What is Keynesian Economics?

MA, Management Science (University College London)

Date Published: 01.08.2023,

Last Updated: 02.09.2024

Share this article

Defining Keynesian economics

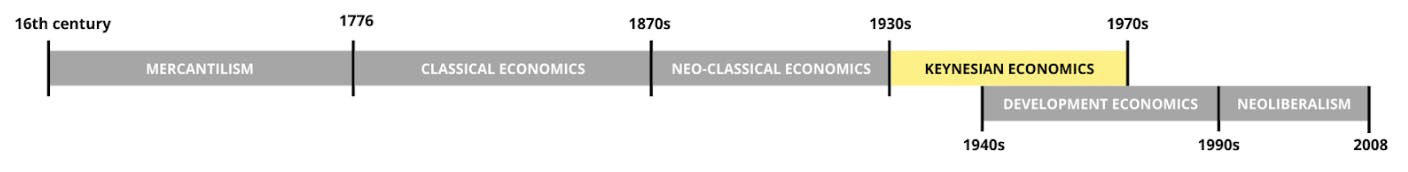

Keynesian economics is a revolutionary wave of economic thought initiated by British economist John Maynard Keynes in the 1930s. It was revolutionary because Keynesian economics challenged the ancestral and long-standing principles of classical economics (1770s - 1870s). The timeline below charts the various phases of general economic thought from the 16th century until the early 21st century.

Figure 1 - Development of Economic Thought

Keynes condensed most of his economic ideas into his book The General Theory of Employment, Interest and Money, usually referred to as The General Theory (1936, [2021]). There, he explains that his theories and findings are fairly simple to understand, but that looking at economics from an innovative, non-classical perspective is where the true challenge for the reader lies.

The ideas which are here expressed so laboriously are extremely simple and should be obvious. The difficulty lies, not in the new ideas, but in escaping from the old ones, which ramify, for those brought up as most of us have been, into every corner of our minds.

John Maynard Keynes

The ideas which are here expressed so laboriously are extremely simple and should be obvious. The difficulty lies, not in the new ideas, but in escaping from the old ones, which ramify, for those brought up as most of us have been, into every corner of our minds.

Classical economic thinking argued that markets were self-regulating and required little to no governmental intervention in order to navigate the natural booms and busts of economies. Indeed, classical economics is mainly supported by Say’s Law. In the book Say's Law: An Historical Analysis (Sowell, 2015), it is stated as the idea that supply creates its own demand because people are always willing to spend their income.

During the Great Depression, Keynes observed that this was not always the case. The English economy had wilted to the point where people were not spending money or demanding goods and services despite their availability in the economy. Essentially, Keynesian economics advocated that economies were not able to automatically stabilise and that government intervention was necessary (to an extent) to encourage demand and allow economies to recover and grow.

What are the key ideas behind Keynesian economics?

Economist and opinion columnist at the New York Times, Paul Krugman, wrote an introduction to a new edition of Keynes’ General Theory (2018). There, he summarized four key principles of Keynesian economics:

- Economies can and often do suffer from an overall lack of demand, which leads to involuntary unemployment.

- The economy’s automatic tendency to correct shortfalls in demand, if it exists at all, operates slowly and painfully

- Government policies to increase demand, by contrast, can reduce unemployment quickly

- Sometimes increasing the money supply won’t be enough to persuade the private sector to spend more, and government spending must step into the breach

From Kugman’s conclusions, Keynes’ novel views on the role of demand, unemployment and money or savings in the economy shaped this economic thought wave at the time.

Keynes on aggregate or effective demand

One of the main differences between classical and Keynesian economics can be looked at as a chicken-and-egg problem. What comes first: supply or demand? Classical economists believed that supply comes first and demand will naturally follow (Say’s Law). For example, an apple vendor would put his home-grown apples on sale and someone would undoubtedly buy them. On the contrary, Keynesian economists believed that demand would come first and supply would follow. That is, someone would express their desire or need for apples and the apple vendor would then put his apples on sale. Because Keynes believed the latter, he defined the components of ‘demand’ on an aggregate, nation-wide level. The textbook Principles of Macroeconomics (Greenlaw, Taylor, and Shapiro, 2017) explains in depth each of its components.

You may also remember that aggregate demand [in Keynesian Analysis] is the sum of four components: consumption expenditure, investment expenditure, government spending, and spending on net exports (exports minus imports).

AD = C + G + I + (X - M)

Steven A. Greenlaw, Timothy Taylor & David Shapiro

You may also remember that aggregate demand [in Keynesian Analysis] is the sum of four components: consumption expenditure, investment expenditure, government spending, and spending on net exports (exports minus imports).

AD = C + G + I + (X - M)

Indeed, Keynes developed the Aggregate Demand (AD) function, which in words, states that aggregate demand (or total output) in an economy is directly proportional to people’s consumption of goods and services, government spending (e.g., in public services, subsidies etc.), investment (e.g., R&D, foreign direct investment) and net exports (i.e., the difference between the value of exports and imports in an economy). In Keynesian economics, effective demand is the equilibrium level of aggregate demand; where aggregate demand equals aggregate supply. For more information on aggregate demand-aggregate supply, see our study guide on the AD-AS model.

Recall that Keynes argued that demand induces supply and that government intervention is needed to incentivise people to spend and help economies stabilize. Therefore, this demand function was an important foundation throughout The General Theory to explain what components governments could play with in order to intervene in economies and aid them in reaching stability.

The marginal propensity to consume (MPC)

Keynes was not a big advocate of savings. From the AD function, excessive saving in an economy meant that output was likely to plummet and limit recovery and output growth. In other words, when people save and put their money in banks, their consumption (C) decreases and aggregate demand falls. It was here that Keynes introduced a novel concept in economics which is vital to understand how economies behave: the marginal propensity to consume (MPC). This is the proportion of income that people are willing to spend, assuming that the remaining will be saved. For example, an MPC of 0.6 means that one will spend 60% of their income, and save the remaining 40%. This simple ratio became one of the building blocks for complex models and theories that were developed during the Keynesian Economics era including the multiplier effect or the IS-LM model.

Keynes on unemployment

Most of Keynes’ contributions stemmed from his stand on the chicken-and-egg problem. Indeed, because Keynes argued that demand came first and supply followed, this had a domino effect on the dynamics of other working elements in an economy such as unemployment. Unlike Classical economists, Keynes argued that full employment was not the optimal level of employment. Instead, he proposed that there was an optimal level of employment which was aligned to the level of demand and supply in a market. If demand for a product increases, supply responds, and the product becomes increasingly available. More workers are needed to produce in that market and wages will adjust to attract the required number of workers. However, he theorised that this process was slow - prices and wages are “sticky” because they respond slowly to changes in supply and demand in a market. This inefficiency led to what he coined to be “involuntary unemployment”. The book Involuntary Unemployment (Vroey, 2004) explains that over time, economists have interpreted and defined involuntary unemployment in different ways but all definitions go back to Keynes’ General Theory.

At least four main definitions of involuntary unemployment can be separated. They can be regrouped into two broader categories, each of which has a lineage in The General Theory: the ‘breaching the reservation wage principle’ and the underemployment definitions.

Michel de Vroey

At least four main definitions of involuntary unemployment can be separated. They can be regrouped into two broader categories, each of which has a lineage in The General Theory: the ‘breaching the reservation wage principle’ and the underemployment definitions.

Essentially, Keynes’ theory of involuntary unemployment occurs when people that are willing to work at the given wage rate cannot find employment because wages and prices have not yet adjusted to market supply and demand.

Criticisms of Keynesian economics

Despite Keynes gaining the support and following of many renowned economists including John Hicks or Nicholas Kandor, he ran into criticism and opponents during his trajectory as a prominent economist. In his book The Road of Serfdom (1944, [2014]), economist Friedrick Hayek argued that Keynes' views assumed that governments knew how to best manage resources and public funds, and that this deprived people and markets from following their free and natural decision-making course.

It is seldom that liberty of any kind is lost all at once.

F. A. Hayek (Edited by Bruce Caldwell)

It is seldom that liberty of any kind is lost all at once.

Moreover, throughout this article, it has become obvious that the presence and role of demand are hard to ignore in Keynesian economics. Milton Friedman, Nobel Prize winner in Economic Sciences (1976), disagreed with Keynes on who the protagonist was in the field of economics. He believed that money supply and monetary policy were a stronger force than demand in the recovery of economies. Indeed, while Keynes prescribed fiscal policy (i.e., altering tax levels and government spending to influence demand in an economy) to regain economic stability, Friedman believed that monetary policy (i.e., altering interest rates and money supply) was more impactful in bringing economies to a state of equilibrium. Milton’s doctrine gained popularity to the point that a new economic thought wave began; Monetarism. The book A Monetary History of the United States, 1867 - 1970 (2008) illustrates his theories and contrasts them to those of Keynesian economics.

As a result of the Great Contraction, of the widespread success of the Keynesian revolution in academic economic thought, and of the experience with wartime controls which succeeded in suppressing some of the manifestations of the accumulation of money balances, the view was accepted that “money does not matter,” that the stock of money adapted itself passively to economic changes and played a negligible independent role.

Milton Friedman & Anna Jacobson Schwartz

As a result of the Great Contraction, of the widespread success of the Keynesian revolution in academic economic thought, and of the experience with wartime controls which succeeded in suppressing some of the manifestations of the accumulation of money balances, the view was accepted that “money does not matter,” that the stock of money adapted itself passively to economic changes and played a negligible independent role.

Closing thoughts

Keynesian economics revolutionised economics to the extent that the so-called “Keynesian revolution” ignited (from 1936 onwards, after the publication of The General Theory). Essentially, Keynes confronted the laissez-faire classical economic doctrine, proposing that demand was of paramount importance in economics and that governments should intervene when needed to incentivise effective demand, helping economies achieve optimal levels of employment and price stability. His views on the components of aggregate demand, people’s relationship with money and savings or the dynamics between unemployment, wages and prices were some of his greatest contributions to economic theory.

Further reading

To read more on Keynes, you can explore our guides on the multiplier effect and the IS-LM model

To read more of Keynes’ contributions to modern economics, read ‘The Economic Consequences of the Peace’ by John Maynard Keynes

To read more about the rivalry and differences between Keynes and Hayeks’ theory, read ‘Keynes vs. Hayek: A Battle of Ideas’ by Thomas Hoerber

To read more about Milton Friedman’s Monetarism and how it differs from Keynesian Economics, read ‘Keynes, the Keynesians and Monetarism’ by Tim Congdon

To read more about Friedrick Von Hayek’s life and contributions, read ‘F. A. Hayek: Economics, Political Economy and Social Philosophy’ by Peter J. Boettke

Keynesian economics FAQs

What is Keynesian economics in simple terms?

What is Keynesian economics in simple terms?

What are the main differences between classical economics and Keynesian economics?

What are the main differences between classical economics and Keynesian economics?

What are the main criticisms against Keynesian economics?

What are the main criticisms against Keynesian economics?

Bibliography

Friedman, M. and Schwartz, A. J. (2008) A Monetary History of the United States, 1867-1960. Princeton University Press. Available at: https://www.perlego.com/book/733854/a-monetary-history-of-the-united-states-18671960-pdf

Greenlaw, S., Taylor, T. and Shapiro, D. (2017) Principles of Macroeconomics 2e. OpenStax. Available at: https://www.perlego.com/book/695162/principles-of-macroeconomics-2e-pdf

Hayek, F. (2014) The Road to Serfdom. 1st edn. Taylor and Francis. Available at: https://www.perlego.com/book/570781/the-road-to-serfdom-pdf

Keynes, J. M. (2021, [1936]) The General Theory of Employment, Interest and Money. Illustrated. Strelbytskyy Multimedia Publishing. Available at: https://www.perlego.com/book/3042299/the-general-theory-of-employment-interest-and-money-illustrated-pdf

Keynes, J. M. (2018) The General Theory of Employment, Interest, and Money. Springer International Publishing. Available at: https://www.perlego.com/book/3496996/the-general-theory-of-employment-interest-and-money-pdf

Sowell, T. (2015) Say’s Law. Princeton University Press. Available at: https://www.perlego.com/book/738503/says-law-an-historical-analysis-pdf

Vroey, M. (2004) Involuntary Unemployment. 1st edn. Taylor and Francis. Available at: https://www.perlego.com/book/717635/involuntary-unemployment-pdf

MA, Management Science (University College London)

Inés Luque has a Masters degree in Management Science from University College London. During high school, she developed a strong interest in Economics, leading her to win the national Economics prize in her country of nationality, Spain. Her expertise is in the areas of microeconomics, game theory and design of incentives. Inés is passionate about the publishing industry and is currently working in the consulting department of the Financial Times in London.