagierenden ePub-Bücher zum Download über die App zur Verfügung. Die meisten unserer PDFs stehen ebenfalls zum Download bereit; wir arbeiten daran, auch die übrigen PDFs zum Download anzubieten, bei denen dies aktuell noch nicht möglich ist. Weitere Informationen hier.

Welcher Unterschied besteht bei den Preisen zwischen den Aboplänen?

Mit beiden Aboplänen erhältst du vollen Zugang zur Bibliothek und allen Funktionen von Perlego. Die einzigen Unterschiede bestehen im Preis und dem Abozeitraum: Mit dem Jahresabo sparst du auf 12 Monate gerechnet im Vergleich zum Monatsabo rund 30 %.

Was ist Perlego?

Wir sind ein Online-Abodienst für Lehrbücher, bei dem du für weniger als den Preis eines einzelnen Buches pro Monat Zugang zu einer ganzen Online-Bibliothek erhältst. Mit über 1 Million Büchern zu über 1.000 verschiedenen Themen haben wir bestimmt alles, was du brauchst! Weitere Informationen hier.

Unterstützt Perlego Text-zu-Sprache?

Achte auf das Symbol zum Vorlesen in deinem nächsten Buch, um zu sehen, ob du es dir auch anhören kannst. Bei diesem Tool wird dir Text laut vorgelesen, wobei der Text beim Vorlesen auch grafisch hervorgehoben wird. Du kannst das Vorlesen jederzeit anhalten, beschleunigen und verlangsamen. Weitere Informationen hier.

Ist An Option Greeks Primer als Online-PDF/ePub verfügbar?

Ja, du hast Zugang zu An Option Greeks Primer von Jawwad Farid im PDF- und/oder ePub-Format sowie zu anderen beliebten Büchern aus Business & Gestione di rischi finanziari. Aus unserem Katalog stehen dir über 1 Million Bücher zur Verfügung.

Information

Thema

BusinessPart I

Refresher

Introduction: Context

1 Options

A vanilla option is a derivative instrument that gives us the right to buy or sell an underlying security on a future date at a price agreed upon today. Unlike a forward or future contract, an option gives us the right to walk away if the market price is not in our favour. If we do decide to walk away, our loss is limited to the upfront premium we paid when we purchased the option.

The right to buy an underlying security is known as a call. The right to sell an underlying security is known as a put. When we sell an option we write it, and our obligation is very different from that of the buyer; while the buyer has the right to walk away, the writer is obligated to perform.

For a more detailed treatment of the Options and derivatives world, see John C. Hull, Paul Wilmott and Jawwad Farid.1

2 Option price drivers

Option prices are determined by a range of methods. Three of the methods that we will refer to in this book are the Black–Scholes equation (also known as the Black–Scholes–Merton Model or BSM for short) for European options; Binomial Trees for American options; and the Monte Carlo simulation.

Irrespective of the method used, the price of an option is determined by the following factors:2

A natural follow-up question is: How does the price of an option change when any of the above variables changes? And then: Which of these variables has the biggest price impact, and which the least?

3 Greeks

Greeks are approximations used to determine the change in price of the option due to a unit change in the value of one of the above drivers. They are also known as option price sensitivities (OPS) or option factor sensitivities. They are called Greeks because their names reference the Greek alphabet: Delta, Gamma, Vega, Theta and Rho.

If you are familiar with the world of fixed income investment you will have heard of the terms ‘duration’ and ‘convexity’, which measure the change in the value of a treasury bond for a change in the underlying interest rates. Duration is a first-order (linear) rate of change in the price of an interest-rate-sensitive instrument (a bond) because of a change in the yield to maturity or reference rate of the instrument. Convexity is a second-order (non-linear) derivative that adjusts the linear sensitivity measure to account for the curvature in the price–yield relationship. In like manner, there are multiple option price sensitivities because of multiple option price drivers. Some, like duration for fixed income securities, are linear (e.g. Delta). Others, like convexity for fixed income securities, are non-linear (e.g. Gamma).

4 Hedging and squaring

Trading desks make money by taking (running) positions for their account, buying and selling at a spread (buying low, selling high) or market making (providing liquidity by holding an instrument on their balance sheet temporarily). In order for them to buy and sell at a spread they need to offset (hedge) their client positions. This process of matching or offsetting positions is called squaring. The spread is booked and realized when they buy (long) from the client at a slightly lower price and then sell (short) in the market at a slightly higher price, and vice versa.

If no appropriate counterparty or security is available to hedge a position, a trader needs to hedge their exposure by using basic principles. An unhedged position is known as an open (or naked) position.

5 Empirical and implied volatility

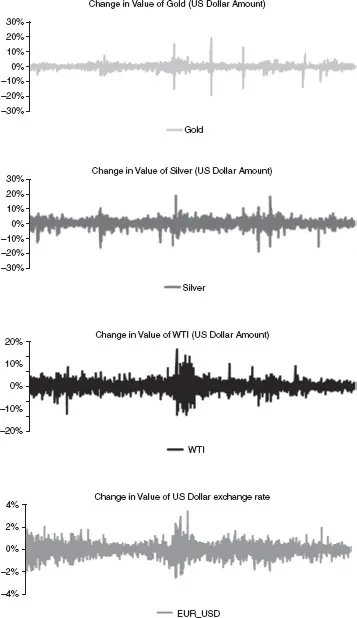

Within the options world, volatility is a measure of relative price changes. These changes can be measured on a daily, weekly, monthly or annualized basis. When volatility is measured using actual historical price data, we call it empirical or historical volatility. Figure 1 illustrates the behaviour of historical volatility for Gold, Silver, WTI and the EUR-USD exchange rate.

The volatility used as an input to determine option prices is not historical or empirical volatility, but implied volatility. While historical volatility is the historical average, implied volatility represents a mixture of future expectations of realized volatility and the level of volatility at which a trader is comfortable taking a position.

Figure 1 Changes in gold, silver, WTI and US dollar prices

Source: The Greeks against Spot. FinanceTrainingCourse.com

...